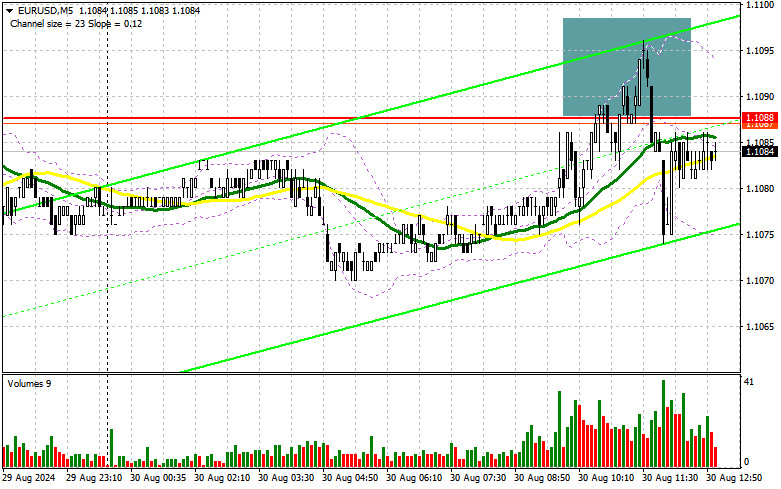

In my morning forecast, I focused on the 1.1088 level for making market entry decisions. Let's look at the 5-minute chart and see what happened. The rise and formation of a false breakout at this level provided an excellent entry point for selling the euro, but a significant drop in the pair did not follow. After a 15-point decline, the bears left the market, leading to a return of EUR/USD to the area of 1.1088. The technical picture has been slightly revised for the second half of the day.

For Opening Long Positions on EUR/USD:

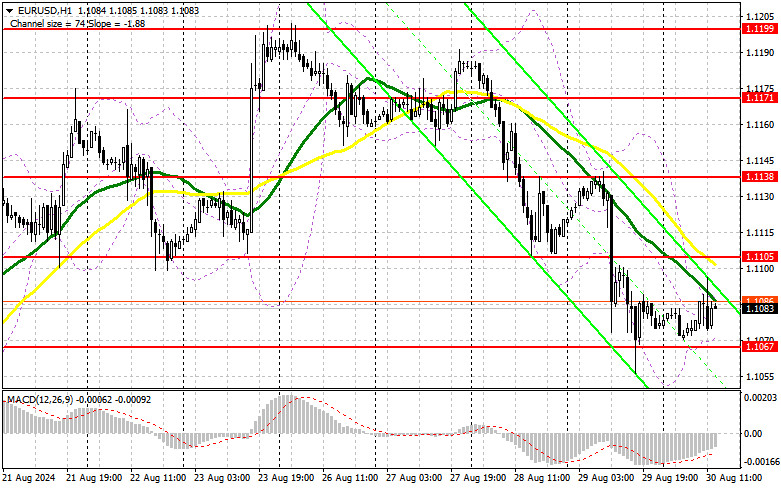

A considerable amount of European data affected the euro, but overall, trading remained within the channel. Now, traders are preparing for another round of important data. Expectations are centered around the U.S. Core Personal Consumption Expenditures (PCE) Index, which plays a significant role for the Federal Reserve in assessing inflation dynamics. This could strengthen the dollar, but only if inflation exceeds economists' forecasts. Data on changes in personal spending and income will also play an important role. Secondary statistics will include reports on the University of Michigan's Consumer Sentiment Index and inflation expectations from the same institution. I plan to act on a decline after a false breakout formation around the nearest support at 1.1067. This will be the appropriate condition for opening long positions in anticipation of a euro rise and a test of the new resistance at 1.1105, where the moving averages are located. A breakout and upward movement from this range could lead to a rally in the pair, with a chance to test 1.1138. The furthest target will be the 1.1171 high, where I will take profit. If EUR/USD continues to fall and there is no activity around 1.1067 in the second half of the day, sellers will strengthen their positions by the end of the week, and a more significant correction could occur. In this case, I will only enter long positions after a false breakout around the next support at 1.1033. I plan to open long positions immediately on a rebound from 1.1006, targeting an intraday upward correction of 30-35 points.

For Opening Short Positions on EUR/USD:

Sellers made their presence known after bulls attempted to break the daily high, but this movement was short-lived. Only strong U.S. statistics can defend the new resistance at 1.1105, where a false breakout will be a good condition for opening short positions at the end of the week. The target will be the new support at 1.1067, where I expect the first signs of bullish activity. A breakout and consolidation below this range, followed by a retest from below, will provide another selling point. This could lead to a move toward 1.1033. The furthest target will be the 1.1006 level, where I will take profit. If EUR/USD moves up and bears are absent at 1.1105, which cannot be ruled out if news of a sharp drop in U.S. inflation emerges, buyers will regain the initiative, with a chance to test the 1.1138 resistance. I will also consider selling from there, but only after a failed consolidation. I plan to open short positions immediately on a rebound from 1.1171, targeting a downward correction of 30-35 points.

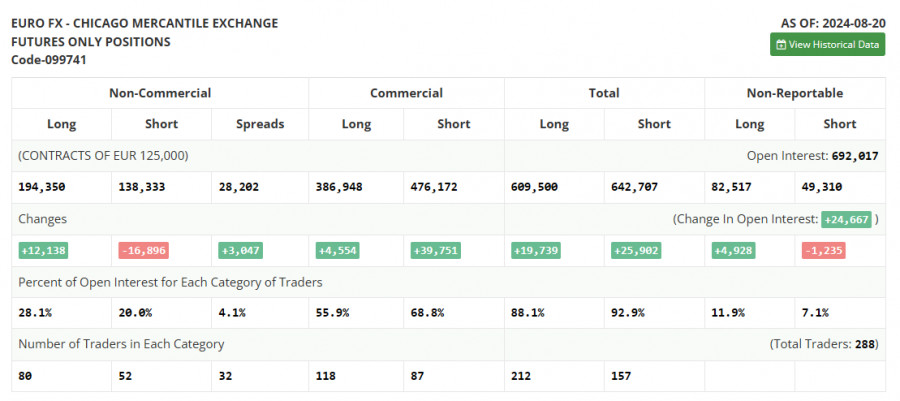

In the COT (Commitment of Traders) report for August 20, the report showed an increase in long positions and a substantial decrease in short positions. This indicates that bullish sentiment among buyers of risk assets persists. The recent speech by Federal Reserve Chair Jerome Powell in Jackson Hole, which has not yet been reflected in this report, will likely lead to further shifts in favor of euro buyers. However, the future direction of the dollar will depend entirely on incoming data related to U.S. inflation and the labor market, so I recommend paying special attention to these indicators. The COT report indicates that non-commercial long positions increased by 12,138 to 194,350, while non-commercial short positions fell by 16,896 to 138,033. As a result, the gap between long and short positions widened by 3,047.

Indicator Signals:

Moving Averages:

Trading is conducted below the 30 and 50-day moving averages, indicating a potential euro decline.

Note: The period and prices of the moving averages are calculated based on the hourly H1 chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands:

If the pair declines, the lower boundary of the indicator around 1.1067 will act as support.

Indicator Descriptions:

- Moving average (MA): Determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average (MA): Determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting specific requirements.

- Long non-commercial positions: The total long open position of non-commercial traders.

- Short non-commercial positions: The total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.