El par de divisas GBP/USD también se negoció al alza el martes. Ayer también advertimos que los informes británicos sobre desempleo y salarios parecen duros y amenazantes, y de hecho, raramente provocan una fuerte reacción en el mercado. Así fue ayer, cuando la tasa de desempleo se redujo inesperadamente para todos del 4,4% al 4,2%, con pronósticos del 4,5%. ¿Acaso no es esa una razón para que la libra esterlina muestre otro crecimiento? Lo mostró, pero ¿es todo tan claro?

En primer lugar, cuestionamos el valor del 4,2%. En cualquier indicador macroeconómico hay imprecisiones, errores y un factor estacional. Es bastante posible que el próximo mes veamos un aumento de nuevo al 4,4%. En segundo lugar, los salarios han disminuido en su crecimiento al 4,5%, lo que significa una disminución gradual en todo tipo de inflación. Las tasas de gasto de la población británica están disminuyendo, por lo tanto, la inflación también disminuirá. El Banco de Inglaterra (y otros bancos centrales también) ha dejado claro que los altos salarios son el principal problema para la inflación. En tercer lugar, el número de solicitudes de beneficios por desempleo aumentó en 135,000 en julio con un pronóstico de +14,500. Recordemos que el informe de desempleo es de junio y el informe de solicitudes de beneficios por desempleo es de julio. Por lo tanto, en julio se puede esperar con seguridad un aumento en la tasa de desempleo.

Y una vez más, la libra esterlina usó una excusa formal para mostrar una subida. La tasa de desempleo disminuyó, por lo tanto, es hora de comprar. Eso es lo que piensa el mercado. El número de solicitudes de beneficios por desempleo superó el pronóstico "solo" por 9 veces, no importa. Los salarios disminuyeron, lo que aumenta significativamente la probabilidad de ver una segunda reducción de tasas por parte del Banco de Inglaterra pronto, también no importa. ¡Aún estamos sorprendidos de que la libra haya subido tan poco!

Sin embargo, no hay tiempo para sorprenderse más. Esta mañana saldrá el informe sobre inflación en Gran Bretaña, y por la tarde, el informe sobre inflación en los EE. UU. No cabe duda de que la mayoría de los participantes del mercado ya están frotándose las manos sobre el botón de "comprar". Si, Dios no lo quiera, la inflación británica se acelera más de lo esperado al 2,3%, y la estadounidense disminuye más de lo esperado al 2,9%, no hay duda, el dólar caerá inmediatamente al abismo.

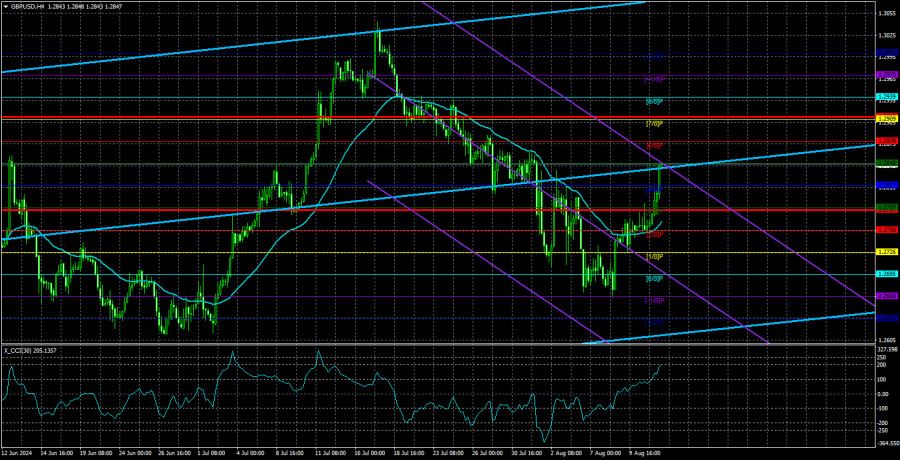

Desde un punto de vista técnico, una corrección alcista ahora es más que justificable. Incluso si hoy el par muestra un aumento impresionante, no cancelará la tendencia descendente que se ha formado en las últimas semanas en el marco temporal de 4 horas, ni cancelará la tendencia descendente global en el marco temporal de 24 horas. Suponemos que el mercado sigue calculando en anticipación las reducciones de tasas de la Fed, por lo que cuando la Reserva Federal finalmente comience a reducir las tasas, podríamos ver una subida del dólar estadounidense. Sí, no se sorprenda por eso. Luego, todos los analistas escribirán que el mercado ya ha tenido en cuenta 2-3-4 rondas de flexibilización de la política monetaria, por lo que "vende con el rumor, compra con el hecho". Después de todo, el mercado ahora solo está ocupado vendiendo el dólar estadounidense... Por lo tanto, si alguien piensa que el dólar caerá aún más bajo tan pronto como la Fed comience a flexibilizar, tememos decepcionarlos...

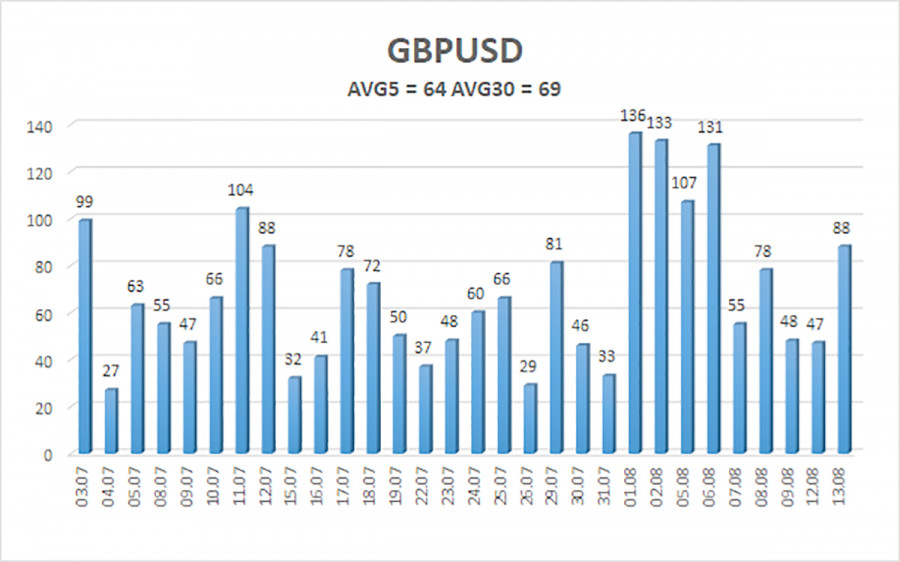

La volatilidad promedia del par GBP/USD en los últimos 5 días de negociación es de 64 puntos, lo que se considera "medio" para el par libra/dólar. Así, el miércoles 14 de agosto, esperamos un movimiento dentro de un rango limitado por los niveles 1,2784 y 1,2912. El canal senior de regresión lineal apunta hacia arriba, lo que indica la continuación de la tendencia alcista. El indicador CCI pronto podría volver a entrar en la zona de sobrecompra.

Niveles de soporte más cercanos:

S1 – 1,2817

S2 – 1,2787

S3 – 1,2756

Niveles de resistencia más cercanos:

R1 – 1,2848

R2 – 1,2878

R3 – 1,2909

Recomendamos la lectura otros artículos del autor:

Análisis del par EUR/USD. El 14 de agosto. El mercado sigue esperando el informe de inflación estadounidense.

Recomendaciones para operar:

El par GBP/USD sigue cerca de la línea media móvil y tiene buenas posibilidades de continuar el impulso hacia el sur. No consideramos las posiciones largas en este momento, ya que creemos que todos los factores de crecimiento de la moneda británica (que no eran muchos) han sido calculados por el mercado varias veces. Las posiciones cortas podrían considerarse, al menos, después de que el precio se consolide por debajo del moving. La libra esterlina puede continuar ajustándose al alza esta semana, como advirtió el indicador CCI, pero si trabajar o no en la corrección es algo que los traders deben decidir por sí mismos. La libra tiene buenas posibilidades de mostrar un crecimiento después de los informes sobre la inflación en los EE. UU. y Gran Bretaña, pero para ello, los propios informes deben ser positivos para ella.

Explicaciones de las ilustraciones:

Canales de regresión lineal: ayudan a determinar la tendencia actual. Si ambos están dirigidos en la misma dirección, significa que la tendencia es fuerte ahora.

Línea media móvil (configuración 20,0, suavizada) - determina la tendencia a corto plazo y la dirección en la que operar ahora.

Niveles Murray - niveles objetivo para movimientos y correcciones.

Niveles de volatilidad (las líneas rojas) - el canal de precios probable, en el que el par pasará el día siguiente, basado en los indicadores de volatilidad actuales.

Indicador CCI - su entrada en la zona de sobreventa (por debajo de -250) o sobrecompra (por encima de +250) significa que se aproxima el cambio de tendencia hacia el lado opuesto.