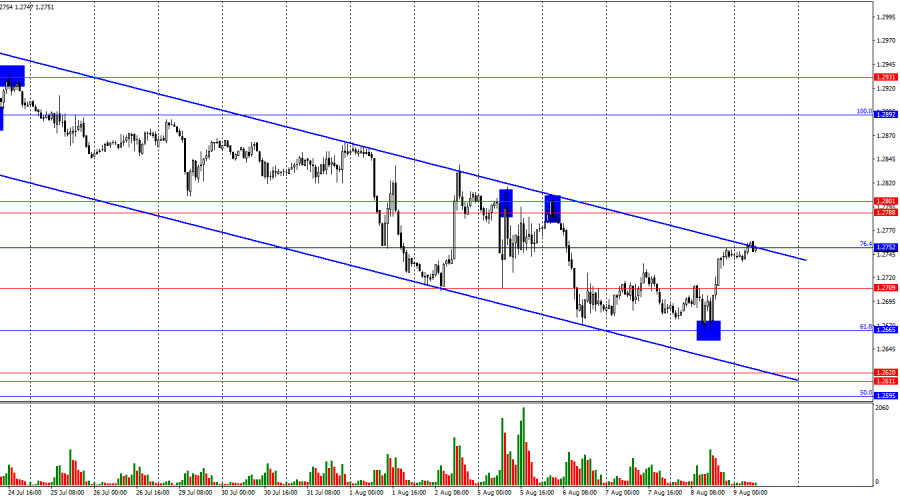

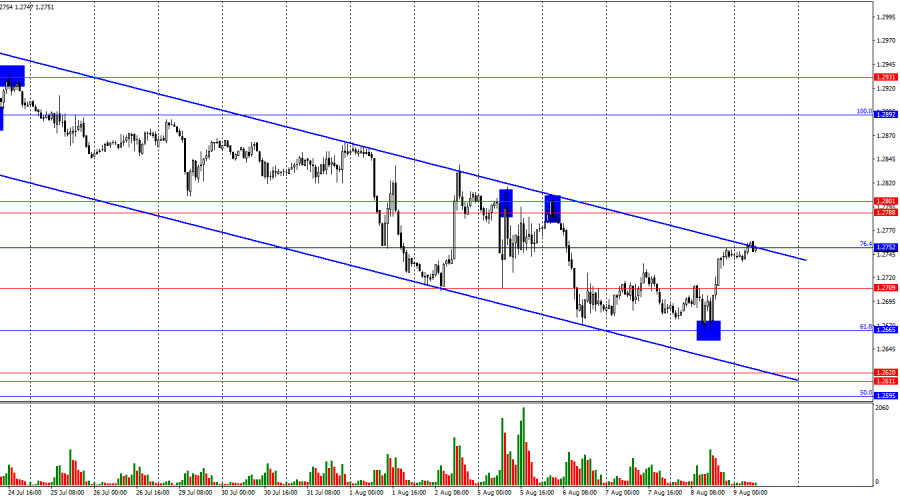

On Thursday, the GBP/USD pair confidently rebounded from the 61.8% corrective level at 1.2665 on the hourly chart, reversed in favor of the pound, and rose to the 76.4% Fibonacci level at 1.2752. Consolidation of the pair's rate above this level will also mean a consolidation above the downward trend channel, which will locally change the trend to "bullish." This suggests that the uptrend will continue towards the resistance zone of 1.2788–1.2801. A rebound from the 1.2752 level would suggest a resumption of the decline toward the 1.2665 level.

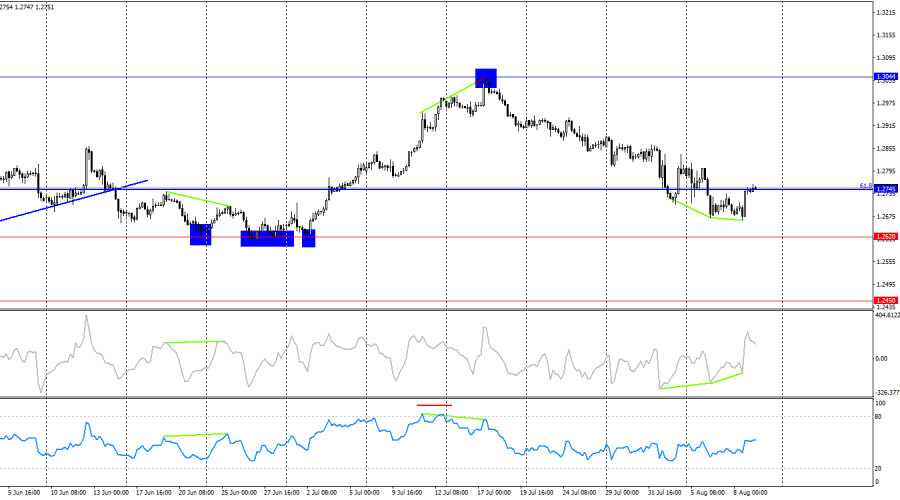

The market's wave pattern has slightly changed. The last completed upward wave (which began forming on July 2) managed to break the low of the previous upward wave, while the last downward wave has not yet broken the low of the previous wave. Thus, we are currently dealing with a "bullish" trend and a deep corrective wave or series of waves. The pound's growth is likely to resume. A trend change to "bearish" is not yet in question from the wave perspective. This would require the pair to break the last low from July 2. However, the waves are now very long, and the pound has been steadily declining over the past few weeks. The local trend is "bearish," but today it may shift to "bullish."

There was no significant news on Thursday. Bears have been attacking for several weeks in a row, and they might need a break. This pause will not be influenced by recent news events, as the bears may be taking profits from their three-week sell-offs. Today and next week, the pair's movement will depend solely on whether the bulls can close above the trend channel.

There was no significant news on Thursday. Bears have been attacking for several weeks in a row, and they might need a break. This pause will not be influenced by recent news events, as the bears may be taking profits from their three-week sell-offs. Today and next week, the pair's movement will depend solely on whether the bulls can close above the trend channel.

On the 4-hour chart, the pair consolidated below the 61.8% corrective level at 1.2745, allowing it to continue its decline toward the next level at 1.2620. However, two "bullish" divergences were formed on the CCI indicator, which suggests that the pound may rise. On the hourly chart, the pair could close above the downward channel, which would also support expectations of growth.

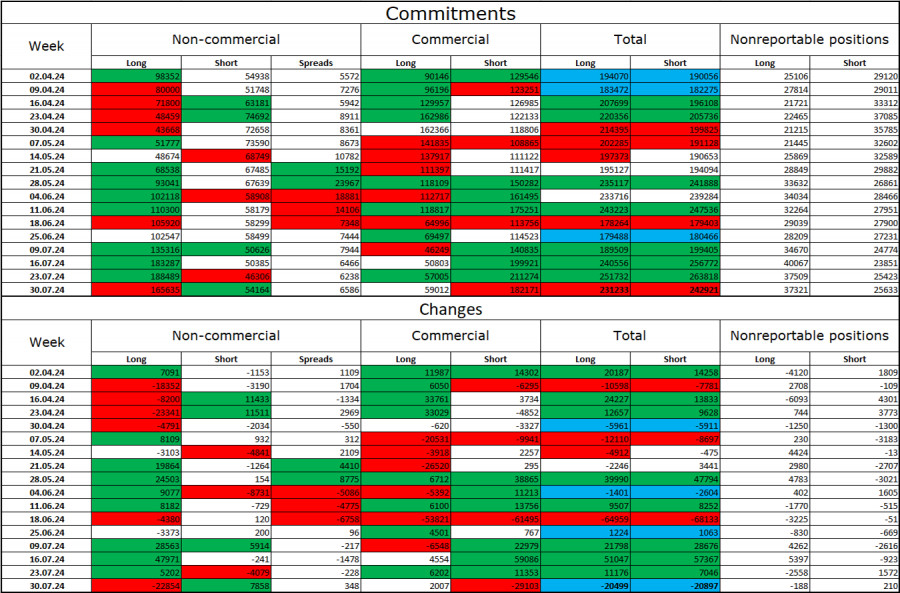

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became less "bullish" in the latest report. The number of long positions held by speculators decreased by 22,854, while the number of short positions increased by 7,858. Bulls still have a solid advantage, with the gap between long and short positions now at 111,000: 165,000 against 54,000.

In my opinion, the pound still has prospects for a decline, but the COT reports currently suggest otherwise. Over the past three months, the number of long positions has increased from 98,000 to 165,000, while the number of short positions has remained unchanged at 54,000. I believe that over time, professional players will begin to shed long positions or increase short positions, as all possible factors for buying the British pound have already been priced in. However, this is just a hypothesis. Graphical analysis suggests a likely decline in the near future, but this does not mean that the decline will last for several months or half a year.

News Calendar for the US and UK:

On Friday, the economic events calendar contains no entries. Today's market sentiment will not be influenced by any significant news.

Forecast for GBP/USD and Trading Tips:

Sales of the pair will be possible today on a rebound from the 1.2752 level on the hourly chart with targets at 1.2709 and 1.2665. Purchases will be possible if the quotes consolidate above the 1.2752 level, with a target of the 1.2788–1.2801 zone.

The Fibonacci levels are drawn at 1.2892–1.2298 on the hourly chart and 1.4248–1.0404 on the 4-hour chart.