Overview of the EUR/USD pair. March 2. The euro currency has flown down again

The EUR/USD currency pair showed a new round of downward movement on Tuesday. Thus, the bulls have not been able to seize the initiative in the market, and the European currency may collapse again in the near future. As we have already said, there is a redirection of capital in the markets now. Moreover, if earlier it was a redirection from risky assets to safe ones, now it is different. In particular, the cryptocurrency market has been growing seriously in recent days. The reason for this growth is quite simple: after tough sanctions were imposed on Russia and Russian banks from half of the globe, the ruble began to fall into the abyss. Naturally, Russians rushed to buy dollars or look for other ways to protect themselves from the depreciation of ruble savings. However, there are no dollars at the box office, and the ruble will fall for an unknown amount.

Thus, presumably, the majority of Russians with serious savings have started investing in cryptocurrencies, since this is almost the only tool available now that can protect against the devaluation of the ruble. After all, there is simply no point in buying stocks in Russia now, since the market has collapsed catastrophically over the past few days. On the one hand, any collapse is a good time to buy. On the other hand, this statement is true for countries against which sanctions are not imposed and access from SWIFT or VISA is not cut off. Thus, the collapse of the stock market in the Russian Federation may remain "just a collapse" without any recovery in the foreseeable future. Returning to the euro/dollar pair. At this time, the price is again as close as possible to its annual and 14-month lows. Several rebounds and turns of correction did not help the pair to start a new upward trend. However, we have already said that at this time the dollar has a much better chance of growth. Geopolitics, the imbalance in the monetary policies of the ECB and the Fed, the strength of the EU and US economies, all plays in favor of the US currency.

What's in Ukraine? What about Finland?

Unfortunately, no new and positive data is being received from Ukraine right now. The war continues, so there is no reason to expect an early resolution and completion of this military conflict. The only thing we can rely on is the statements of Kyiv and Moscow. And these statements further aggravate the situation. Official Moscow said yesterday that it will continue the "military operation" until all the goals are achieved. Or a joint solution will not be reached in negotiations with Kyiv. Kyiv has once again stated that it is not going to follow Moscow's lead and is ready to end the conflict on its terms, and not on the Kremlin's terms. And also applied for accelerated EU membership. Thus, Ukraine continues to take steps in the direction of the West and the European Union, and the Russian Federation continues to try to prevent this rapprochement, in particular with NATO.

However, it also became known yesterday that the Finnish Parliament will consider the possibility of joining NATO in the near future. It is reported that most of the Finnish people consider it necessary to join NATO after Moscow launched a military invasion of Ukraine. Finns, who have the longest border with the Russian Federation, believe that Moscow may eventually start conducting "military operations" in their country, so in the coming days their parliament may decide to join NATO. And Sweden is not far away there. Recall that the Kremlin has repeatedly stated that it is not only and not so much in Ukraine as in the non-expansion of NATO, which poses a real threat to the security of the Russian Federation. Thus, it is unlikely that Putin or Lavrov will like the idea of Finland joining NATO. The only question is, what will follow? Another military operation? One way or another, the geopolitical situation, despite the start of negotiations, is only getting worse day by day. If the Finns join NATO, it could even unleash a full-scale war between NATO and the Russian Federation.

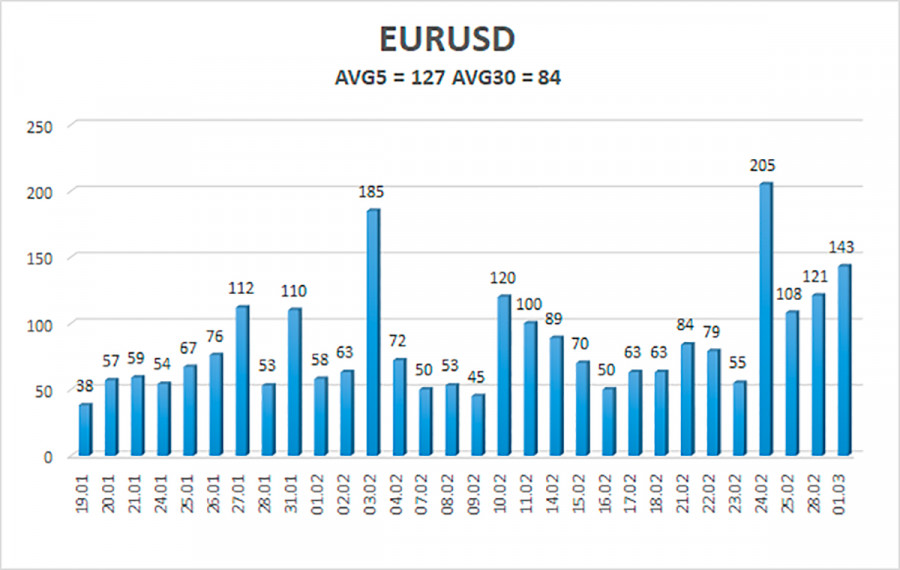

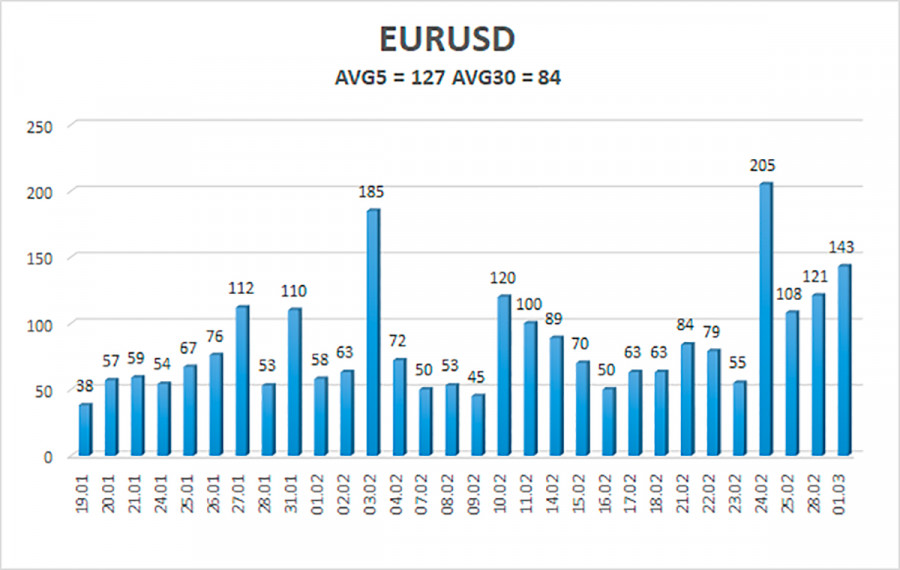

The volatility of the euro/dollar currency pair as of March 2 is 127 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0976 and 1.1230. A reversal of the Heiken Ashi indicator upwards will signal a new round of corrective movement.

Nearest support levels:

S1 – 1.1108

S2 – 1.1047

S3 – 1.0986

Nearest resistance levels:

R1 – 1.1169

R2 – 1.1230

R3 – 1.1292

Trading recommendations:

The EUR/USD pair resumed a strong downward movement. Thus, it is now possible to stay in new short positions with targets of 1.1047 and 1.0986 until the Heiken Ashi indicator turns up. Long positions should be opened no earlier than the price-fixing above the moving average line with targets of 1.1292 and 1.1353.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.