The GBP/USD currency pair adjusted to the moving average line on Thursday but has yet to overcome it. Therefore, the upward trend continues, and the pound may continue its illogical growth. Recall that we expected a serious downward correction from the beginning of the week, but the pound only rose even more in the end. Of course, the correction may begin later since it is quite difficult to guess its timing. Moreover, a serious correction implies fixing the price below the moving average line. And since there has been no such consolidation, the correction has yet to begin. But this week, British inflation came out, which had every chance of provoking the pound to new growth. The consumer price index has risen again. It has grown very strongly, which significantly increases the chances of further aggressive tightening of the monetary policy of the Bank of England. And any tightening of the Central Bank's policy is good for the national currency. The pound can be said to have ignored at least seven rate hikes out of eight, but now, the situation may change when the Fed slows down the rate hikes. It could have changed if it were not for serious concerns that the Bank of England may also begin to slow down the growth rate.

Similar rumors have started to appear recently. Many experts say that the increase may be only 0.5% in December, which could be better for the pound. The final rate may be 4.75%, but when will it be reached? There are a few serious reasons for the pound's growth after it has already grown by 1,650 points.

Jeremy Hunt presented the draft budget.

Many traders and economists have been waiting for a very long time for yesterday. British Finance Minister Jeremy Hunt was due to present his draft budget on Thursday. Recall that the last government intended to lower taxes to ease ordinary Britons' fate against the background of a sharp jump in energy prices. However, this plan was fiercely criticized by both parties and, at the same time, provoked a frenzied collapse of the pound and a strong increase in British bond yields. The Bank of England even had to stabilize financial markets by buying bonds. And so the new plan was presented. According to it, tax rates will not increase; for example, the threshold for a maximum 45% income tax will be lowered. Previously, it was 150,000 pounds, and all those with an annual income below this amount paid fewer taxes. Now it will be reduced to 125 thousand pounds. Thus, the government will receive more tax revenue. Recall that the "hole" in the budget is 50 billion, 20 of which is planned to be covered by higher tax charges and 30 billion – by reducing state spending.

Further, Jeremy Hunt said that the British economy is already in recession and that next year's GDP will drop by 1.4%. However, in 2024, the situation will improve, and the economy will grow again (growth is expected to be 1.3%). It should be noted that according to the forecasts of the Bank of England, the economy will lose 1.5% in 2023 and 1% in 2024. Hunt also noted that the average annual inflation this year will be 9.1% and next year – 7.4%. Thus, we are not talking about its rapid return to the target level. It may take three or more years to achieve this goal. The Finance Minister also noted that the upper limit of annual electricity bills would be raised from 2,500 pounds to 3,000 pounds, again allowing the state to save on helping Britons pay their bills. Most likely, the pound reacted yesterday to this new batch of pessimistic statements. Recall that Andrew Bailey did not try to calm the markets but instead talked about the recession, high inflation, and budget problems. So far, the pound is holding quite well, but there are fewer reasons to buy it.

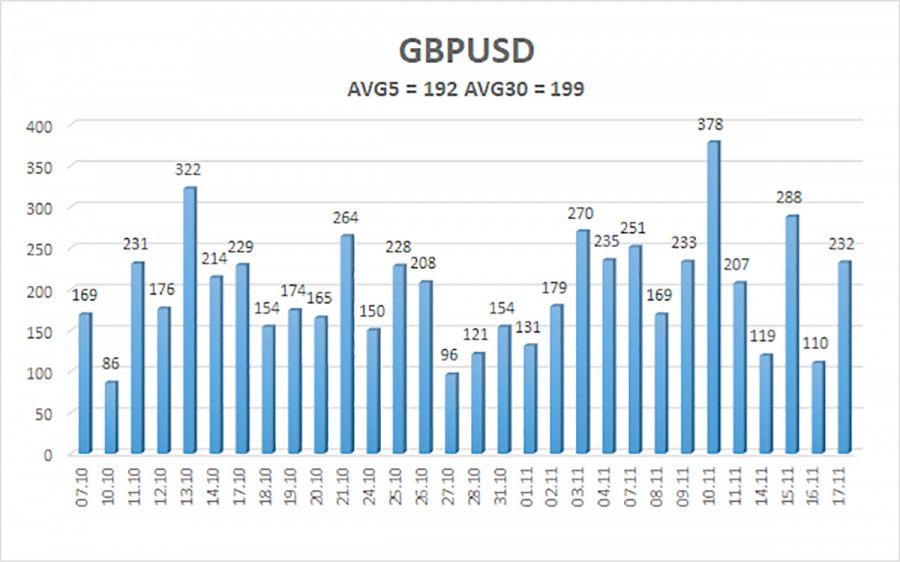

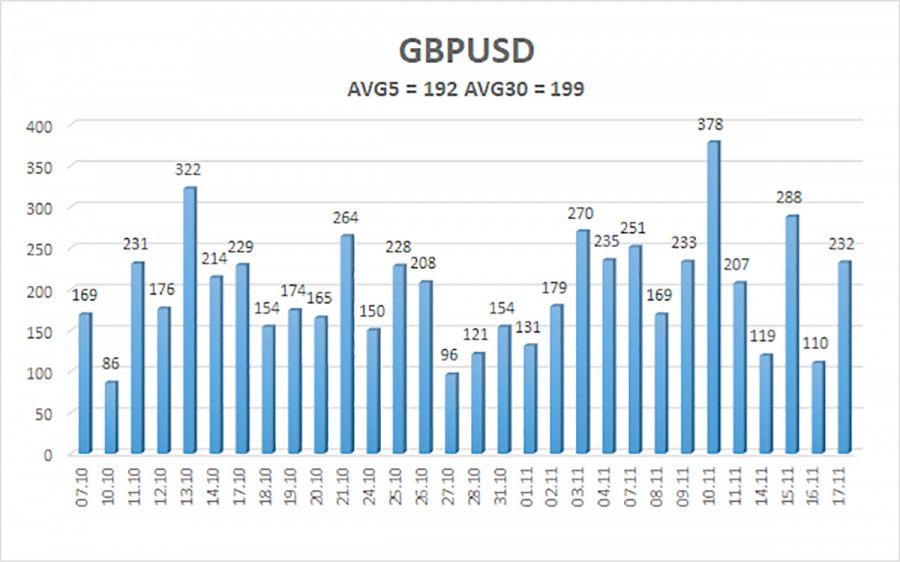

The average volatility of the GBP/USD pair over the last five trading days is 192 points. For the pound/dollar pair, this value is "very high." On Friday, November 18, thus, we expect movement inside the channel, limited by the levels of 1.1630 and 1.2015. The upward reversal of the Heiken Ashi indicator signals the completion of the correction movement.

Nearest support levels:

S1 – 1.1719

S2 – 1.1597

S3 – 1.1475

Nearest resistance levels:

R1 – 1.1841

R2 – 1.1963

R3 – 1.2085

Trading Recommendations:

In the 4-hour timeframe, the GBP/USD pair began a round of downward correction. Therefore, at the moment, purchase orders with targets of 1.1963 and 1.2015 should still be considered in the event of a reversal of the Heiken Ashi indicator or a rebound of the price from the moving average. Open sell orders should be fixed below the moving average with targets of 1.1630 and 1.1475.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.