GBP/USD

Brief Analysis:The direction of the pound's trend since late summer has been defined by a downward wave. The current wave aligns with the daily timeframe scale. Three weeks ago, the price rebounded from the lower edge of a broad reversal zone and is now approaching a cluster of resistance levels across various timeframes.

Weekly Forecast:The pound is expected to remain in a sideways range near the calculated resistance zone at the start of the week, with a potential brief breach of the upper boundary. Increased volatility, a reversal, and a downward price movement are anticipated by the end of the week.

Potential Reversal Zones:

- Resistance: 1.2810/1.2860

- Support: 1.2500/1.2450

Recommendations:

- Buying: Lacks potential and may lead to losses.

- Selling: After reversal signals appear near resistance, consider short-term trades with fractional volume sizes.

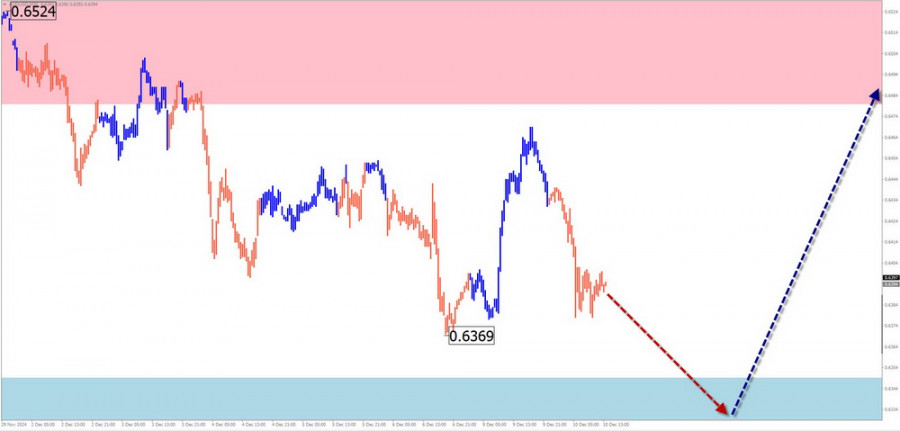

AUD/USD

Brief Analysis:The short-term trend for the Australian dollar is dominated by a downward movement. The structure of this trend remains incomplete, and the price is approaching the upper boundary of the preliminary target zone.

Weekly Forecast:The pair is expected to gradually move toward the calculated support zone this week, with a flat trading pattern likely. Toward the weekend, a directional change may occur, with potential brief pressure on the lower boundary of the support zone.

Potential Reversal Zones:

- Resistance: 0.6480/0.6530

- Support: 0.6350/0.6300

Recommendations:

- Buying: Premature until the current wave is completed. After reversal signals appear, fractional volume trades can be considered.

- Selling: Possible with reduced volume sizes but limited by the support zone.

USD/CHF

Brief Analysis:The ongoing bullish wave, which began in early August, appears as a shifting flat structure. The final segment (C) is still incomplete. The pair is trading within a broad weekly reversal zone.

Weekly Forecast:After possible pressure on the support zone, a reversal and price growth are expected. The price could rise toward the calculated resistance zone, which represents the upper boundary of the current wave's target range.

Potential Reversal Zones:

- Resistance: 0.8980/0.9030

- Support: 0.8750/0.8700

Recommendations:

- Selling: No conditions for such trades in the coming days.

- Buying: After reversal signals appear, consider trades limited by the calculated resistance zone.

EUR/JPY

Brief Analysis:The ongoing upward wave for EUR/JPY began on August 5. A corrective downward move started in late October, exceeding the retracement level of the last segment and continuing to develop. Recently, the price has rebounded upward from the upper edge of a strong reversal zone.

Weekly Forecast:The pair is expected to continue its gradual rise toward the calculated resistance zone in the coming days. A reversal and a return to bearish momentum are anticipated after reaching this zone, with the highest volatility likely near the weekend.

Potential Reversal Zones:

- Resistance: 161.00/161.50

- Support: 157.80/157.30

Recommendations:

- Buying: Acceptable with reduced lot sizes for intraday trades, but close positions upon initial reversal signals.

- Selling: Fractional volume trades can be considered after reversal signals appear near resistance, during individual sessions.

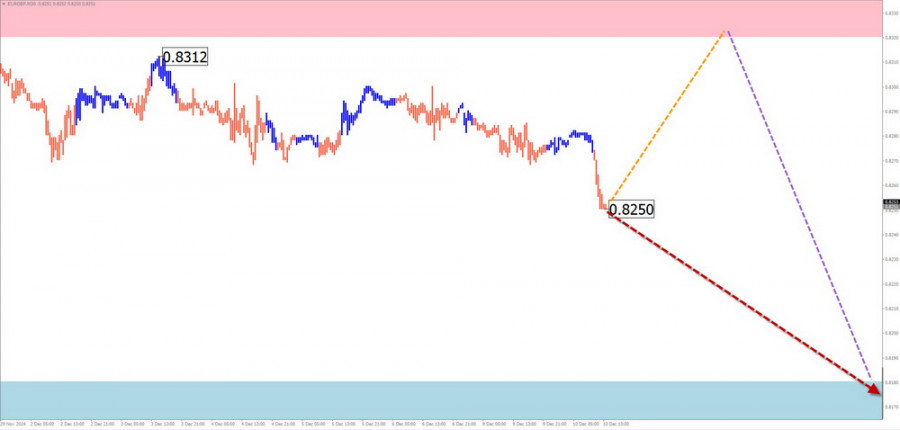

EUR/GBP

Brief Analysis:The long-term trend for EUR/GBP has been bearish in recent years. The current incomplete trend segment began on August 5 and is forming its final part (C), which remains unfinished.

Weekly Forecast:For the next couple of days, the pair is likely to trade sideways. A brief price rise toward the support zone may occur, followed by a reversal and a return to bearish sentiment. The support zone marks the lower boundary of the pair's likely weekly range.

Potential Reversal Zones:

- Resistance: 0.8320/0.8370

- Support: 0.8180/0.8130

Recommendations:

- Buying: Can be considered after reversal signals appear in your trading system.

- Selling: Fractional volume trades are possible during individual sessions but have limited potential.

US Dollar Index

Brief Analysis:On the daily timeframe, the dollar index is nearing the completion of its bullish trend, which began on September 25. A bearish wave starting on November 6 has reversal potential, with price extremes forming an extended horizontal flat pattern.

Weekly Forecast:The index is expected to continue declining relative to other major currencies this week. A brief rise in dollar values is possible in the next day or two, but it is unlikely to exceed the resistance level. The calculated support zone contains a cluster of potential reversal levels across different timeframes.

Potential Reversal Zones:

- Resistance: 106.20/106.40

- Support: 104.70/104.50

Recommendations:

- No conditions for selling national currencies are expected this week. Brief trades to strengthen other currencies against the U.S. dollar could be profitable in the next couple of days.

Explanation of Simplified Wave Analysis (SWA):

- All waves consist of three parts (A-B-C).

- Only the latest incomplete wave is analyzed for each timeframe.

- Dotted lines indicate expected movements.

Note: The wave algorithm does not account for the duration of price movements over time.