The American currency has kicked off the new week with gains. Its bullish run remains intact, thus putting pressure on the EUR/USD pair. Euro buyers are still on the sidelines for the time being. Nevertheless, the euro stubbornly strives to take the lead, bypassing the dollar from time to time.

Strong gains in the US currency stemmed from upbeat macroeconomic reports from the United States. The current data keeps the Fed's hawks from tightening monetary policy too much, while maintaining the economic balance. Recent reports showed that the US producer price index increased by 0.7% in January from 0.2% in December. At the same time, the consensus estimate suggested an increase of 0.4%.

According to the US Labor Department, initial jobless claims amounted to 194,000 in the week ending on February 11, while economists projected 200,000. This means that the US labor market remains stable. Notably, a reduction in the number of Americans filing new claims for unemployment benefits is pushing the Fed to keep monetary policy tight. At the same time, some experts expect the key rate to peak at 5.25% by July and then decline to 5% by the end of 2023. Others forecast that the rate could reach 6%.

Data from the US Department of Commerce showed US retail sales rebounded sharply in January. Last month's surge followed two months of steep declines. At the same time, inflation is still high, although US consumer price increases have moderated. Last week, the value of the net long dollar position climbed. However, this rise was later offset amid a stronger dollar and rising US Treasury yields. This indicates a possible revision of the dollar outlook by investors as the Fed's hawkish rhetoric and current macroeconomic statistics suggest a significant increase in interest rates. Analysts assume that dollar volatility may increase if stock markets collapse or real bons yields rise sharply.

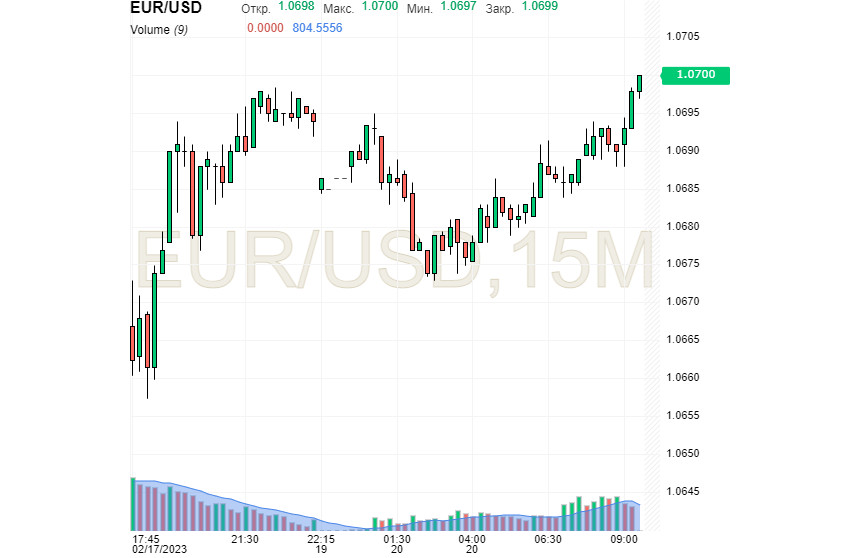

On February 17, the greenback soared to a six-week high. Today, the greenback continues to move upwards, trying to maintain its leading position against the euro. At the same time, the European currency keeps trying to regain control of the market, overtaking the US dollar from time to time. In early trade on February 20, the EUR/USD pair traded around the 1.0700 mark.

Currency strategists at Morgan Stanley have revised their previous forecasts for the euro and now believe that the European currency will rise, driven by further rate hikes by the ECB. Analysts say the euro area will survive further monetary tightening and avoid a recession thanks to lower energy prices and a strong labor market. Currently, labor market flows in EU nations show positive dynamics. This makes officials at the European Commission think that the European economy will expand in 2023.

Against this background, analysts provide their forecasts regarding further rate increases by the ECB. Interestingly, the European regulator was the last among the major central banks to start raising rates. Since July 2022, the ECB has lifted its interest rate by 300 basis points, up to 3%. By September 2023, the rate is expected to peak in the range of 3.5% - 3.75%. The prospect of further rate hikes against the backdrop of the block's stable economy indicates the euro's long-term upside potential, Morgan Stanley notes. Bank analysts recommend holding long positions on the European currency.

The US economy is not far behind the European one. Moreover, it seeks to outstrip the latter, experts believe. The current macroeconomic data from the US, covering a number of key indicators, signals that the national economy is pretty stable. Nevertheless, market participants are wondering how successful the US economy will be in the medium term, especially given rising interest rates. The focus of traders and investors is on the Fed's monetary policy and potential interest rate hikes. In 2022, the US central bank raised the key rate seven times in order to combat surging inflation. This bore fruit but greatly increased the risks of a recession. For the time being, US inflation shows signs of cooling, but it is still above the target of 2%.

Meanwhile, markets are awaiting the outcome of the Fed's February meeting to be announced on Wednesday. According to analysts, the report may contain signals about the Fed's further plans to change the rate. The next day, Thursday, market participants will receive data on the second estimate of US GDP for the fourth quarter of 2022. This may have a severe impact on the dollar's dynamic.

Bank of America has joined the current market expectations regarding interest rates, which now anticipates an additional hike in 2023. According to investment bank analysts, the driving force behind another rate increase will be the absence of data indicating a slowdown in the US economy. Other factors contributing to the Fed's hawkish stance are signs of cooling price pressures and US job growth. This year, BofA sees the peak for Fed funds at 5.25 - 5.5% and a pause in the rate hike trajectory in July 2023. As for rate cuts, the regulator is unlikely to reduce the federal funds rate before March 2024, BofA summed up.