The EUR/USD currency pair on Wednesday almost from the very morning just resumed its upward movement. There was no news or publications that could provoke the growth of the European currency. However, this was not necessary. Thus, the rather paradoxical growth of the euro currency continues this week. Why "paradoxical"? Because there was no reason for the growth of the euro currency. The maximum is technical - correction. But the correction usually proceeds impressively, slowly. Immediately, the European currency rose by 200 points for three days, although on Monday a very weak report on GDP in the Eurozone was published, and on Tuesday there were no important statistics at all. Yesterday, at first glance, it may seem that there were grounds for strengthening the European currency, but this is only at first glance. The inflation report for January showed another acceleration in price growth in the European Union. This time, the consumer price index was 5.1% y/y. This is although traders expected inflation to slow down to 4.4%. However, it is unclear why such forecasts appeared at all. There were no special prerequisites for reducing the rate of price growth. Of course, in one of her last speeches, Christine Lagarde said that she still expects inflation to slow down in 2022. But so far, her rhetoric looks exactly like Jerome Powell's a few months ago. The head of the Fed also firmly believed that inflation would begin to slow down by itself. And while he believed, it rose to a 40-year high. In the States, there is a strong economy that will withstand multiple increases in the key rate. And in the European Union, the growth rate in the 4th quarter was 0.3%. Thus, even one rate increase can lead to a reduction in the volume of the economy. In general, the situation is complicated.

It makes no sense for the ECB to raise the rate even with ever-rising inflation.

So, inflation is already 5.1% y/y, and what's next? And then, dear traders, nothing. To stop inflation, it is necessary to raise rates. Here, even a complete rejection of the PEPP and APP incentive programs will not help the case. In America, the corresponding program has already been reduced from 120 billion dollars a month to 30, and inflation has been growing and growing. Therefore, most likely, this method will not help Europe either. But the ECB's hands are tied at the seams. The economy continues to be in a very weak state, so raising the rate is deathlike for it. This means that in the European Union, no matter how inflation increases, it does not bring the ECB closer to tightening monetary policy, as, for example, it was in the United States. Consequently, the European currency showed growth yesterday, which can be linked to the inflation report, but in fact, growth began much earlier than its publication, growth has been going on for two days without it, growth does not increase the likelihood of an ECB rate hike in any way, so a market reaction to the report cannot be called logical. If, of course, there was a reaction at all. From all of the above, it follows that the ECB's decisions and rhetoric should not be influenced by the inflation report today. It is noteworthy that some experts still believe that the European regulator may go for a rate hike this year. However, we are talking only about one increase and not earlier than the second half of the year. Perhaps, of course, Christine Lagarde will still be right and inflation will begin to slow down over time. But now there are too many "buts" in all these arguments. One thing is clear – the European currency still has no fundamental reasons for growth. The growth of this currency in the last few days looks like the preparation of the market for some strategy of its own for the ECB meeting. And it is difficult to imagine what will happen after the meeting at all. At the moment, the pair continues to be located above the moving average line, so the trend is now upward. However, today everything can change. Moreover, the market reaction can be almost any: fall, further growth, flat. Each of these options can be easily explained after the meeting.

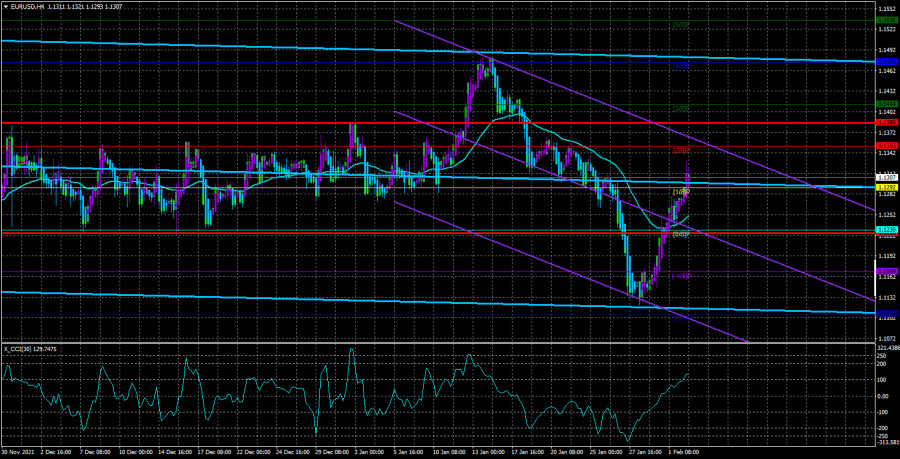

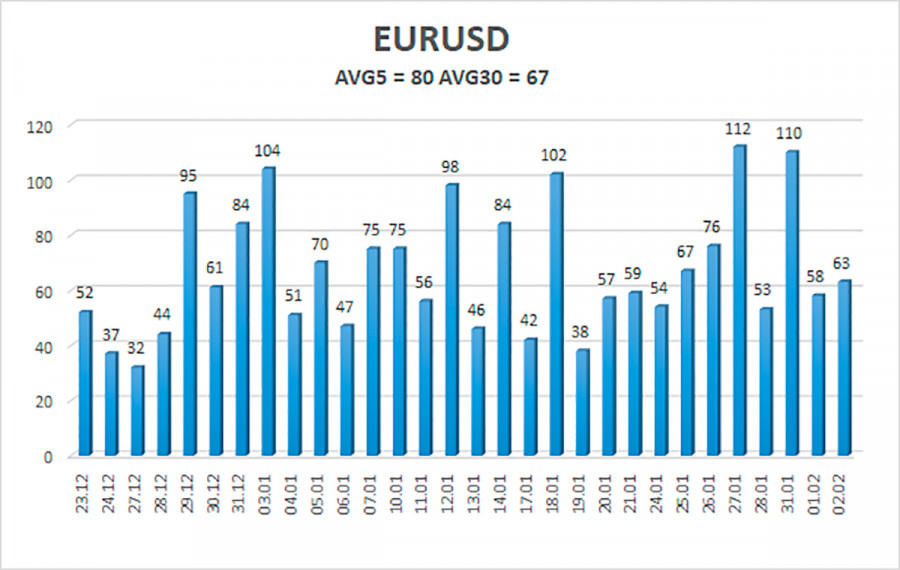

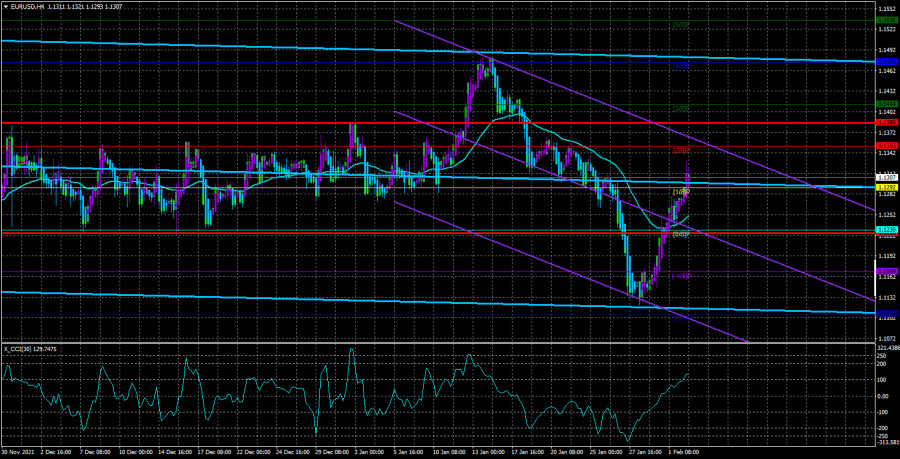

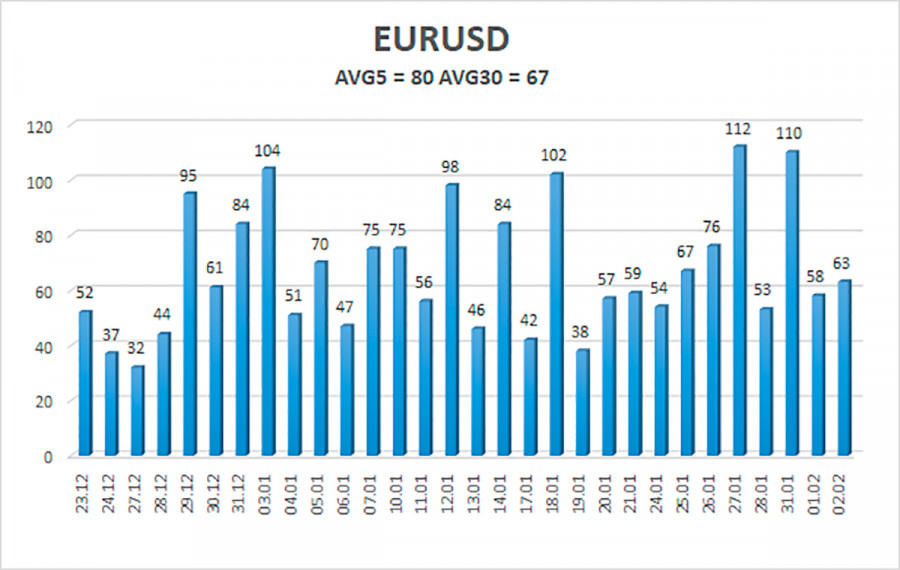

The volatility of the euro/dollar currency pair as of February 3 is 80 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1226 and 1.1386. The reversal of the Heiken Ashi indicator downwards signals a round of corrective movement.

Nearest support levels:

S1 – 1.1292

S2 – 1.1230

S3 – 1.1169

Nearest resistance levels:

R1 – 1.1353

R2 – 1.1414

R3 – 1.1475

Trading recommendations:

The EUR/USD pair continues to be located above the moving average line. Thus, now it is necessary to stay in long positions with targets of 1.1353 and 1.1386 until the Heiken Ashi indicator turns down. Short positions should be opened no earlier than the price-fixing below the moving average line with a target of 1.1168.

We recommend you to familiarize yourself:

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.