El lunes el par de divisas EUR/USD volvió a negociarse con mínima volatilidad. El mercado no tenía ningún deseo de comerciar antes de la publicación de informes importantes, que, por cierto, no serán tantos. Por supuesto, un informe aparte esta semana es el informe de inflación en EE. UU., del cual depende el destino del dólar. Recordemos que el momento clave para el par EUR/USD sigue siendo el canal lateral en el marco temporal de 24 horas. Este canal es 1.0600-1.1000. Hasta que el precio no salga de él de manera precisa, no tiene sentido hablar de hacia dónde se moverá el par a medio plazo. Como la última vez el rebote fue cerca del límite superior del canal, esperamos una caída hacia el inferior, independientemente del contexto fundamental y macroeconómico.

Sin embargo, debemos admitir que los informes de inflación en los Estados Unidos últimamente provocan una volatilidad muy fuerte en el mercado. Incluso en aquellos casos en que la inflación parece tener una mínima desviación de la previsión (o coincide completamente con ella), el dólar puede moverse hacia arriba o hacia abajo en 50-100 puntos, lo que en la volatilidad actual del mercado es de gran significancia. Por lo tanto, es en este informe en el que los comerciantes deberían centrarse esta semana.

¿Qué esperar de la inflación estadounidense? Honestamente, somos escépticos respecto a las expectativas de su desaceleración. Incluso si las predicciones se cumplen y la inflación cae al 2.9%, ¿le da esto a la Reserva Federal una base para comenzar a flexibilizar la política monetaria en septiembre? En nuestra opinión, no. El 2.9% está demasiado lejos del objetivo del 2%. Recordemos que el BCE comenzó a reducir las tasas de interés al nivel de inflación del 2.4%, y el Banco de Inglaterra al 2%. Si la economía estadounidense enfrentara problemas insuperables, entenderíamos el deseo de la Reserva Federal de estabilizarla lo antes posible. Pero con la economía de EE. UU. todo está bien, en el segundo trimestre mostró un crecimiento del 2.8%, mucho más alto que en la UE o el Reino Unido.

Lo mismo se aplica al mercado laboral de EE. UU. Si los valores de las NonFarm Payrolls se dirigieran a cero cada mes, no habría preguntas. Sin embargo, cada mes, la economía estadounidense crea 100-200 mil nuevos empleos. Sí, los valores de este informe a menudo son más débiles que las previsiones y expectativas, ¿quién tiene la culpa? ¿No son los propios pronosticadores, que establecen valores excesivamente altos? Creemos que el mercado laboral de EE. UU. se está enfriando, pero permanece en un estado bastante estable. Por lo tanto, no hay razón para preocuparse.

La tasa de desempleo en EE. UU. está aumentando, pero esto es absolutamente normal en tiempos de altas tasas de la Reserva Federal. Los representantes de la Reserva Federal han declarado repetidamente que el enfriamiento del mercado laboral (que implica un aumento del desempleo) es necesario para reducir la inflación. Resulta que el propio regulador no ve ningún problema en el aumento del desempleo y la contracción del mercado laboral, pero el mercado ha decidido por él que es necesario reducir urgentemente las tasas. Por lo tanto, el miércoles, en el informe de inflación, bien podríamos ver una nueva caída del dólar estadounidense. Pero si la inflación aumenta o se mantiene en el 3%, esto proporcionará un fuerte apoyo al dólar.

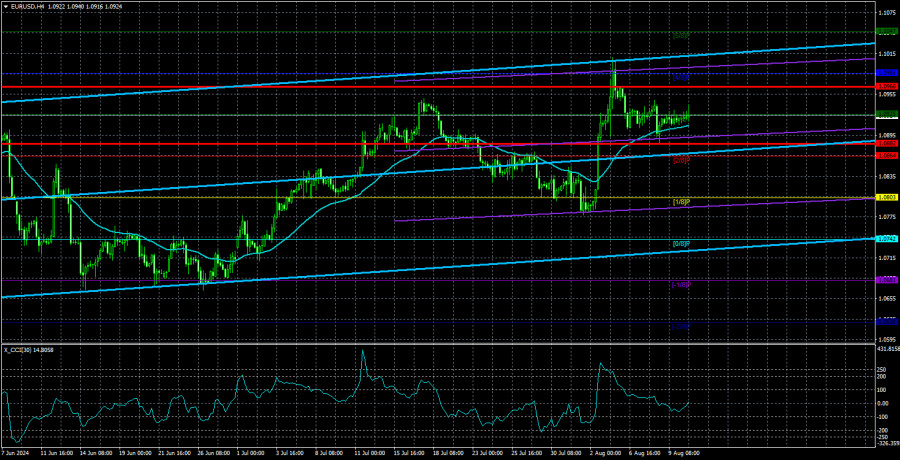

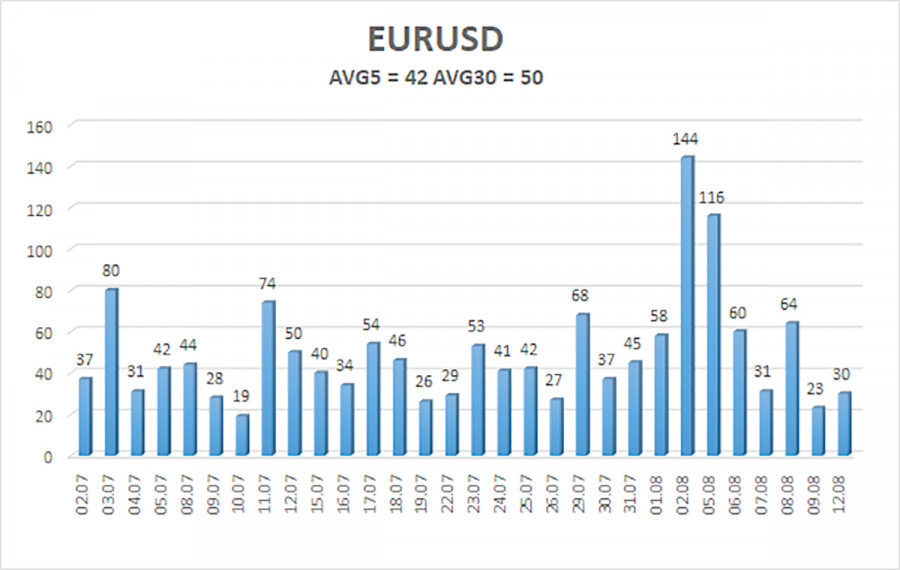

La volatilidad promedio del par de divisas euro/dólar en los últimos 5 días de negociación a 13 de agosto es de 42 puntos y se caracteriza como "baja". Esperamos que el par se mueva entre los niveles 1.0882 y 1.0966 el martes. El canal superior de regresión lineal está orientado hacia arriba, pero la tendencia descendente global se mantiene. El indicador CCI entró en la zona de sobrecompra dos veces, lo que advierte de un posible cambio de tendencia a la baja.

Niveles de soporte más cercanos:

S1 – 1.0864

S2 – 1.0803

S3 – 1.0742

Niveles de resistencia más cercanos:

R1 – 1.0925

R2 – 1.0986

R3 – 1.1047

Recomendamos la lectura de otros artículos del autor:

Análisis del par GBP/USD. El 13 de agosto. La libra esterlina sigue indecisa.

Recomendaciones para operar:

El par EUR/USD mantiene la tendencia descendente global, y en el marco temporal de 4 horas comenzó una corrección descendente que podría ser el comienzo de una nueva etapa del movimiento hacia el sur. En revisiones anteriores hemos dicho que solo esperamos una caída del euro. No creemos que el euro sea capaz de iniciar una nueva tendencia global con una flexibilización de la política monetaria del BCE, por lo que es probable que el par siga fluctuando entre los niveles 1.0600 y 1.1000 por un tiempo. Por ahora, todo parece como si el precio hubiera rebotado del límite superior del canal lateral y tomara curso hacia el límite inferior. Desafortunadamente, la volatilidad sigue siendo muy baja.

Explicaciones de las ilustraciones:

Canales de regresión lineal: ayudan a determinar la tendencia actual. Si ambos están dirigidos en la misma dirección, significa que la tendencia es fuerte ahora.

Línea media móvil (configuración 20,0, suavizada) - determina la tendencia a corto plazo y la dirección en la que operar ahora.

Niveles Murray - niveles objetivo para movimientos y correcciones.

Niveles de volatilidad (las líneas rojas) - el canal de precios probable, en el que el par pasará el día siguiente, basado en los indicadores de volatilidad actuales.

Indicador CCI - su entrada en la zona de sobreventa (por debajo de -250) o sobrecompra (por encima de +250) significa que se aproxima el cambio de tendencia hacia el lado opuesto.