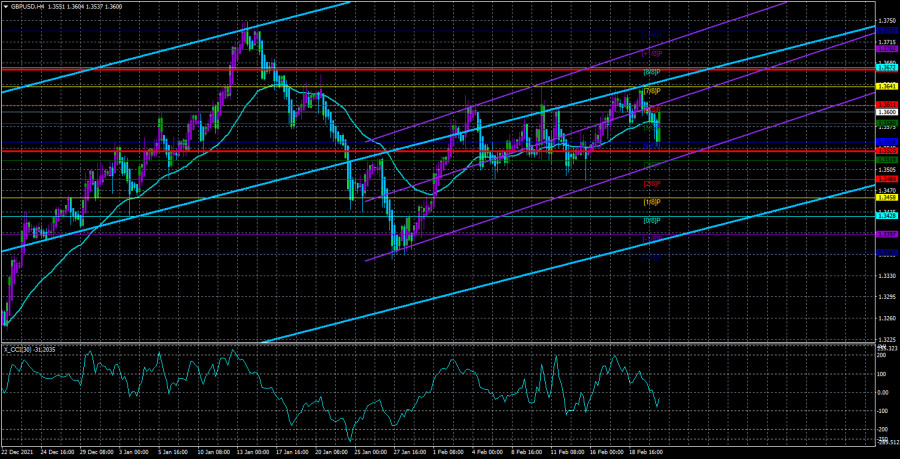

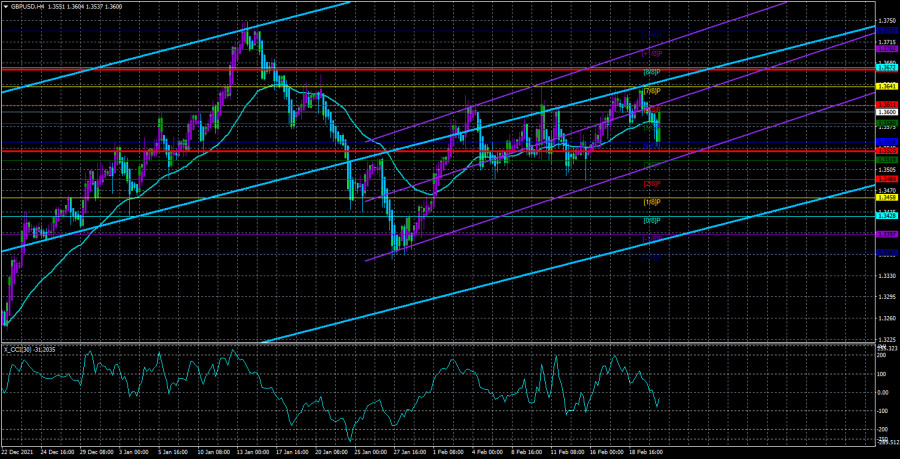

The GBP/USD currency pair began a new round of downward movement on Tuesday, however, as in the case of the EUR/USD pair, we are now talking primarily about the flat. It is perfectly visible in the 4-hour timeframe. The boundaries of the side channel are 1.3500 and 1.3641. This is not the narrowest channel, and it takes several days for the price to move from one border to another. Nevertheless, this is still a side channel, that is, about the same picture as for the euro currency. It is noteworthy that in the last few weeks, the bulls have been trying to continue the upward trend. Each subsequent peak was at least slightly higher than the previous one. However, from our point of view, the bulls missed the opportunity to continue growing. Now, most of the factors play into the hands of the US dollar. Despite even the mitigating factor in the form of a rate hike by the Bank of England. Most likely, the trend that has been observed in the last year will continue. We are talking about the fact that the pound sterling was much less willing to fall against the dollar than the euro and much more willing to grow than the euro. Thus, there is still a certain positive impact from the increase in the BA rate. However, it should be noted that BA raised the rate only in the last 2 months, and before that, there were no such conversations. Nevertheless, the pound still felt much more confident than the euro currency. Thus, it is probably not worth counting on a strong drop in the pair right now. Moreover, the market clearly showed: it is interested in the geopolitical background, but not so much as to transfer it to the charts of currency pairs.

Nothing but geopolitics.

We would now like to share with you the news from the Bank of England or Boris Johnson, talk about the prospects for a Fed rate hike or discuss the speeches of FOMC members. However, there is simply nothing like that now. Even the rare macroeconomic information that comes to the market from time to time does not cause almost any reaction from traders. For example, quite good reports on business activity in the UK were published on Monday. So what? Within an hour after their publication, the pound sterling fell seriously. All of Boris Johnson's speeches in recent weeks relate only to the topic of the Ukrainian-Russian conflict. At the moment, Johnson advocates the introduction of "tough" sanctions against the Russian Federation, up to disconnecting from SWIFT and freezing the Nord Stream-2 projects. We do not know whether these sanctions will be imposed or not, but there will be some sanctions in any case. It is worth noting that Moscow recognized the independence of the DPR and the LPR, which infuriated almost the whole world. In addition to Russia, the DPR and the LPR were recognized either by the allies of the Russian Federation or by the same unrecognized states as the LPR and the DPR themselves. Thus, there will be sanctions, in any case, the only question is what?

However, the market in any case does not show any interest in these geopolitical twists and turns. It doesn't look like it is interested in anything right now. In such a situation, we can only wait for the situation to resolve itself, or for some important event, such as a meeting of the central bank. Today and tomorrow there will also be speeches by the head of the Bank of England, Andrew Bailey, and theoretically, he can report something that the markets will not be able to ignore. On the other hand, it is unlikely that Bailey will openly declare that BA will raise the rate for the third time in a row at the next meeting. Bailey is generally reserved and rarely makes loud statements. So it turns out that this week traders will have almost nothing to react to. In the UK, no publications are scheduled at all for the rest of the week. In the States - not everything is so bad, but also not very bad. The world will continue to monitor the Ukraine-Russia conflict, as well as wait for the results of a personal meeting between Putin and Biden. However, he is not predisposed to actively trade now.

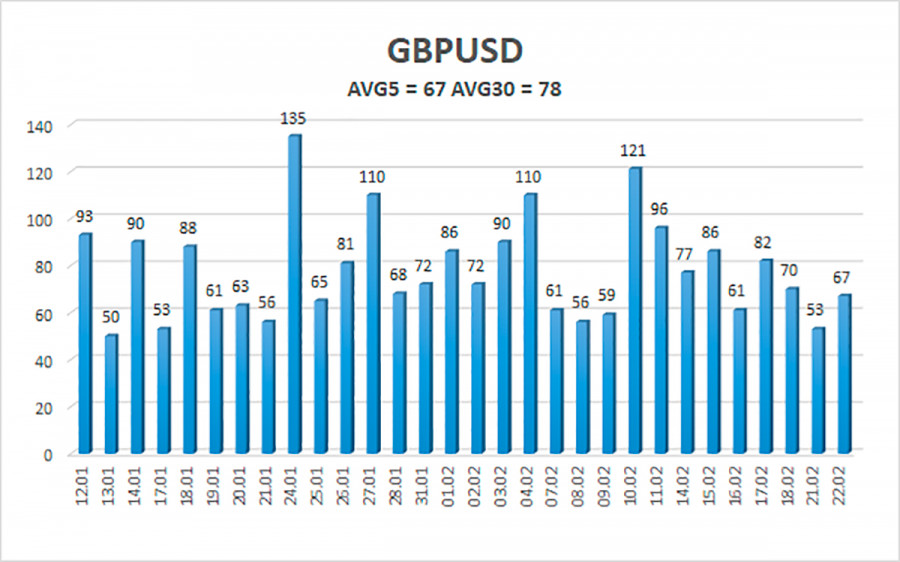

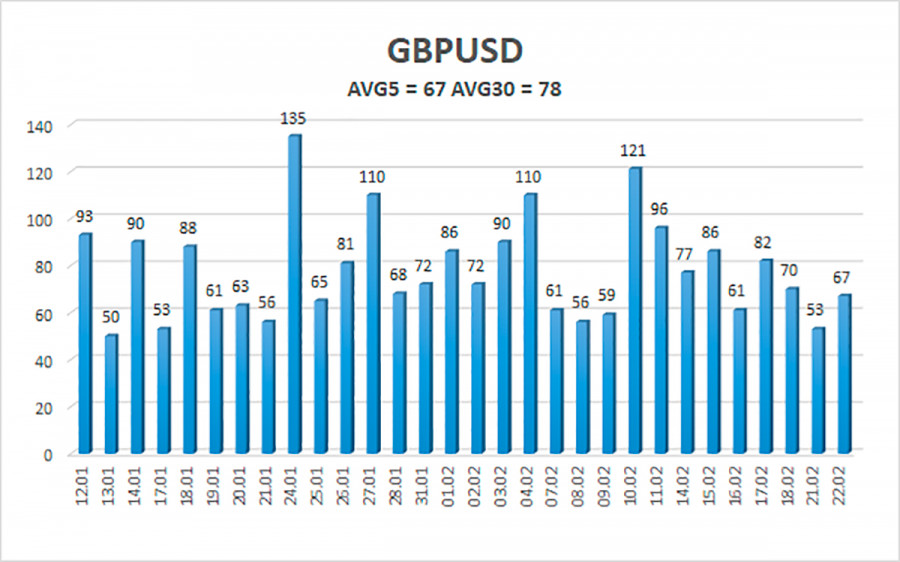

The average volatility of the GBP/USD pair is currently 67 points per day. For the pound/dollar pair, this value is "average". On Tuesday, February 23, thus, we expect movement inside the channel, limited by the levels of 1.3535 and 1.3670. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement within the framework of the "swing".

Nearest support levels:

S1 – 1.3580

S2 – 1.3550

S3 – 1.3519

Nearest resistance levels:

R1 – 1.3611

R2 – 1.3641

R3 – 1.3672

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe continues to trade near the moving in the "swing" mode. Thus, at this time, long positions with targets of 1.3641 and 1.3661 can be considered in case of consolidation above the moving average, but the high probability of a flat should be taken into account. It is recommended to consider short positions if the pair is fixed back below the moving average, with targets of 1.3535 and 1.3519, but again - a high probability of a flat.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.