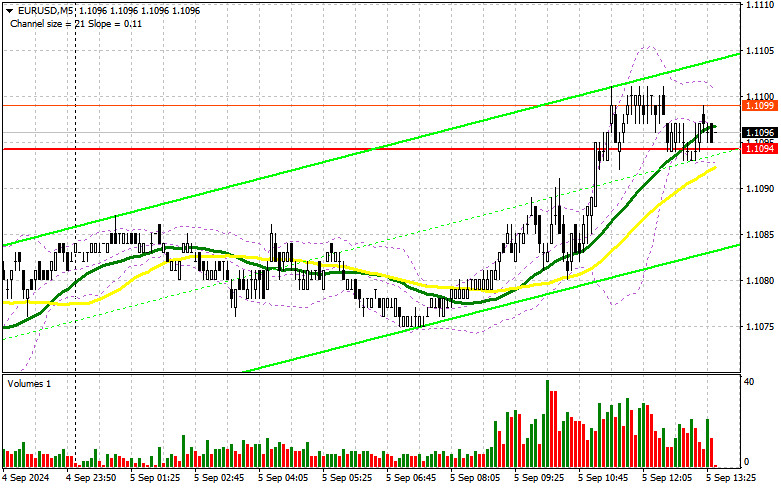

In my morning forecast, I focused on the 1.1094 level and planned to base market entry decisions on it. Let's look at the 5-minute chart and see what happened. The price reached the 1.1094 level, but I wasn't able to find a suitable entry point at this level. The technical picture was slightly revised for the second half of the day.

To open long positions on EUR/USD:

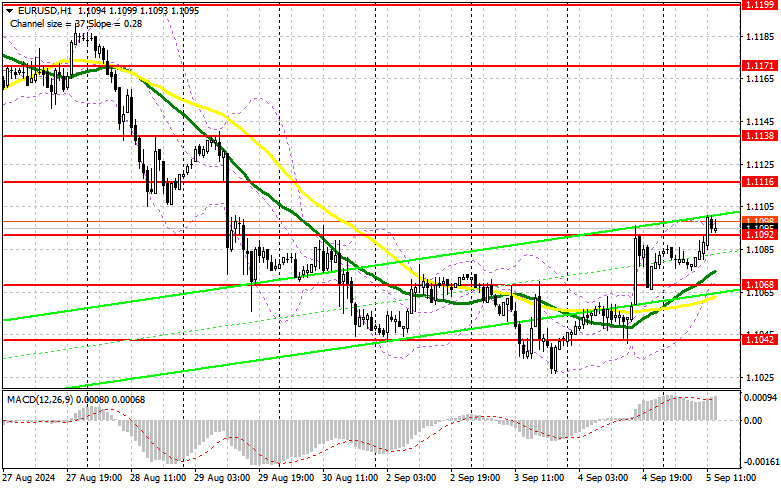

It's clear that data from Germany and the Eurozone supported the euro, but not enough to trigger new active purchases. In the second half of the day, all attention will shift to the important ADP report related to the U.S. labor market. The ADP employment change and the weekly initial jobless claims will be key events, but it's also important to watch the ISM services index. Weak labor market reports will trigger another dollar sell-off, as seen in yesterday's market action. On the other hand, strong figures could strengthen the dollar. In this case, I will consider buying only on a decline around the new support level of 1.1092, formed in the first half of the day. A false breakout at this level will provide an entry point for long positions, aiming to test new resistance at 1.1116. A breakout and retest from above on weak data, which cannot be ruled out, will lead to further growth of the pair with a chance to test 1.1171. The furthest target will be the 1.1199 level, where I will be taking profits. If EUR/USD falls and fails to show significant buying interest around 1.1092 in the second half of the day, sellers will regain the initiative, leading to a larger correction. In that case, I'll only enter long positions after a false breakout around the next support at 1.1068. I plan to open long positions on a rebound from 1.1042, targeting an upward correction of 30-35 points within the day.

To open short positions on EUR/USD:

Sellers are standing aside for now, and this strategy is likely to continue until tomorrow when the U.S. unemployment rate will be released. For now, the bears should focus on defending the nearest resistance at 1.1116. A false breakout there will provide a good opportunity to open short positions, aiming for a pullback to new support at 1.1092, where I expect the first wave of buyers to appear. A breakout and consolidation below this range, followed by a retest from below, will offer another selling opportunity with a move toward 1.1068, where the moving averages are located. The furthest target will be around 1.1042, where I will be taking profits. If EUR/USD rises and sellers are absent at 1.1116, buyers will strengthen their advantage and have a chance to target resistance at 1.1138. I will also sell from there, but only after a failed consolidation. I plan to open short positions on a rebound from 1.1171, targeting a 30-35 point drop.

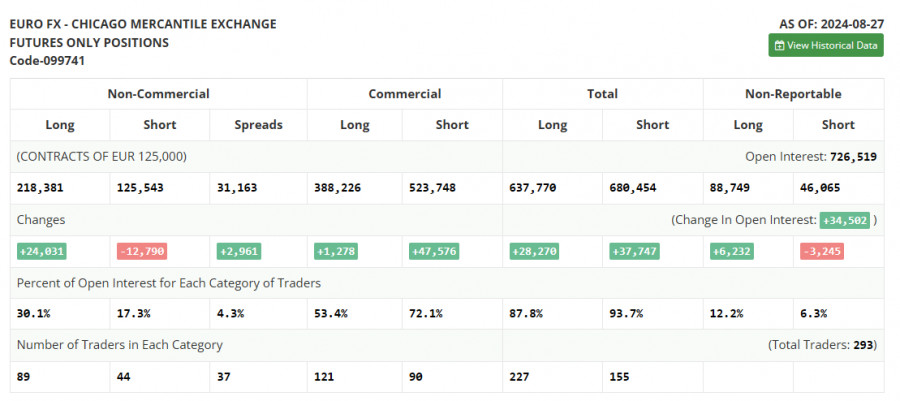

The COT report (Commitment of Traders) for August 27 showed an increase in long positions and a significant reduction in short positions. This indicates a bullish sentiment among risky asset buyers, which only strengthened after Federal Reserve Chair Jerome Powell's speech at Jackson Hole, which clearly signaled that U.S. rates would be cut in September. The current report reflects the market's immediate reaction to these statements. The dollar's future direction will depend entirely on upcoming labor market and inflation data, so I recommend paying close attention to these indicators. The COT report showed that long non-commercial positions increased by 24,031 to 218,381, while short non-commercial positions fell by 12,790 to 125,543. As a result, the spread between long and short positions widened by 2,961.

Indicator Signals:

Moving Averages:

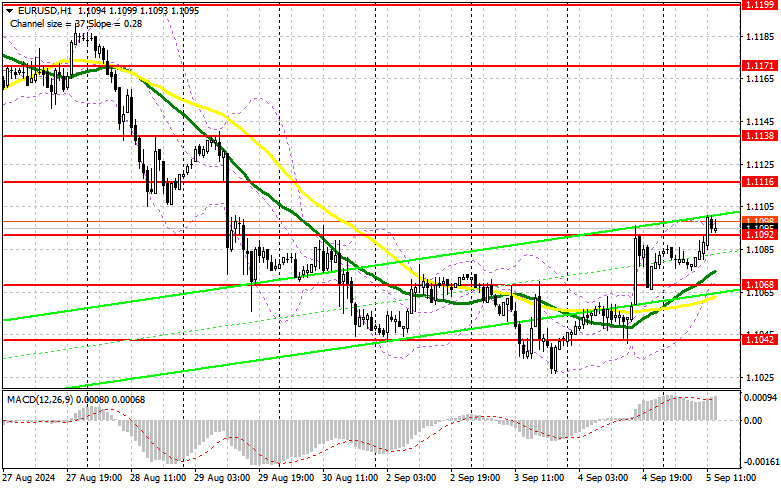

Trading is above the 30 and 50-day moving averages, indicating further growth of the pair.

Note: The period and prices of the moving averages are considered by the author on the hourly H1 chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.1068 will act as support.

Indicator Descriptions:

- Moving average: Defines the current trend by smoothing volatility and noise. Period: 50. Marked in yellow on the chart.

- Moving average: Defines the current trend by smoothing volatility and noise. Period: 30. Marked in green on the chart.

- MACD indicator: (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA: period 12. Slow EMA: period 26. SMA: period 9.

- Bollinger Bands: Period: 20.

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.