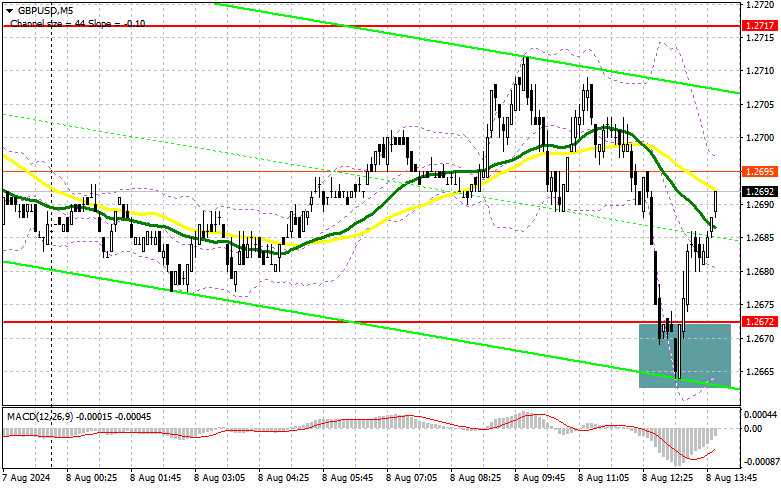

In my morning forecast, I identified the 1.2672 level as a key point for market entry decisions. We should examine the 5-minute chart to understand what transpired. A decline and the formation of a false breakout at that level led to a buying opportunity for the pound, resulting in a rise of more than 20 points at the time of writing. For this reason, the technical picture was not revised for the second half of the day.

To Open Long Positions on GBP/USD:

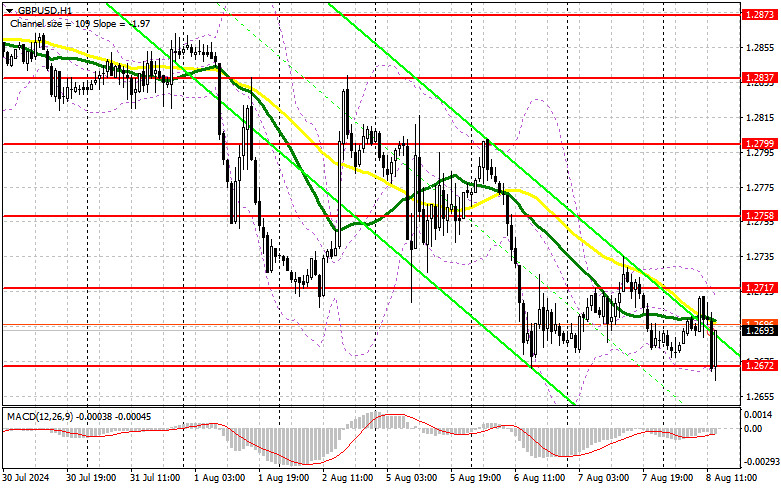

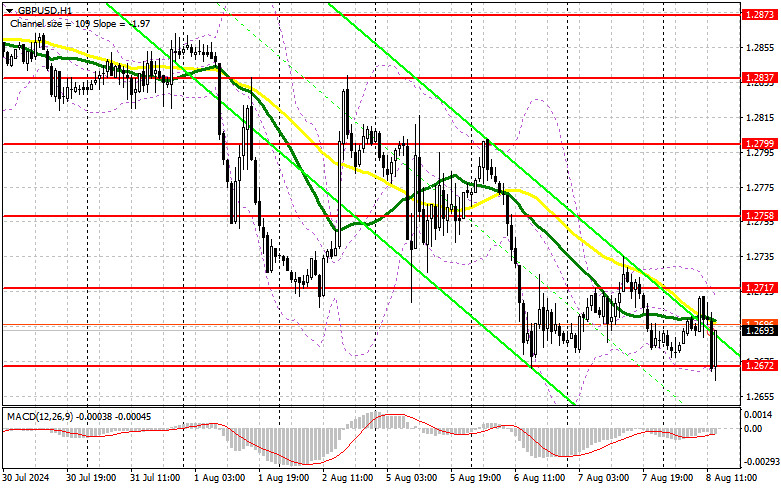

Given the absence of important statistics from the UK, the active actions of the bulls around 1.2672 were not surprising, and it can be expected that they will aim to update the daily high. Weak statistics from the U.S., related to the number of initial jobless claims and changes in wholesale inventories, might help with the pound's rise. What matters more is what FOMC member Thomas Barkin will say regarding recent volatility in stock markets and interest rates. In case of a bearish reaction to his statements, only a false breakout around 1.2672, similar to what I discussed above, will be a suitable scenario for opening long positions, targeting a correction to the resistance at 1.2717, which we haven't reached yet. A breakout and top-down retest of this range will increase the chances of the pound rising, leading to a long position entry point with a target of reaching 1.2758. The furthest target will be the 1.2799 level, where I plan to take profits. If GBP/USD declines and there is no activity from the bulls around 1.2672 in the latter half of the day, the pound's situation will worsen. This will lead to a decline and an update of the next support at 1.2643, increasing the chances of a larger drop in the pair. Therefore, only a false breakout formation will be a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.2613 low with a target of an upward correction of 30-35 points within the day.

To Open Short Positions on GBP/USD:

Sellers maintain control over the market, but they failed to break below the weekly low, which is a sign pointing towards a potential rise in the latter half of the day. For this reason, it is crucial to defend 1.2717, and only a false breakout will confirm the presence of major players betting on further pound decline, providing an opportunity to open new short positions to continue the bearish trend, targeting to update the weekly low and support at 1.2672. A breakout and bottom-up retest of this range will strike a blow to buyers' positions, leading to stop-loss orders being triggered and opening the way to 1.2643. The furthest target will be the 1.2613 level, where I plan to take profits. Testing this level will only strengthen the new bearish trend. If GBP/USD rises and there is no activity around 1.2717 in the latter half of the day, coupled with dovish statements from Fed representatives regarding interest rates, buyers will have a good chance to recover losses and restore the pound to more acceptable levels. In that case, I will postpone sales until a false breakout at the 1.2758 level. If there is no downward movement, I will sell GBP/USD immediately on a rebound from 1.2799, but only expecting a downward correction of 30-35 points within the day.

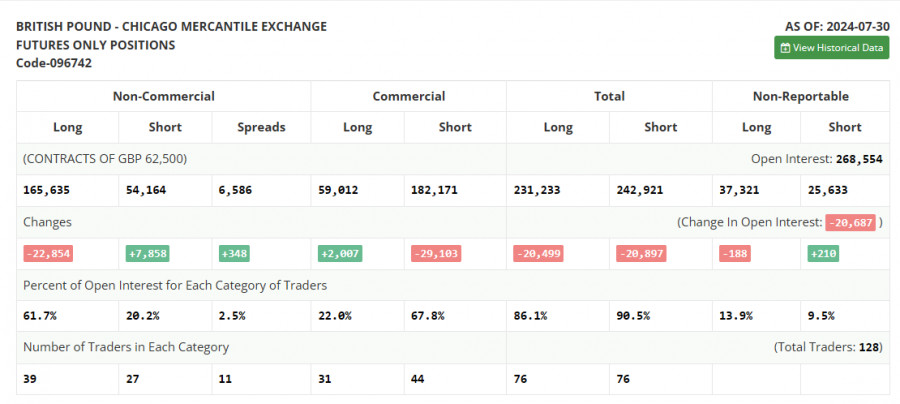

In the report (Commitment of Traders) for July 30, there was an increase in short positions and a reduction in long ones. Such a change in the balance of power is not surprising, since according to the results of the meeting, the Bank of England made it clear that it was going to further reduce interest rates, because now, more than ever before, after putting inflation in order, the economy needs special support. The decision of the Federal Reserve System to leave interest rates unchanged, unlike the Bank of England, resulted in a fall in the pound, which will continue in the near future. The latest COT report says that long non-profit positions fell by 22,854 to the level of 165,635, while short non-profit positions increased by 7,858 to the level of 54,164. As a result, the spread between long and short positions increased by 348.

Signals of Indicators:

Moving Averages:

Trading is conducted around the 30 and 50-day moving averages, indicating issues with further pound decline.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.2672 will act as support.

Description of Indicators:

- Moving average (MA): Determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average (MA): Determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Net non-commercial position: The difference between short and long positions of non-commercial traders.