The GBP/USD currency pair has continued to trade lower over the past few days. Although there were no good reasons for a new fall in the pound, which has updated its 37-year lows, sellers continued to adhere to the downward trend, rightly believing that if there is a strong trend, why open countertrend positions? Therefore, the British currency resumed its decline last Tuesday, when a relevant report on inflation in the United States was published, and has been falling almost every day since then. In principle, we said earlier that the downward trend would likely continue, and the 37-year lows would be updated more than once. The pound has the same problem as the euro – it can't adjust. And if there is not a tangible correction, how can the current trend end? The pound is sold simply by inertia and not based on a "foundation" or statistics. As we said earlier, the British statistics last week were not so disastrous that the pound fell by almost 400 points more.

Nevertheless, all technical indicators continue to indicate a downward trend now. We have no technical signals to buy nor fundamental reasons to buy. Yes, the "foundation" has recently begun to level out a little for the euro and the pound, but what's the use of that if both currencies have been falling and continue to fall? The Bank of England has raised the rate six times in a row and will probably raise it for the seventh time this week, so what? Did it help the pound in any way? Therefore, now we can only draw the same conclusion as before: the British pound will continue to fall until sellers get enough and begin to reduce short positions. And when it happens, it is quite difficult to say. We could try to link the beginning of a new trend with some important event, but something tells us that there will be no such clear cause-and-effect relationship. Too easy.

The pound is preparing for "flights" this week.

Central bank meetings will be held in the UK and the US this week. These events do not need an additional announcement or explanation. It is clear to everyone that these are mega-important events, following which a strong market reaction may follow, especially if the market receives unexpected information. Let's go through other events, although they will clearly be in the shadow of the meetings of the BA and the Fed. In the UK, all the most important statistics were already published last week. This one shows only September's indices of business activity in the service and manufacturing sectors. According to forecasts, all three indices will continue to decline, which is not surprising, given that the British economy is racing towards recession at full speed.

There will be no important events in the States this week, except for the Fed meeting. Several secondary reports will be published, the market's reaction to which happens every few years. These reports include applications for unemployment benefits and the number of new residential buildings or foundation work. Only the data on business activity on Friday will be more or less interesting. Thus, this week, all the attention of traders will be focused on the meetings of the two central banks. We remind you that the market reaction to meetings can be anything, and in terms of duration, it can take more than a day for each meeting. Therefore, no matter what movements we see immediately after the announcement of the results, it should be remembered that over the next 24 hours, the pair can safely go in the other direction for an even greater distance. There is no need to rush to conclusions, and there is no need to rush to open positions to avoid losses. The downward trend remains relevant and strong, but the lower the pair, the less willing to continue selling it because, sooner or later, the trend will be completed.

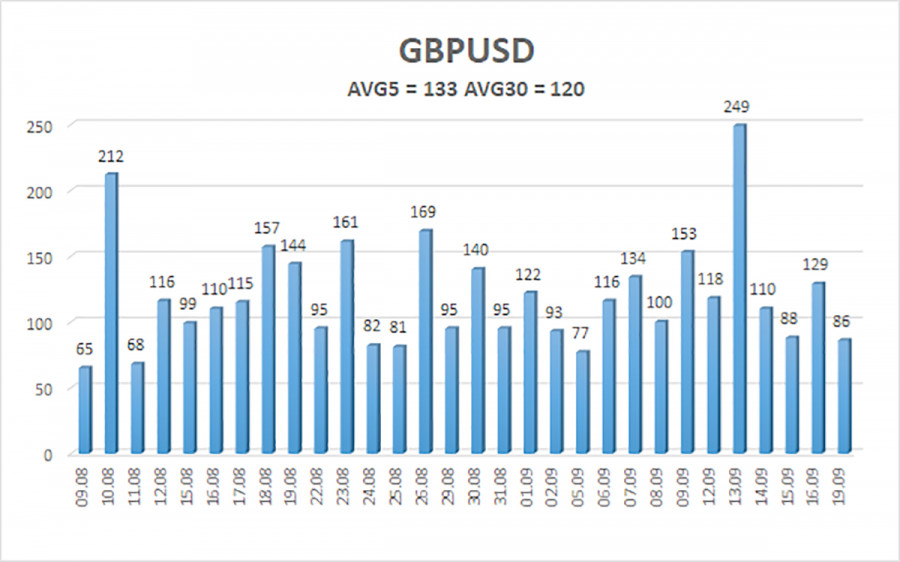

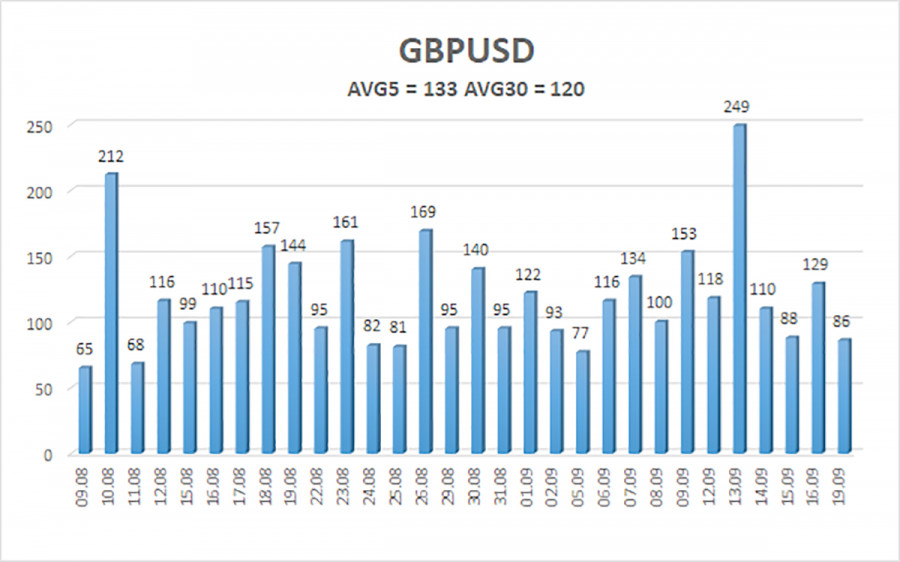

The average volatility of the GBP/USD pair over the last five trading days is 133 points. This value is "high" for the pound/dollar pair. On Tuesday, September 20, we expect movement inside the channel, limited by the levels of 1.1273 and 1.1538. A reversal of the Heiken Ashi indicator upwards will signal a round of upward correction.

Nearest support levels:

S1 – 1.1353

S2 – 1.1292

S3 – 1.1230

Nearest resistance levels:

R1 – 1.1414

R2 – 1.1475

R3 – 1,1536

Trading Recommendations:

The GBP/USD pair continues to slide down on the 4-hour timeframe. Therefore, at the moment, you should stay in sell orders with targets of 1.1292 and 1.1273 until the Heiken Ashi indicator turns up. Buy orders should be opened when fixed above the moving average with targets of 1.1536 and 1.1597.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.