The GBP/USD currency pair also made a sluggish attempt to begin a downward correction on Friday. Still, despite having every opportunity to do so, it could not establish a foothold, even below the moving average. Remember how the market on Friday centered on international macroeconomic data on the labor market, unemployment, and wages? This statistic is crucial, particularly on the eve of the Fed meeting, which will take place in a few weeks. Recall that the state of the labor market and unemployment will play a major role in the aggressiveness of Jerome Powell's tone and any decisions that may be made at the upcoming meetings. The Fed can afford to raise the rate if the labor market is healthy (and Friday's nonfarm data once again demonstrated that the condition is excellent). This is no longer necessary since inflation has been falling for four consecutive months, and the key rate has already risen to 4%. As a result, instead of growing by 0.75% in December, as most experts predict, it will increase by 0.5%. However, the labor market is important. And if it is robust, the value of the US dollar should rise. It had to expand.

If only the market had considered all the recent developments that favor the dollar. Remember, there are very specific reasons why we have been waiting for a strong downward correction for the past two weeks. There is no justification for the pound to increase. It has increased by 2,000 points in just a few months, but the UK has yet to give any incredibly upbeat news. Yes, we do remember that Liz Truss resigned along with her reforms, and there will not be any tax cuts. Additionally, keep in mind that Scotland won't be holding an independence referendum anytime soon, which is excellent news for the pound. The growth in recent months is still unjustified, though.

Practically no significant news will be released; how will the pound perform?

The UK's new week will start with the business activity index (services sector) release. Forecasts indicate that this index will continue to be below 50.0, so traders won't have anything to react to. The construction industry's business activity index was released on Tuesday. Not the most important report, either. Nothing in Britain will be more intriguing.

Events in the United States will be a little bit more interesting.

Applications for unemployment benefits are due on Thursday, the Michigan consumer confidence index is due on Friday, and a fairly significant index of business activity in the ISM services sector will be released on Monday. The ISM index will undoubtedly garner the most attention, and the macroeconomic backdrop will be quite weak, but this is all that is currently on the calendar. A meeting of the monetary committee will take place soon, and its members are not permitted to give interviews or speeches. As a result, Fed representatives won't give any speeches this week. As a result, there won't be many significant news stories or events this week.

Will the market continue to trade irrationally and purchase the British pound? Which is the question we must ask once more? We might learn the answer to this query this week. If the British pound manages to rise this week, all doubts will be finally answered because there will be little news. Still, we'll wait for a downward correction, which we'll have to spot by breaking through the moving average line. Opening short positions is not advised in the absence of this overcoming.

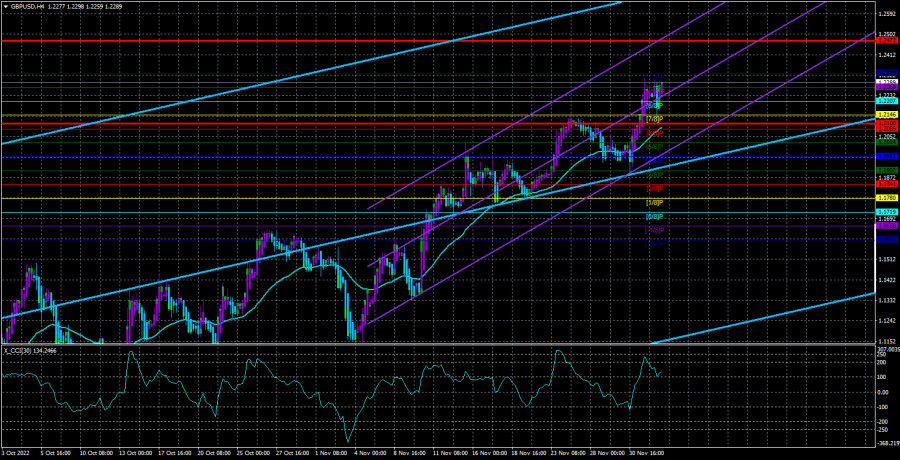

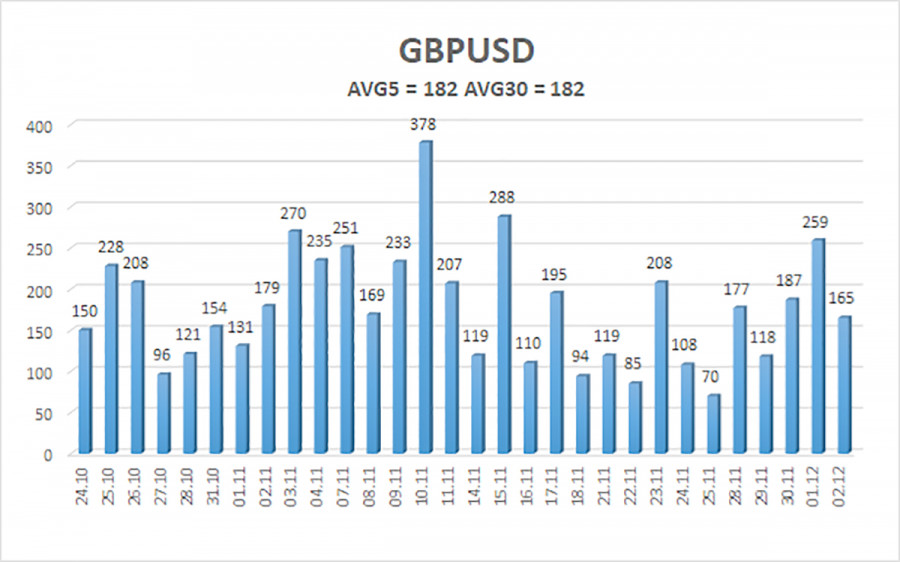

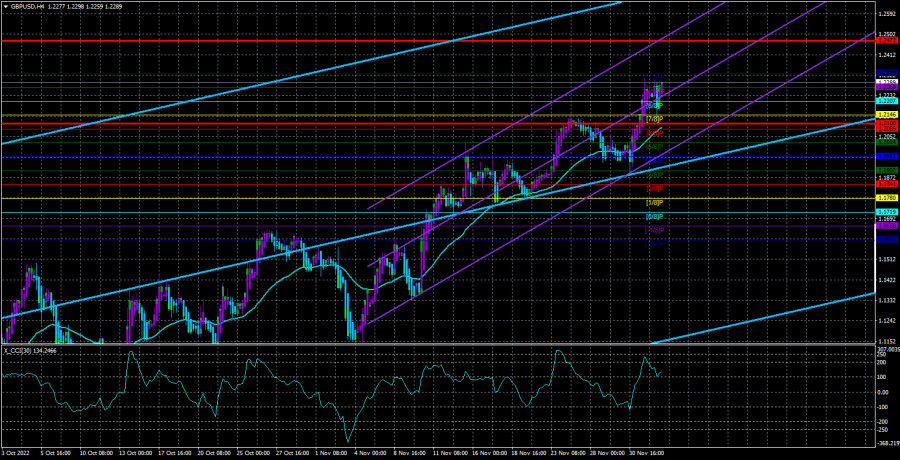

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 163 points. This value for the dollar/pound exchange rate is "very high." Thus, on Monday, December 5, we anticipate movement within the channel and are constrained by the levels of 1.2108 and 1.2472. The Heiken Ashi indicator's turning downward indicates a new phase of the corrective movement.

Nearest levels of support

S1 – 1.2268

S2 – 1.2207

S3 – 1.2146

Nearest levels of resistance

R1 – 1.2329

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair resumed its upward trend. Therefore, until the Heiken Ashi indicator turns down, you should maintain buy orders with targets of 1.2329 and 1.2472. With targets of 1.1963 and 1.1902, open sell orders should be fixed below the moving average.

Explanations of the illustrations:

Linear regression channels help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.