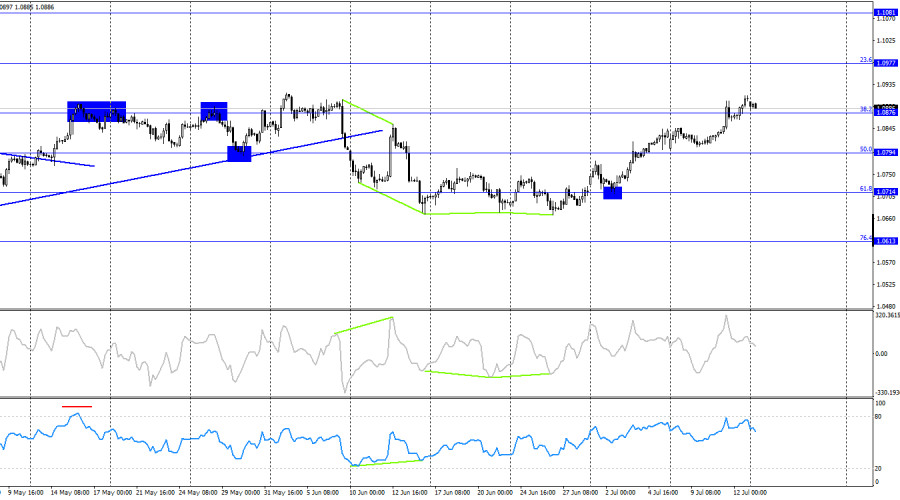

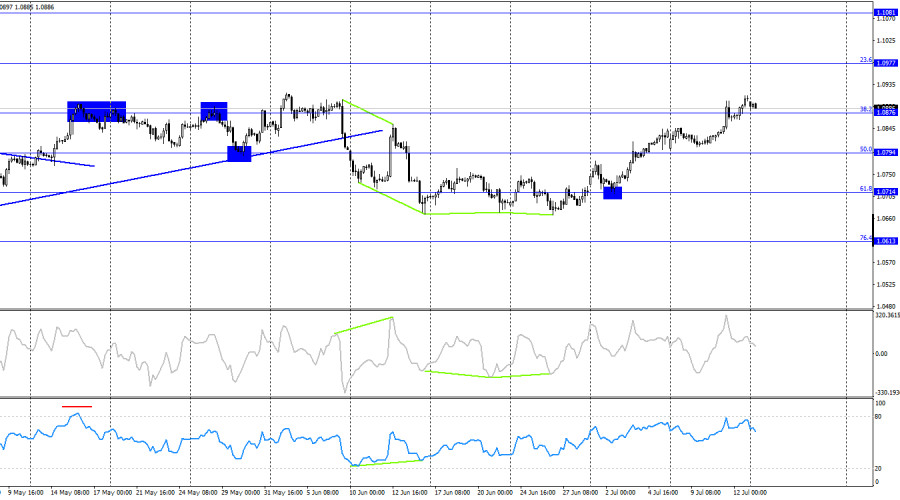

The EUR/USD pair continued to rise on Friday and by the end of the day almost reached the corrective level of 0.0%-1.0917. A rebound from this level would suggest a reversal in favor of the US dollar and some decline towards the Fibonacci level of 23.6% at 1.0843. However, I do not expect a significant fall in the euro until the quotes consolidate below the ascending trend channel and the support zone of 1.0785–1.0797. The bulls do not have unlimited potential, but there are no signs of a trend reversal yet.

The wave situation has become more complicated. The new upward wave broke the peak of the previous wave and continued to form, while the last completed downward wave could not break the low of the previous wave. Thus, two signs of a trend change from "bearish" to "bullish" were obtained. The informational background has been supporting only the bulls for two weeks in a row. Therefore, the bears have not had the opportunity to form even a corrective wave. There are currently no signs of a trend reversal to "bearish."

The informational background on Friday became slightly better for the US dollar, as the producer price index showed an unexpected increase from 2.4% y/y to 2.6% y/y. Most traders expected it to decrease to 2.3%. The increase in producer prices indicates that the downward trend in inflation may end around 3%, as it has in previous instances. If this indicator drops slightly below 3%, this will not be a reason for the FOMC to lower rates. Thus, at the moment, I cannot confidently say that the Fed will start easing monetary policy in September. Moreover, there are serious doubts that this will happen in early autumn. However, the market has been waiting for this moment for so long that it is ready to believe almost anything. Based on this optimism, the dollar continues to fall.

On the 4-hour chart, the pair consolidated above the corrective level of 38.2%-1.0876. Thus, the growth process may continue towards the next Fibonacci level of 23.6% at 1.0977. No forming divergences are observed in any indicator today. There is a need to form a corrective wave on the hourly chart, so a close on the 4-hour chart below 1.0876 would work in favor of the dollar and some decline towards the corrective level of 50.0%-1.0794.

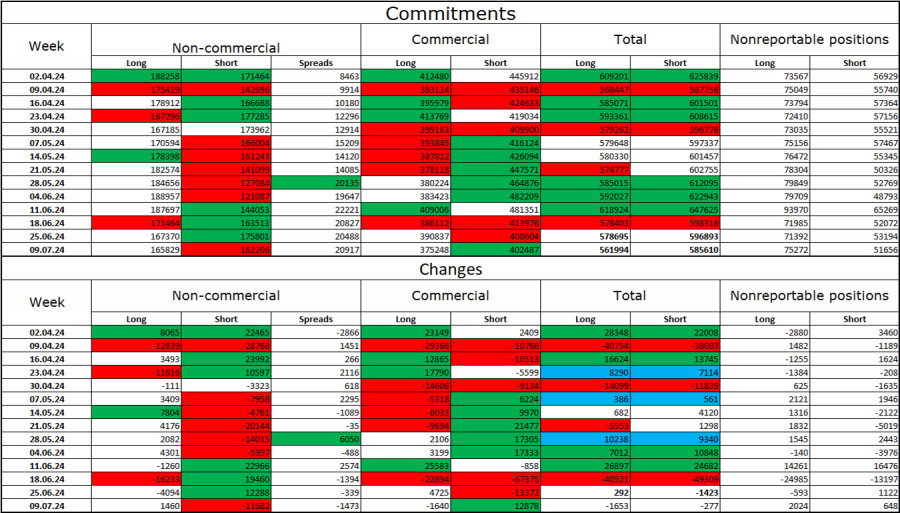

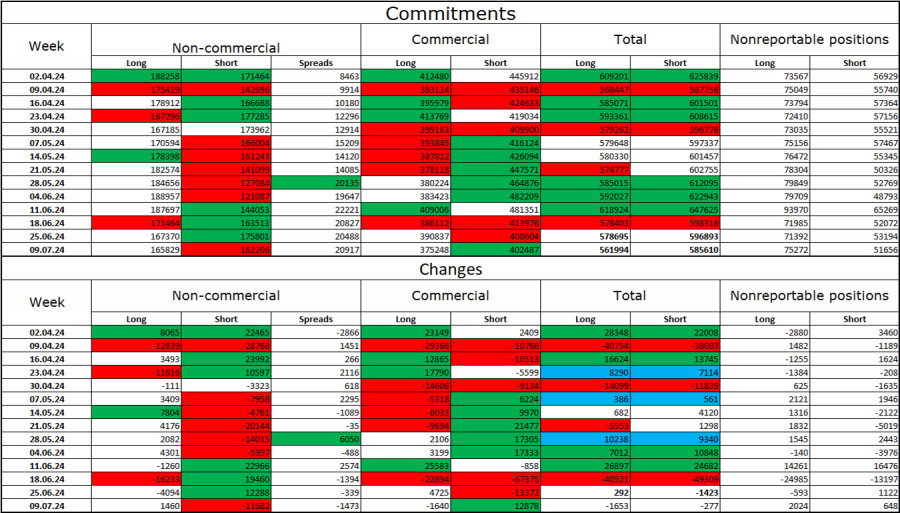

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 1,460 long positions and closed 11,682 short positions. The sentiment of the "Non-commercial" category turned "bearish" a few weeks ago, but currently, there is parity between bulls and bears. The total number of long positions held by speculators now stands at 165,000, and short positions at 162,000. I still believe that the situation will continue to change in favor of the bears. I see no long-term reasons to buy the euro, as the ECB has begun to ease monetary policy, which will reduce the yield on bank deposits and government bonds. In America, they will remain at a high level for several more months, making the dollar more attractive to investors. The potential for the euro to decline even according to COT reports looks significant. Currently, the number of short positions among professional players is growing. However, one should not forget about graphical analysis, which currently allows for the opposite conclusions.

News Calendar for the USA and the Eurozone:

- Eurozone – Change in Industrial Production (09:00 UTC).

- USA – Speech by FOMC Chairman Jerome Powell (16:30 UTC).

On July 15, the economic event calendar contains two entries, highlighted by Jerome Powell's speech. The impact of the informational background on trader sentiment today may be weak.

Forecast for EUR/USD and Recommendations for Traders:

Sales of the pair are possible today with a rebound on the hourly chart from the level of 1.0917 with a target of 1.0843. Purchases were possible on a close above 1.0843 with a target of 1.0917. These trades can be kept open now. On a close above 1.0917, purchases can be held with a target of 1.0977.

The Fibonacci level grids are built on 1.0602–1.0917 on the hourly chart and on 1.0450–1.1139 on the 4-hour chart.