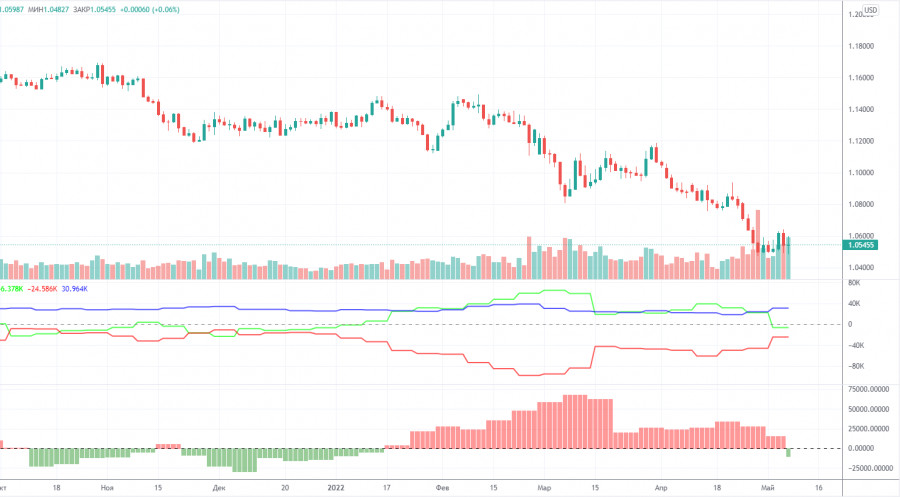

EUR/USD 5M

The EUR/USD pair made another attempt to correct on Monday. Successful this time. Even this luck did not help the pair to update at least its previous local high. Thus, it is better to say that yesterday there was a new round of upward movement inside the horizontal channel. This channel is far from obvious, however, some semblance of it is present. In principle, the pair may try to go to the level of 1.0637 in the coming days, but even such an increase will not mean anything extraordinary. As long as the price is below the Senkou Span B line, all current movement is just a correction. The euro is still very difficult to find grounds for growth. Once again: what did we see on Monday? A spiral of upward movement, of which we saw no less than four last week. There were no important macroeconomic statistics on Monday. There were no important speeches or geopolitical news. Everything remains as it was for the pair.

There was a clear problem with trading signals on the 5-minute timeframe yesterday. The first sell signal was formed when the price bounced off the critical line. After that, it went down about 30 points, which was enough to put Stop Loss at breakeven. But it was most likely not possible to make a profit on a short position. The next signal was generated when the pair broke the 1.0579 extreme level, however, it was formed too late to work it out. As a result, zero profit on Monday.

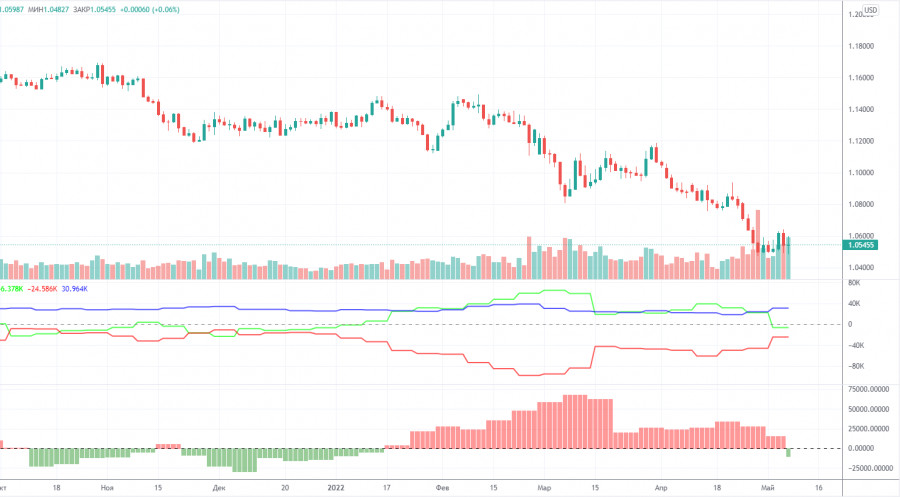

COT report:

The latest Commitment of Traders (COT) reports on the euro raised more questions than they answered! But finally the situation began to change and now the COT reports more or less reflect the real picture of what is happening on the market, as the mood of the non-commercial group has become bearish. The number of long positions decreased by 14,500 during the reporting week, while the number of shorts in the non-commercial group increased by 14,000. Thus, the net position decreased by 28,500 contracts per week. This means that the bullish mood has changed to bearish, as the number of short positions now exceeds the number of non-commercial traders' long positions by 6,000. However, what happened in the last reporting week is a double-edged sword. On the one hand, COT reports now reflect what is happening on the market. On the other hand, if now the demand for the euro has also begun to fall, then we can expect another new fall in this currency. Recall that in recent weeks, professional traders, oddly enough, maintained a bullish mood and bought the euro more than sold. And even in this scenario, the euro fell like a stone. What will happen now, when the major players have begun to sell the euro? Demand for the dollar remains high, demand for the euro falls. Thus, it is quite reasonable now to expect a new decline in the euro/dollar pair. Moreover, the reaction to the Federal Reserve's hawkish meeting was not quite adequate.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. May 10. Going through the throes of the euro around the 5th level. Hungary blocked the oil embargo.

Overview of the GBP/USD pair. May 10. Sanctions are being introduced, the British pound is trying to rise from the dead.

Forecast and trading signals for GBP/USD on May 10. Detailed analysis of the movement of the pair and trading transactions.

EUR/USD 1H

It is clearly seen on the hourly timeframe that the pair has been desperately trying to correct in recent weeks and on Monday there was a new round. However, the pair still has a downward trend, and the euro can resume to fall at almost any moment. Recall that last week quite strong statistics came out in the United States, and the Federal Reserve raised the key rate. Only the factor of the need to correct on the 24-hour timeframe works in favor of the euro's growth. On Tuesday, we highlight the following levels for trading - 1.0340-1.0369, 1.0471, 1.0579, 1.0637, 1.0729, as well as Senkou Span B (1.0703) and Kijun-sen (1.0563). Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. There are also secondary support and resistance levels, but no signals are formed near them. Signals can be "rebounds" and "breakthrough" extreme levels and lines. Do not forget about placing a Stop Loss order at breakeven if the price has gone in the right direction for 15 points. This will protect you against possible losses if the signal turns out to be false. No important events or publications are scheduled for May 10 in the European Union and the US. It is hardly possible to consider the index of consumer sentiment from the ZEW institute "an important event". However, the pair now continues to move quite briskly even without macroeconomics.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.