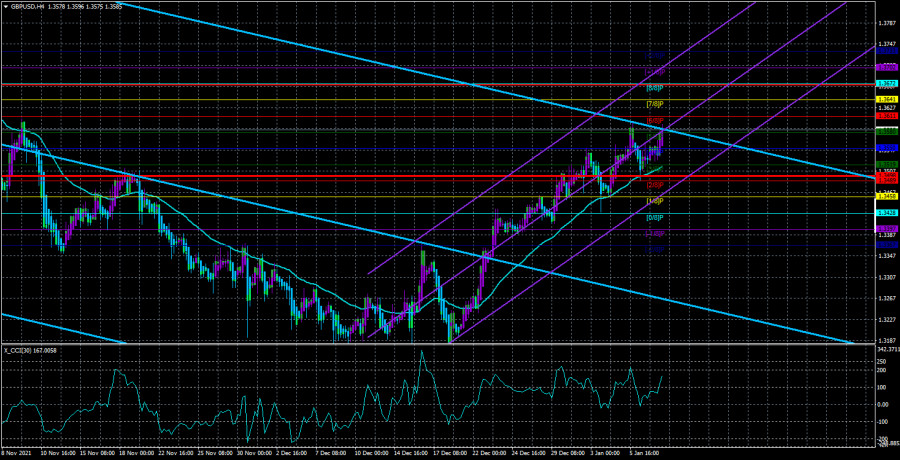

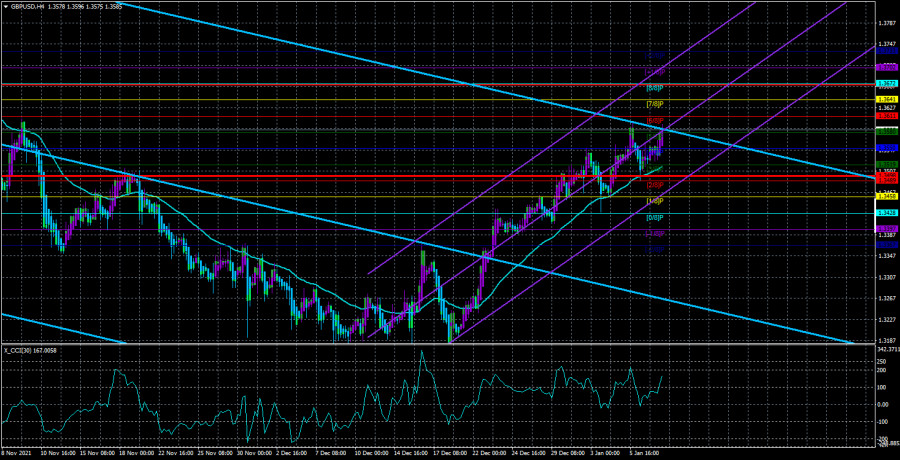

The upward movement on GBP/USD resumed on Friday, following a bounce from the moving average. So, the pair is in the uptrend, which is indicated by the MA and the lower linear regression channel. Since mid-December when the pound started to grow (right after the BoE raised the benchmark interest rate), not a single correction has occurred and the sterling has soared by over 400 pips. This move is a bright example of how the market should react to crucial fundamentals. Therefore, every time you find a movement of 20-30 pips that could be a reaction to any event, you should remember that it could be just noise. Since the price is still above the MA, the uptrend continues. Consequently, traders could consider buying the pound. Fundamentally, the short-term growth of the sterling should have stopped by this point. A 400 pips move is a good reaction of the quote to the BoE's decision. Meanwhile, the pound could extend gains in the mid-term if the US Federal Reserve does not take a more hawkish stance on monetary policy. It is quite possible that 2-3 rate hikes are already priced in the current dollar rate this year. So, further growth of the American currency is likely, but not obvious.

Omicron is less harmful but spreads faster

Omicron spreads faster than its predecessors. At the same time, it is less harmful to people. This means that it is less likely to cause complications and hospitalizations that could result in the death of a patient. However, as soon as the world found out about that, many epidemiologists and doctors said that the mild symptoms of the Omicron strain could be easily offset by its quicker spread. This fact is confirmed by what is now going on in the UK where the government has had to involve its armed forces to support the NHS amid staff shortages due to Covid-19. The country reported some 150K-200K new infection cases daily last week. During the two previous waves of the pandemic, the highest daily infection rate was 60K cases. No wonder, hospitals in the UK are full of Covid patients. Downing Street announced that more than 2,000 troops were sent to support the NHS. Prime Minister Boris Johnson said no lockdown was needed because the symptoms of the latest variant of the virus were mild. At the same time, he also stressed that the NHS would face several tough weeks due to staff shortages as many hospital workers would have to self-isolate. Moreover, there are other diseases apart from the coronavirus. This means that the shortage of personnel could also affect other people in the UK requiring treatment or awaiting surgery. So, Mr. Johnson may face a new portion of criticism in the near future, although very few in the British Parliament support the introduction of a lockdown. They are mainly Laborites and their followers who are in favor of strict quarantine.

Generally speaking, Boris Johnson could be right at some point that he opposed the introduction of a lockdown. The foreign exchange market is at least not at all worried about this and the UK PMI for December showed no fall. Perhaps this decision would be less harmful to the economy this time.

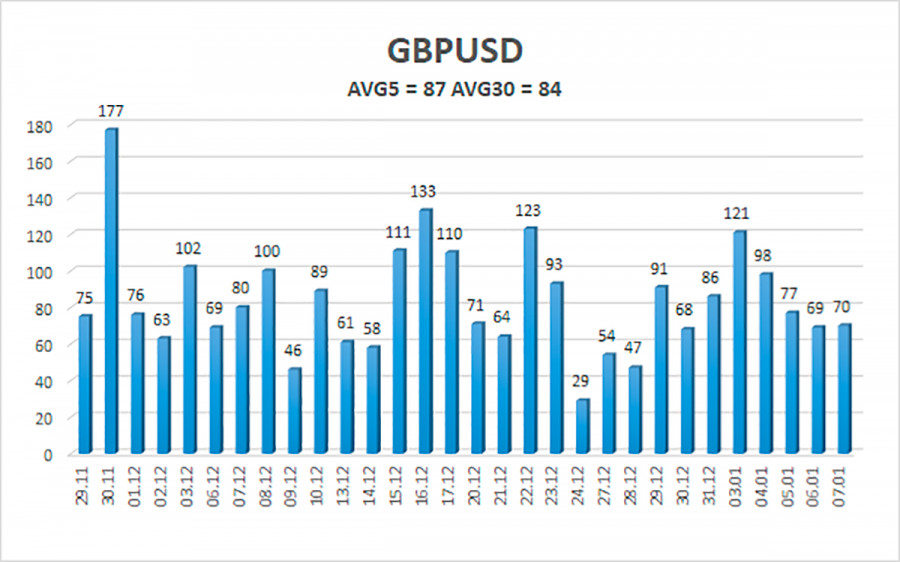

On January 10, the volatility of GBP/USD totals 87 pips. Today, the pound/dollar pair is expected to move in the range between 1.3498 and 1.3671. Heiken Ashi's downward reversal is likely to indicate a correction.

Closest support levels:

S1 – 1.3550

S2 – 1.3519

S3 – 1.3489

Closest resistance levels:

R1 – 1.3580

R2 – 1.3611

R3 – 1.3641

Outlook:

The GBP/USD pair is rising, according to the H4 time frame. So, long positions could be opened with traders at 1.3641 and 1.3671 until Heiken Ashi's downward reversal. Traders could consider selling the pair in case of consolidation below the MA with targets at 1.3489 and 1.3458 until Heiken Ashi's upward reversal.

Indicators on charts:

Linear Regression Channels help identify the current trend. If both channels move in the same direction, a trend is strong.

Moving Average (20-day, smoothed) defines the short-term and current trends.

Murray levels are target levels for trends and corrections.

Volatility levels (red lines) reflect a possible price channel the pair is likely to trade in within the day based on the current volatility indicators.

CCI indicator. When the indicator is in the oversold zone (below 250) or in the overbought area (above 250), it means that a trend reversal is likely to occur soon.