The GBP/USD currency pair has increased by 100 points, and this is only in the first half of the day. Naturally, such a strong movement with an empty calendar of macroeconomic events could only be provoked by a geopolitical factor. In principle, it is based on this factor that the foreign exchange market showed the strongest movement on Tuesday. It should be noted here right away that it was impossible to predict this movement. No one could have known what the results of the negotiations between the Ukrainian and Russian delegations in Turkey would be. Especially because the previous rounds ended with almost nothing. However, after the negotiations ended, it became known that Ukraine was ready to make significant concessions on the issues of abandoning the development of nuclear weapons and joining NATO. And Russia no longer insists on demilitarization and denazification of Ukraine. In general, both sides decided that it was better to make peace than to continue fighting.

Of course, now it is completely unclear what and how will happen in the world in a month or two. Let's say a peace agreement will be signed in the coming weeks and hostilities will cease. At whose expense will Ukraine be restored? Which of the sanctions will be lifted from Russia? According to the top officials of the European Union and the United States, the "catastrophic" sanctions imposed against Russia over the past month will not be lifted even if the special operation is completed and the Russian troops are completely withdrawn from the territory of Ukraine. In addition, gas and oil issues are very acute now. For example, the same UK has already decided to abandon purchases of Russian oil and gas in 2022. If the special operation ends, will London want to buy gas and oil in Russia again? And Europe? Brussels stated that they are ready to reduce dependence on Russian hydrocarbons as much as possible. Vladimir Putin noted that from now on Europe will pay for energy in Russian rubles. Michel Borrel (European Council) said that the EU will not pay in the currency which Putin wants. The Russian President replied that in this case there would be no more gas supplies to Europe. As you can see, the special operation has a theoretical chance of completion in the near future, but there are so many open questions that it is completely unclear how everything will end for Russia and the European Union.

Andrew Bailey urged not to count on a strong tightening of monetary policy

At the same time, the head of the Bank of England, Andrew Bailey, gave a speech. He said that, given the existence of a military conflict in Ukraine, it is very difficult to predict the economic situation at any time in advance. According to Bailey, the Ukrainian-Russian conflict may have long-lasting consequences for the global economy, so it makes no sense to make predictions of British politics and, based on them, predict a certain rate increase in 2022. The Bank of England will be very cautious with a further increase in the key rate. In addition to the high probability of a new global financial crisis, Bailey also mentioned the coronavirus, the global epidemic of which is by no means over. On the contrary, in China, a "lockdown" was recently introduced in some regions, which means that the virus has not evaporated anywhere and can begin to terrorize humanity with renewed vigor. It's just that the attention of the public and the authorities in the last month has been diverted from the epidemic. Thus, at this time, it is still very early to talk about overcoming all the problems.

Nevertheless, the Bank of England may continue to raise the rate this year. It is simply obliged to bring it to at least 1%, and some optimistic experts believe that it will be 2% by the end of the year. Recall that the Fed has approximately the same plans. The Fed is also preparing to raise the rate by the end of 2022 by about 2-2.5%. If both expectations are confirmed, then the pound will still be the most resistant currency against the US dollar. Recall that in the European Union, no one even stutters about raising the rate, and the whole block is on the verge of an energy and food crisis. Therefore, the chances that the euro will fall against the dollar in the medium term are much greater than the pound.

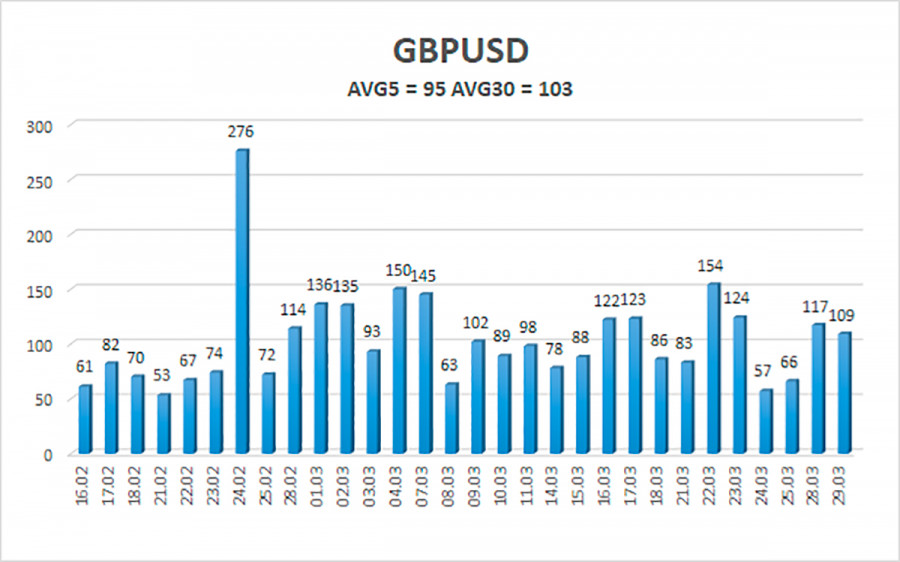

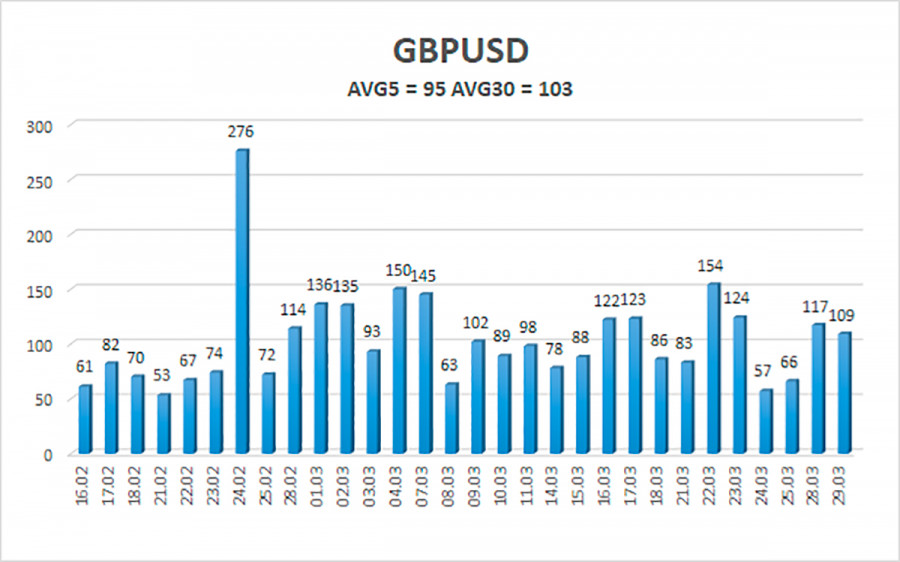

The average volatility of the GBP/USD pair is currently 95 points per day. For the pound/dollar pair, this value is the average. On Wednesday, March 30, thus, we expect movement inside the channel, limited by the levels of 1.2972 and 1.3163. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward correction.

Nearest support levels:

S1 – 1.3062;

S2 – 1.3000;

S3 – 1.2939.

Nearest resistance levels:

R1 – 1.3123;

R2 – 1.3184;

R3 – 1.3245.

Trading recommendations:

The GBP/USD pair has started a new round of downward movement in the 4-hour timeframe. Thus, at this time, it is possible to maintain sell orders with targets of 1.3000 and 1.2972 until the Heiken Ashi indicator turns upwards. It will be possible to consider long positions no earlier than fixing the price above the moving average with targets of 1.3245 and 1.3306.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now;

Murray levels - target levels for movements and corrections;

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators;

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.