The EUR/USD currency pair continued to trade very low for itself on Thursday and Friday. However, there is an important achievement for the euro - it has not fallen below the Murray level of "2/8"-1.0498. Thus, despite the strongest fundamental and macroeconomic background last week, the euro refrained from conquering new lowlands. In the current circumstances, this can be fully considered an achievement. On Friday, traders frankly ignored the reports on non-farm and unemployment, which, from our point of view, were quite strong. However, the dollar has not risen in price, so it is reasonable now to talk about a certain "day" for the pair. Now it remains only to understand whether this is the "bottom" from which the formation of a new upward trend will begin, or whether the bears are just gathering strength to continue selling the euro?

We believe that there is now only one factor to end the downward trend. This factor is too long and too strong, almost recoilless fall. No currency or instrument can move in the same direction all the time. This is especially true for currencies, which, whatever the "foundation", remain instruments that are not too volatile (for example, in comparison with cryptocurrencies). If bitcoin loses 10% of its value in a day, then hardly anyone will be very surprised. This is possible because the cryptocurrency market is much smaller than the currency market. Consequently, there are fewer players on it, and it is more "thin". With currencies, a 10% drop per day is almost impossible. Of course, if we are talking about stable, strong currencies, like the euro, pound, dollar, and yen. Therefore, when the pair moves in the same direction for a long time, it means that a commensurate correction will follow. But in our case, this correction still does not begin. Although all the factors of the fall have been worked out a long time ago. Thus, the 5th level is now the mainstay of the euro currency. As long as it is not overcome, we can count on an upward correction. And even strong. If it is overcome, the euro may reach its 20-year low near the level of 1.0350.

The military conflict between Ukraine and the Russian Federation may escalate.

Unfortunately, the conflict between Ukraine and Russia may escalate in the coming weeks. Many military experts are already talking about this. Rumors have been actively circulating for several weeks that a full or partial mobilization will be announced in Russia, which can mean only one thing - new tens and hundreds of thousands of soldiers will go to Ukraine to achieve the goals set by Moscow. Ukraine, on the other hand, continues to be pumped up with Western weapons, so it will be much easier for it to hold the defense. According to the statements of official Kyiv, so far only a small part of all Western weapons have arrived at the front. We are talking now about heavy equipment and artillery. It takes a lot of time to get the equipment, learn how to work on it, and then deliver it to the front line. Therefore, now Ukraine is still fighting back with what it has. However, if mobilization is carried out on the part of Russia, and technical equipment is increased several times on the part of Ukraine, this means only one thing: new bloody battles. Thus, in the near future, the conflict may move into a new active phase, and no one even stutters about peace talks either in Moscow or in Kyiv. For risky currencies, this may mean the emergence of a new fall factor.

As for macroeconomic statistics, there will be practically no interesting events in the European Union in the new week. ECB President Christine Lagarde will deliver a speech on Wednesday, and a report on industrial production will be published on Friday. It is difficult for us to imagine what Lagarde should say for traders to start buying euros. Only that the regulator is ready to raise the rate in the near future. However, we still do not believe that the ECB will take such a step in the coming months. Thus, unfortunately, the situation for the euro remains very difficult and pessimistic. Buying a pair on a strong downtrend is very dangerous, and 2022 promises to be a nightmare for the whole world.

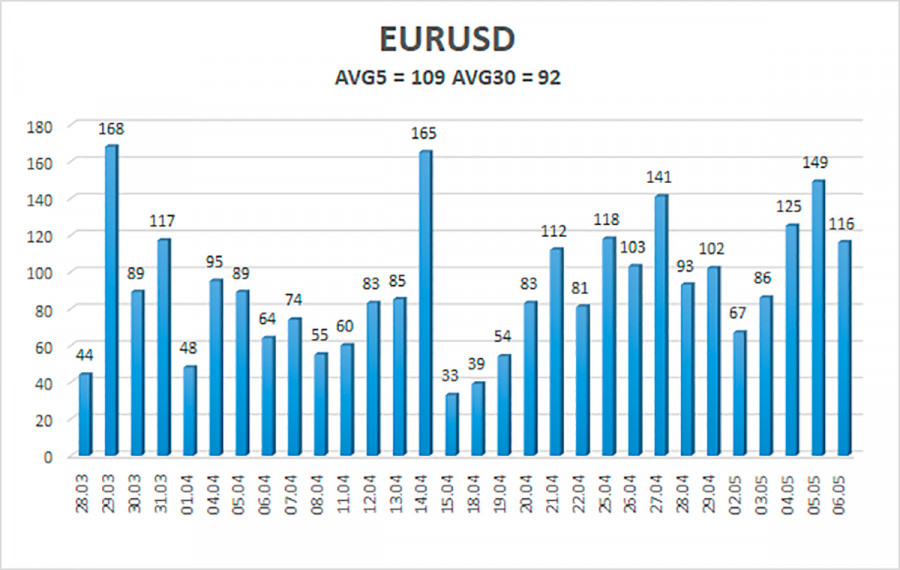

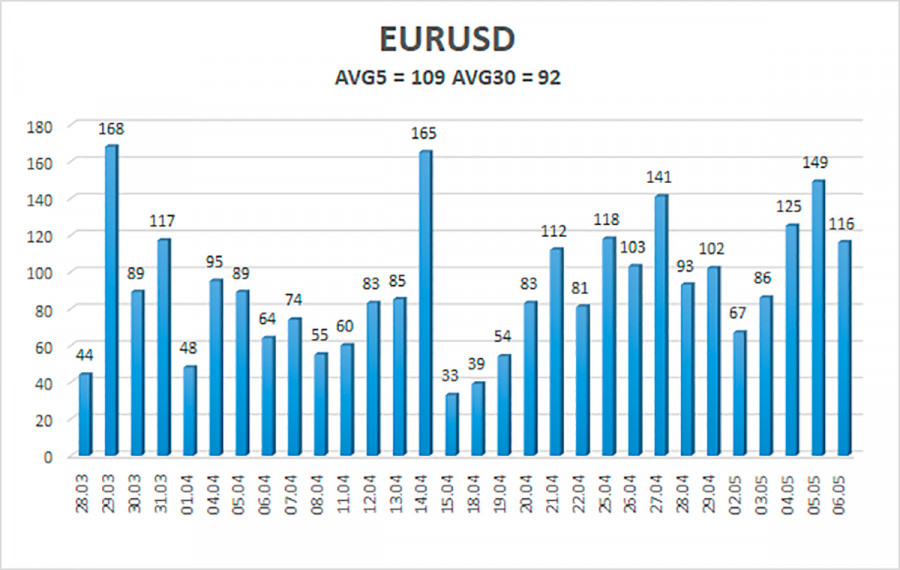

The average volatility of the euro/dollar currency pair over the last 5 trading days as of May 9 is 109 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0442 and 1.0661. The reversal of the Heiken Ashi indicator downwards signals a new attempt to continue the downward trend.

Nearest support levels:

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest resistance levels:

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading recommendations:

The EUR/USD pair is trying to maintain a downward trend. Thus, now we should consider new short positions with targets of 1.0442 and 1.0376 in case of overcoming the level of 1.0498. Long positions should be opened with a target of 1.0742 if the price is fixed above the level of 1.0620.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.