Analysis of GBP/USD 5M

The GBP/USD pair rose again on Monday, reaching a new local high. Like the euro, the day began with a decline that started an hour before the release of macroeconomic data in the UK. The British pound understandably fell as the business activity indices in the services and manufacturing sectors were weaker than expected. However, what followed was another wave of baseless growth. In principle, if there are still traders who don't believe in the illogical nature of the current movement, Monday serves as a vivid example of how the pound is rising. Weak data emerged in the UK – the pound fell by 65 pips. Then it climbed 80 pips out of nowhere and lost another 30 on less-than-stellar US business activity indices.

Thus, traders can exploit the current upward movement using "bare" technical analysis or other trading systems and indicators, but that doesn't make the movement logical or reasonable. Therefore, it's difficult for us to advise anyone to buy the pound now, even though it keeps rising. The British currency could continue to increase by momentum for a long time. If the market isn't even considering the possibility of selling the pair, nothing stops them from buying it for another month or two. We expect the relentless buying to end within the next month since the Federal Reserve has begun lowering the key rate. The market started pricing in this event two years ago.

Yesterday, on the 5-minute timeframe, two trading signals were formed, both around the 1.3273 level. The first sell signal was false, while the second buy signal was valid. After the buy signal was triggered, the pair moved up by 60 pips, which was enough to cover the loss from the first trade and still end up in profit.

COT report:

The COT reports for the British pound show that commercial traders' sentiment has been constantly changing in recent years. The red and blue lines, representing the net positions of commercial and non-commercial traders, intersect frequently and are often near the zero mark. We also see that the last downward trend occurred when the red line was below the zero mark. The red line is above 0, and the price has broken through the important level of 1.3154.

According to the latest report on the British pound, the non-commercial group closed 17,200 buy contracts and opened 10,000 sell contracts. Thus, the net position of non-commercial traders decreased by 27,200 contracts over the week. Yet, the pound sterling still appreciated.

The fundamental background still does not provide any grounds for long-term purchases of the pound sterling, and the currency has a real chance to resume the global downtrend. However, an ascending trend line formed in the weekly time frame, we have an ascending trend line, so until this line is broken, a long-term decline in the pound is unlikely. The pound sterling continues to rise against almost all odds, and even when COT reports show that large players are selling the pound, it still keeps climbing.

Analysis of GBP/USD 1H

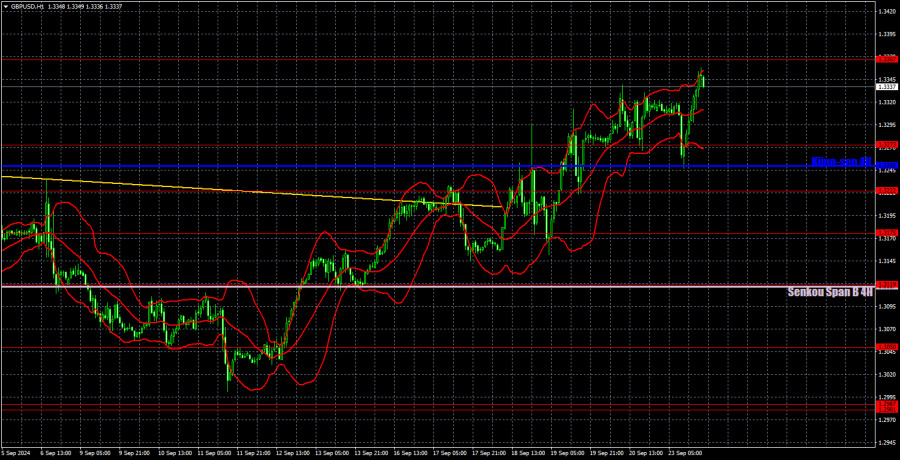

In the hourly time frame, the GBP/USD pair resumed its upward movement, but we still cannot confidently predict a continuation of the pound's growth. The illogical upward trend of the British currency may continue for some time, even though the pair is once again highly overbought. Yesterday, there were far more reasons for the British pound to fall than to rise, but we saw a new move to the north. As usual, the pound rises both with and without justifications.

For September 24, we highlight the following key levels: 1.2796-1.2816, 1.2863, 1.2981-1.2987, 1.3050, 1.3119, 1.3175, 1.3222, 1.3273, 1.3367, 1.3439. The Senkou Span B line (1.3117) and Kijun-sen (1.3250) can also be sources of signals. Setting the Stop Loss to break even when the price moves in the intended direction by 20 pips is recommended. The Ichimoku indicator lines may shift during the day, which should be considered when determining trading signals.

No significant or secondary events are scheduled for Tuesday in the UK and the US. We can expect low volatility, but the pound may continue to rise at a slower pace, even in an empty economic calendar. We would not be surprised by this at all.

Explanation of Illustrations:

Support and resistance levels: Thick red lines near which the trend may end. They are not sources of trading signals.

Kijun-sen and Senkou Span B lines: These Ichimoku indicator lines, transferred from the 4-hour timeframe to the hourly chart, are strong lines.

Extreme levels: Thin red lines from which the price previously bounced. These provide trading signals.

Yellow lines: Trend lines, trend channels, and other technical patterns.

Indicator 1 on COT charts: The net position size for each category of traders.