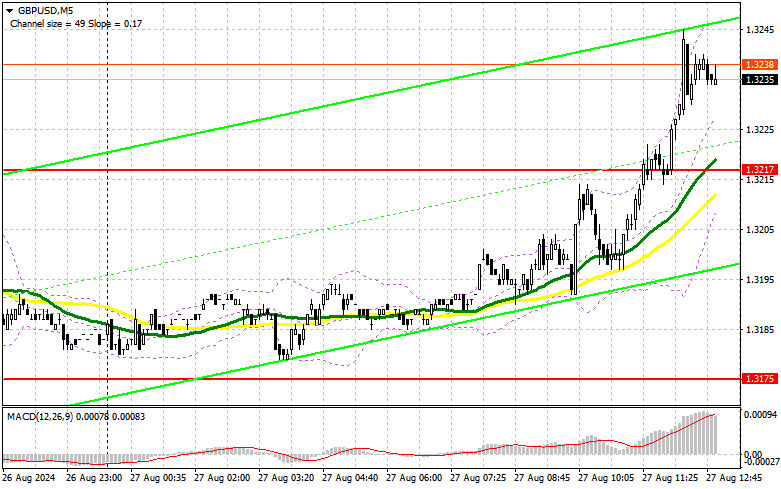

In my morning forecast, I highlighted the 1.3217 level and planned to make market entry decisions based on it. Let's take a look at the 5-minute chart and analyze what happened. The price increased, but there was no false breakout at that level. The breakout occurred without a retest, leaving me without suitable entry points. As a result, the technical outlook was slightly revised for the second half of the day.

To Open Long Positions on GBP/USD:

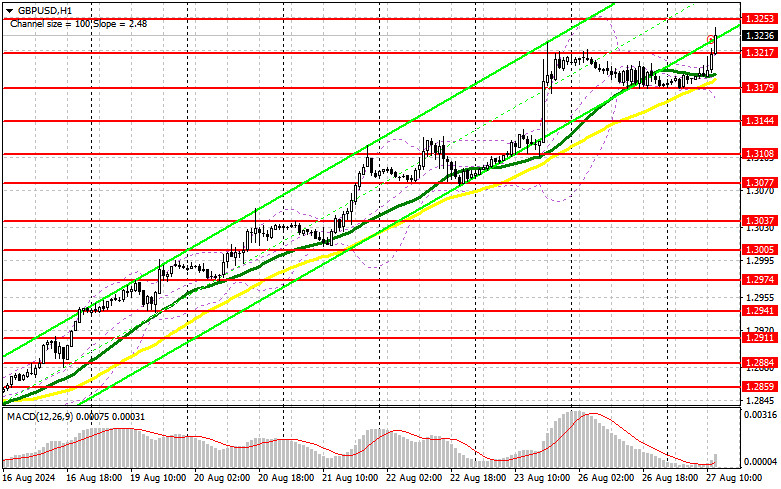

The pound continued its rise without delay. In the second half of the day, the bullish market may continue, especially if the U.S. consumer confidence data for July turns out weak, which would trigger another round of dollar selling and a rise in the British pound. The Richmond Fed Manufacturing Index, and the S&P/Case-Shiller Home Price Index in the 20 largest U.S. cities, will have secondary importance. If the U.S. data does not disappoint, waiting for a correction to the new support at 1.3217, which served as resistance earlier in the day, would be advisable. A false breakout at this level would provide a good entry point for long positions, aiming for the continuation of the bullish market and a new monthly high at 1.3253. A breakout and upward retest of this range after weak U.S. data will enhance the likelihood of further uptrend development. This could trigger stop-losses for sellers, providing a suitable entry point for long positions with the potential to reach 1.3286. The furthest target will be the 1.3340 level, where I plan to take profit. If GBP/USD declines without significant bullish activity around 1.3217 in the second half of the day, trading may return to a sideways range that could persist until the end of the day. This would also lead to a drop and a retest of the next support at 1.3179, slightly above the moving averages. A false breakout at this level would be the only condition to open long positions. I plan to buy GBP/USD on a rebound from the 1.3144 low, targeting a 30-35 point correction within the day.

To Open Short Positions on GBP/USD:

Sellers have practically given up, easily surrendering to each push from the major pound buyers. Although selling the pound at these attractive levels may seem appealing, remember to use stop-loss orders, as this goes against the trend, and the outcome is uncertain. The bears' primary task is to defend the monthly high at 1.3253. A false breakout at this level, combined with strong U.S. statistics, would be a suitable scenario to open short positions against the trend, aiming for a correction and a retest of the 1.3217 support. A breakout and downward retest of this range would undermine buyers' positions, triggering stop-losses and opening the way to 1.3179, where I expect more active involvement from major players. The furthest target will be the 1.3144 level, where I plan to take profit. Testing this level could lead to a decent downward correction in the pair, but nothing more. If GBP/USD rises and there is no bearish activity at 1.3253 in the second half of the day, sellers will have no choice but to retreat further, as the initiative will remain with the buyers. In this case, I will postpone selling until a false breakout at 1.3286. If no downward movement occurs, I plan to sell GBP/USD on a rebound from 1.3340, targeting a 30-35 point intraday downward correction.

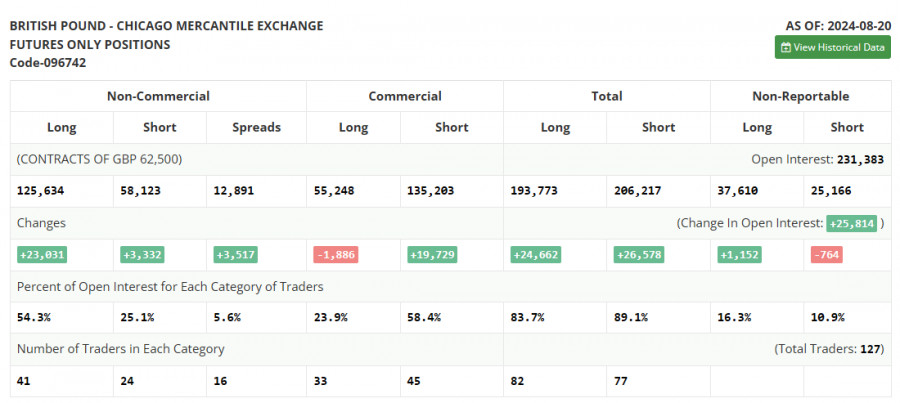

In the COT (Commitment of Traders) report for August 20, there was a sharp increase in long positions and a slight reduction in short ones. Clearly, more and more people are betting on the pound's rise, which demonstrated one of the strongest rallies in recent times last week. The market is not concerned that the Bank of England plans to continue lowering interest rates, as there is confidence in more aggressive easing from the U.S. Federal Reserve. Therefore, it is not so much about the strength of the pound as it is about the weakness of the U.S. dollar, whose problems are expected to persist in the near future, especially given the upcoming statistics indicating further declines in U.S. inflation this week. The latest COT report shows that long non-commercial positions jumped by 23,031 to 125,634, while short non-commercial positions increased by 3,332 to 58,123. As a result, the spread between long and short positions widened by 3,517.

Indicator Signals:

Moving Averages:

Trading is taking place above the 30 and 50-day moving averages, indicating a further rise in the pound.

Note: The period and prices of the moving averages are considered by the author on the hourly H1 chart and differ from the general definition of classic daily moving averages on the daily D1 chart.

Bollinger Bands:In case of a decline, the lower boundary of the indicator around 1.3179 will act as support.

Indicator Descriptions:

- Moving average: Determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average: Determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Net non-commercial position: The difference between short and long positions of non-commercial traders.