While investors wait for the Federal Reserve's decision on interest rates to be released today (at 18:00 GMT), market participants watching the quotes of the main currencies of the Pacific region—AUD and NZD—will study the report of Stats NZ with data on the country's gross domestic product for the 1st quarter of 2022. This indicator assesses the total value of all goods and services produced by the economy and is considered the main indicator of business activity and its condition.

As New Zealand Finance Minister Grant Robertson recently stated, "the New Zealand economy is strong and resilient." In his opinion, there is currently "a high level of demand" in the country's economy. At the same time, it (demand) cannot be fully satisfied due to a failure in supply chains, which is "largely due to global factors."

Economists expect that the country's GDP in the 1st quarter grew by +0.6% (+3.3% YoY) against growth of +3% QoQ (+3.1% YoY) in the 4th quarter of 2021, despite the fact that the Omicron strain wave exerted pressure on the economy.

GDP data (along with data on the labor market and inflation in the country) directly affect the decisions of the central bank of New Zealand on monetary policy. Therefore, today's publication (at 22:45 GMT) of the country's GDP data is very important for economists and managers of the RBNZ, as well as for market participants trading NZD.

At a meeting on May 25, the RBNZ raised its interest rate to 2.0% from 1.5% after a similar-scale increase in April. According to the central bank's forecast, the key rate will reach 3.4% by the end of this year and 3.9% in April-June 2023. Earlier, the RBNZ predicted that the rate would be 2.2% in the last quarter of this year and reach a peak of about 3.4% in 2024.

"The members (of the committee) agree that a larger and faster increase in the official interest rate will avoid serious costs to employment and the economy as a whole as a result of high inflation," the RBNZ said in an accompanying statement.

Consumer prices in New Zealand in the 1st quarter jumped by 6.9% (in annual terms), which was the strongest growth in the last 30 years.

If the GDP report for the 1st quarter turns out to be strong, surpassing economists' forecasts, then there are fewer obstacles for the RBNZ to raise the interest rate again at its next meeting on July 13. Thus, the RBNZ will continue to follow the example of the Fed and other major world central banks, carrying out its most aggressive tightening cycle in the last few decades.

In normal economic conditions, an increase in the interest rate usually leads to a strengthening of the national currency. However, the current economic situation cannot be called normal, given the problems caused by large-scale monetary and fiscal incentives, confusing global supply chains, and rising prices for energy and other goods after the start of Russia's military operation in Ukraine.

Nevertheless, if today's New Zealand GDP report exceeds market expectations, then we should expect the NZD to strengthen.

As for the NZD/USD pair, the biggest impact on its dynamics today will not be the report of the Stats NZ on GDP, but the Fed's decision on the interest rate. It is known that it will be published today at 18:00 (GMT).

The US dollar has strengthened significantly in recent days in anticipation of this decision. Despite the fact that economists expect the Fed to raise the interest rate by 0.50% today and the same decision at the July meeting, the market is still waiting for tougher decisions from the Fed. This is pushing the US dollar to new multi-year highs.

Thus, the dollar index (DXY) hit a new high yesterday (since January 2003) at 105.47. Despite the fact that the DXY index is declining today (as of this writing, DXY futures are trading near 104.71), the dollar retains positive dynamics and an advantage in the foreign exchange market in relation to all its main competitors, including NZD.

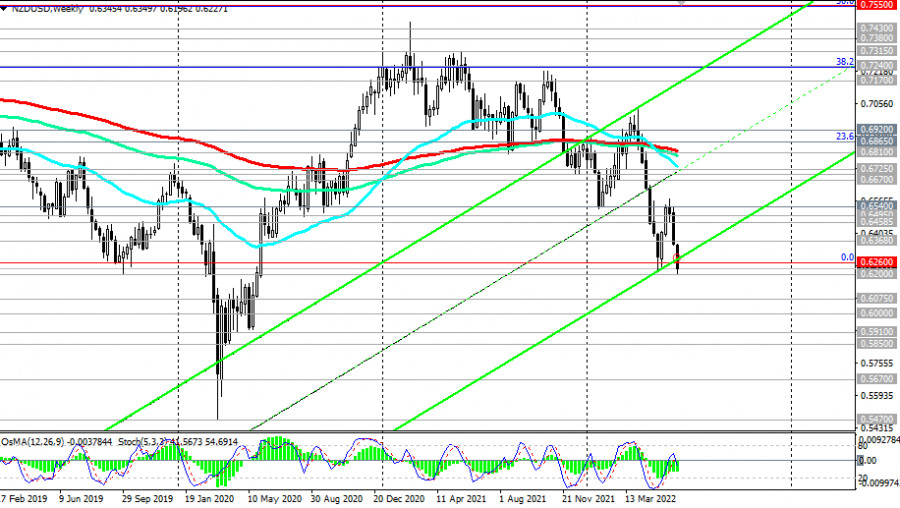

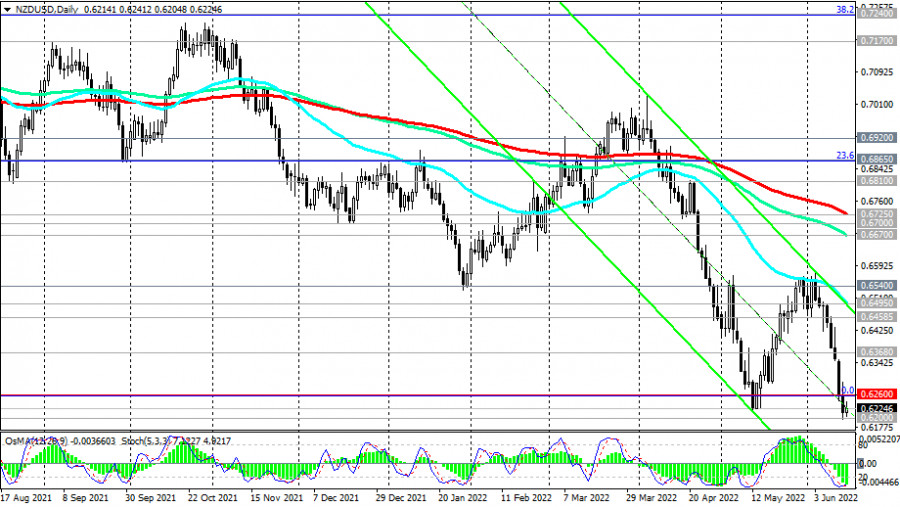

The NZD/USD pair, like other "major" dollar currency pairs, has significantly decreased (NZD weakened against USD) in recent days. Its fall this month (for its first half) has already amounted to about 5%, and yesterday the price updated an almost 2-year low, breaking through the 0.6200 mark.

The pressure on NZD/USD due to the total strengthening of the US dollar remains. It is possible that already tonight we will see new 2-year lows in NZD/USD quotes. However, much will also depend on the rhetoric of the accompanying statements by the Fed leaders. Recall that the Fed press conference will begin today at 18:30 (GMT), and it will be of the greatest interest to investors.