Recently it became known that the SEC approved the creation of the Volt Crypto Industry Revolution and Tech ETF. And today, Bloomberg's chief ETF analyst Eric Balchunas again raised the topic of Bitcoin ETFs. They are expected to be approved by the US Securities and Exchange Commission in late October - early November this year.

Prospects for Bitcoin Futures ETF Approval

If all goes well, ProShares, the first to apply for a Bitcoin ETF, will be able to launch it in eight days.

Balchunas noted on Twitter that the SEC has a few days left to either approve or again delay consideration of the creation of Bitcoin futures ETFs. In 2021, nearly two dozen applications were submitted, including from the giants Galaxy Digital and VanEck.

The first application for a BTC ETF, according to Balchunas, came from ProShares. There is no news yet from the SEC about these bitcoin futures ETFs, but the expert says that in this particular case, the lack of news is perhaps good news.

But there is another side of the coin here. The same Balchunas notes that the crypto community may overestimate the demand for these bitcoin funds. He acknowledges that if they are launched, it will be a huge step forward. However, it is likely that in the first year their volume will not exceed $4 billion, and this is a very small amount.

Investors are in no hurry to sell bitcoin

A recent weekly report released by Glassnode shows that the total number of active Bitcoin addresses in the past week has reached 291,000, up nearly 19% since the beginning of October. The average transaction size for the main cryptocurrency has also grown. Now it is 1.3 BTC.

Long-term bitcoin holders have significantly increased their savings since March 2021. Over the past seven months, the volume of assets of long-term holders has grown by 2.37 million BTC. During the same period, only 186,000 new coins were mined.

At the same time, the daily number of active participants in the network has grown by 19% this week, reaching about 291,000. This value corresponds to the indicators of the end of 2020 at the beginning of the last bullish period. More active market participants have historically been correlated with growing interest in the asset in the early stages of bull markets, Glassnode notes.

Long-term holders now own a total of 13.28 million bitcoins. The latest Glassnode report shows that long-term bitcoin holders are still unwilling to sell their digital assets, despite the price of the main cryptocurrency rising above $57,000. In March 2021, the volume of coins in long-term holders was 10.91 million.

In parallel, there was a sharp decline in the supply of bitcoins on the exchange.

"Coin retention has dominated over the past 7 months, with over 2.37 million BTC crossing the short-term and long-term holding threshold (~155 days)," Glassnode added in its report.

Big growth or big disappointment?

So, several interesting events are brewing on the market: the possible approval of the Bitcoin ETF and the approach of the main cryptocurrency to historical highs. In the market, judging by the reduction in supply and the growth in the number of holders, this is expected.

And here, in my opinion, two scenarios are possible. Traders are well aware that the market is growing on rumors and expectations. While it pushes the price up. But reaching an all-time high, if it roughly coincides in time with the possible actual approval of the SEC funds, could lead to a fall in the main cryptocurrency. Firstly, some of the buyers are likely to fix profits, and secondly, sales based on facts have not been canceled.

The second scenario is a rapid passage of the historical high, as was the case with the 2017 high, without significant corrections. That's when you can soon expect $100,000 for one bitcoin.

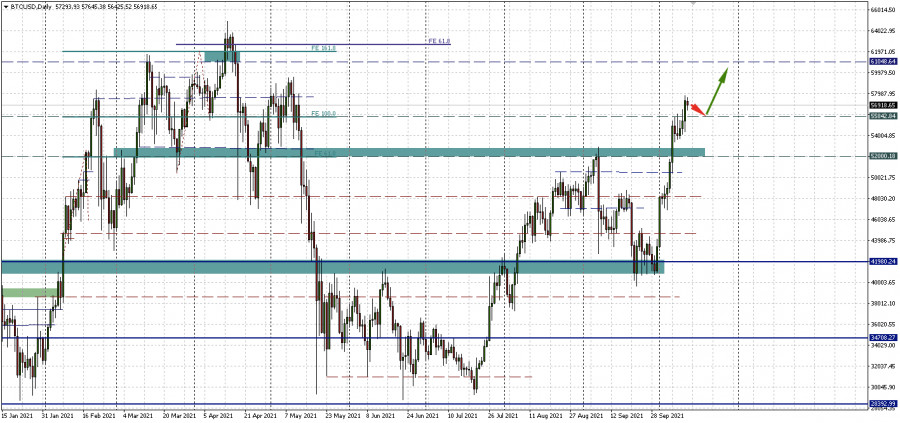

But these are scenarios for the future, perhaps not very distant. So far, BTCUSD is rolling back to the level of 55,842.84 that was broken yesterday and, possibly, will confirm it as a support.