The ISM report published last Monday showed that business activity in the US manufacturing sector continued to contract at an accelerated pace in March. The PMI manufacturing business activity index in March fell to 46.3 compared to 47.7 in February and a forecast of 47.5. The corresponding indicator from S&P Global was adjusted from 49.3 to 49.2 in March, also remaining below the 50.0 mark which separates business activity growth from a slowdown. The new orders index in the manufacturing sector, presented in yesterday's ISM report, also declined in March to 44.3 compared to 47.0 in February and a forecast of 44.6.

Today, a new set of important US macroeconomic statistics will be published. At 12:15 GMT, ADP will present its monthly report on employment in the private sector for March. Although this report does not usually have a direct correlation with Non-Farm Payrolls, it generally has a strong impact on the market and the US dollar, being considered a predictor of the official US Department of Labor report. As we know, it will be published traditionally on the first Friday of the month, that is, the day after tomorrow at 12:30 GMT.

According to the ADP report, the number of employees in the US private sector is expected to increase by 200,000 in March (after an increase of 242,000 in February and 119,000 in January). This is a strong indicator, but the dollar may come under pressure if the ADP report data does not meet market expectations. In any case, during the publication of this report, market volatility may increase, primarily in the dollar quotes.

At 14:00 GMT, another key indicator will be published. We are talking about the ISM PMI business activity index in the US services sector which shows the state of the services sector in the country's economy. The services sector data (unlike the manufacturing sector) practically does not affect the country's GDP. However, another negative report from ISM following the manufacturing activity report published on Monday could hit the US dollar hard.

The forecast for March is 54.5 (compared to 55.1 in February and 55.2 in January). This is still strong reading despite a relative decline. However, a drop in the index below 50 may have a strong negative impact on the dollar.

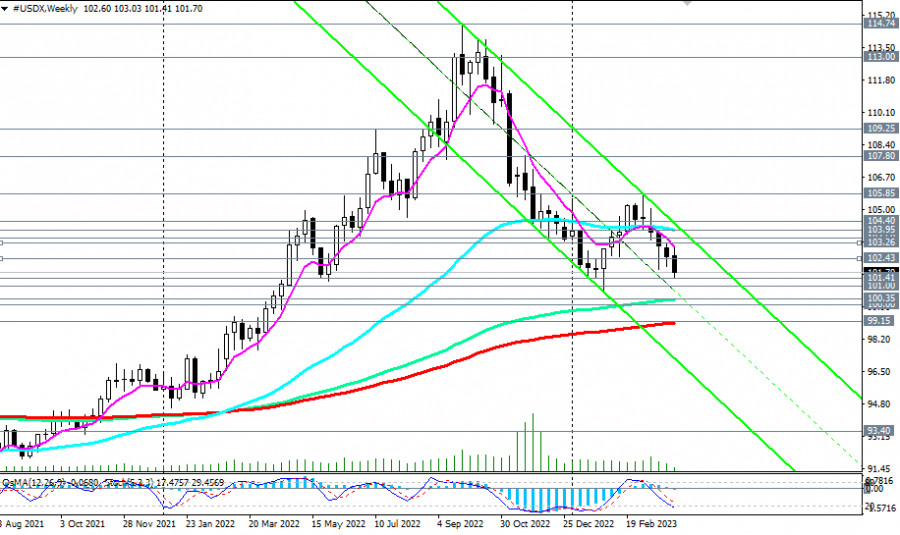

A block of negative statistics from the US published this week could push the US dollar index (DXY) towards the psychological mark of 100.00. At the time of the publication, DXY was trading close to 101.38 which corresponds to the April lows recorded in 2022.

Investors are increasingly concerned about the transition of the US economy towards a recession, while inflation remains at elevated levels despite tightening monetary conditions in the US and other large economies.

This is clearly illustrated by the dynamics of gold, whose quotes skyrocketed yesterday towards record highs reached a year ago at the level of $2,070.00 per troy ounce. Yesterday, the XAU/USD pair rose to the level of $2,025.00, and today it has already managed to retest this high while heading for $2,028.00.

Market participants still vividly remember the recent events surrounding the closure of 2 American and 1 Swiss bank. In response to the collapse of the American Silicon Valley Bank and Signature Bank, the Federal Reserve announced an emergency support program for the banking sector (BTFP) in the amount of $25.0 billion and promised an emission of about $250 billion to pay back to depositors of Silicon Valley Bank and Signature Bank under the guarantees of the US Treasury. Economists have already called these programs a hidden quantitative easing.

In other words, the greenback is very likely to continue its decline, unless investors flee to it as a safe-haven asset, and for that, a strong reason is needed, such as another major geopolitical conflict.

From a technical point of view, the US dollar index (DXY) is trading in the zone of a medium-term bear market, rapidly declining towards the key support levels of 100.35, 100.00, and 99.15. Breaking through the latter will significantly increase the risks of canceling the global bullish trend in USD. This may happen if the price breaks through the support levels of 93.40 and 89.50.

*) https://t.me/fxrealtrading