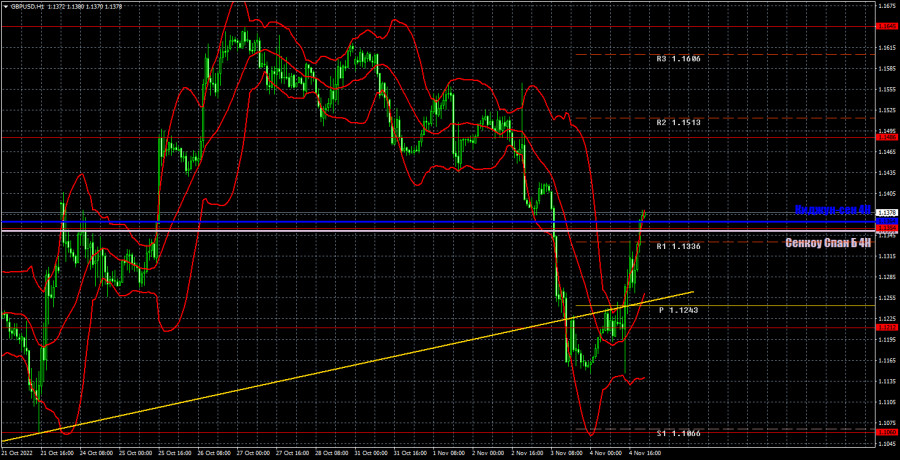

Analysis of GBP/USD, 5-minute chart

The GBP/USD currency pair rose sharply on Friday. From our point of view, such growth is most suitable for the definition of a "correction". The pound has been falling against the dollar for a couple of weeks. Sometimes it is quite logical, sometimes groundless, but one way or another a correction was required. And it happened on Friday. It happened when few people were expecting it, since the US statistics, in our humble opinion, were neither weak nor a complete disappointment. That is, the dollar fell when it should have continued to grow. On the other hand, on Thursday, when the Bank of England raised its rate by 0.75%, the pound fell when it should have risen. In general, it was absolute illogical, which can persist for several more days. In principle, there is nothing more to talk about Friday's statistics, a lot has already been said about it.

As for the movements and trading signals, everything was not easy here. It was absolutely flat during the European trading session, but this flat was quite difficult to recognize at first. Traders may have entered one or two positions on signals around the 1.1212 level that turned out to be false and unprofitable. At the US trading session, a strong signal to buy was already formed after the release of statistics on the labor market and unemployment. But in this case, it would be much more logical to expect the pair's fall, rather than its growth. In general, the situation was difficult. Traders could open longs only in hopes of ending the flat and increasing volatility. If they did this, they covered the morning losses and remained in profit.

COT report

The latest Commitment of Traders (COT) report on the British pound showed a slight weakening of the bearish sentiment. In the given period, the non-commercial group closed 8,500 long positions and 11,500 short positions. Thus, the net position of non-commercial traders increased by 3,000, which is very small for the pound. The net position indicator has been slowly rising in recent weeks, but this is not the first time it has risen, but the mood of the big players remains "pronounced bearish" and the pound remains on a downward trend in the medium term. And, if we recall the situation with the euro, then there are big doubts that based on the COT reports, we can expect a strong growth from the pair. How can you count on it if the market buys the dollar more than the pound? The non-commercial group has now opened a total of 79,000 shorts and 34,000 longs. The difference, as we can see, is still very big. The euro cannot rise even though major players are bullish, and the pound will suddenly be able to grow in a bearish mood? As for the total number of open longs and shorts, here the bulls have an advantage of 21,000. But, as we can see, this indicator also does not help the pound too much. We remain skeptical about the long-term growth of the British currency, although there are certain technical reasons for this.

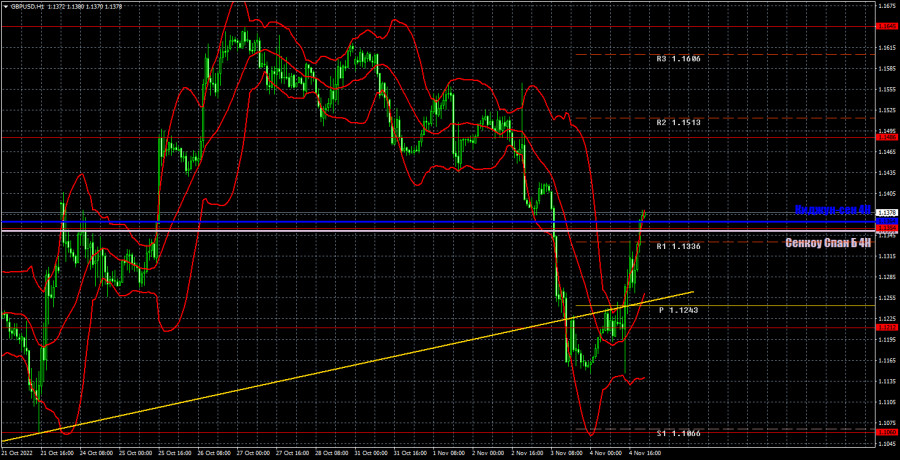

Analysis of GBP/USD, 1-hour chart

The pound/dollar pair shows such movements on the one-hour chart that it is very difficult to say which trend it is in at all. At first, there was a landslide fall with consolidation below the key lines of the Ichimoku indicator, as well as the trend line. Now the pair has returned to the Kijun-sen and Senkou Span B lines and it is unclear whether it will bounce off them or overcome them? In general, there are clearly more questions than answers. On Monday, the pair may trade at the following levels: 1.0930, 1.1060, 1.1212, 1.1354, 1.1486, 1.1645. Senkou Span B (1.1351) and Kijun-sen (1.1364) lines can also give signals if the price rebounds or breaks these levels. The Stop Loss level is recommended to be set to breakeven when the price passes in the right direction by 20 points. The lines of the Ichimoku indicator may move during the day, which should be taken into account when determining trading signals. Also, there are support and resistance levels that can be used to lock in profits. There are no important events scheduled for Monday in the UK and the US, but the market can trade in a very volatile manner, continuing to work out the events and reports of the past week. Not all of them were worked out logically.

What we see on the trading charts:

Price levels of support and resistance are thick red lines, near which the movement may end. They do not provide trading signals.

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, moved to the one-hour chart from the 4-hour one. They are strong lines.

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT charts reflects the net position size of each category of traders.

Indicator 2 on the COT charts reflects the net position size for the non-commercial group.