The GBP/USD currency pair on Tuesday continued to trade in the same direction as in recent weeks. If the European currency shows at least some attempts to adjust, then the pound sterling does not. On the other hand, the volatility of the pound is much lower than the volatility of the euro, which happens extremely rarely. Thus, the pound/dollar pair is now definitely maintaining a downward trend. Both linear regression channels are directed downwards, the moving average is directed downwards. The pair cannot adjust by more than 100 points. Moreover, this state of affairs is hardly due to the upcoming meetings of the Bank of England and the Fed. Recall that the results of the Fed meeting will also matter for the euro/dollar pair, so both major pairs should now trade approximately the same. But this is not happening. Maybe it's all about the Bank of England? Let's take a closer look.

The Bank of England, which will hold its meeting on Thursday, now has only two possible options for making a decision. The first is to raise the rate for the third time in a row by 0.25%. The second is to refuse to raise the rate in March. Recall that in December, BA unexpectedly raised the rate for many. I raised it when even the Fed was not ready for such a step yet. Then a second promotion immediately followed, and in the last few weeks, BA representatives have regularly made it clear that they are ready to hold two more promotions at the next two meetings, after which they will take a break. However, now that the geopolitical and economic situation around the world has changed beyond recognition in just three weeks, the regulator may refuse to take drastic actions and take a pause to see how the new economic reality will affect the British economy. Perhaps traders are no longer waiting for a new tightening of monetary policy and this is the reason for the fall of the British pound. But recall that the ECB also did not raise the rate and is not even talking about it now. Therefore, the euro and the pound are still in approximately the same conditions at this time.

Boris Johnson continues to put pressure on Russia.

As we said earlier, the United Kingdom and the United States are among the most ardent opponents of Russia after the outbreak of the conflict in Ukraine. It was these countries that made the loudest statements and called on everyone to impose sanctions against the Kremlin. Now, three weeks later, when all possible sanctions have already been imposed, there are only oil and gas sales to Europe, the Prime Minister of Great Britain Boris Johnson has written an entire article on how to abandon Russian hydrocarbons. The article was published in the British tabloid Telegraph. According to the British Prime Minister, now is a good time to switch to "green energy" as much as possible. In his opinion, Western countries are very dependent on Russian oil and gas, which makes them dependent on the will of the Kremlin. If we refuse energy carriers from the Russian Federation, it will mean complete freedom of action. Johnson noted that the process of abandoning hydrocarbons from Russia will be difficult and painful. However, taking into account global warming, which is caused by emissions of waste products into the atmosphere when using oil, gas, coal, and gasoline, it is time for the whole world to switch to "carbon neutrality" a long time ago.

And now, when Moscow has decided on a military operation in Ukraine, endangering world security and the principle of democracy, it is time to say "no" to Russian gas and oil, Johnson believes. Recall that London and Washington support the introduction of a full embargo of oil and gas from Russia. The states have already abandoned purchases, the UK will do it by the end of this year. However, EU countries cannot abandon the import of petroleum products overnight. It will take them a decade to repurpose their oil and gas industry and the entire economy with industry. Meanwhile, oil on the world market began to decline significantly in price. At the moment, it is already worth $ 96 per barrel, although a week ago it was trading at $ 130. Many experts believe that the price is influenced by the unwillingness of many companies and states to buy oil at inflated prices, the end of the heating period, as well as the refusal to cooperate with Russia.

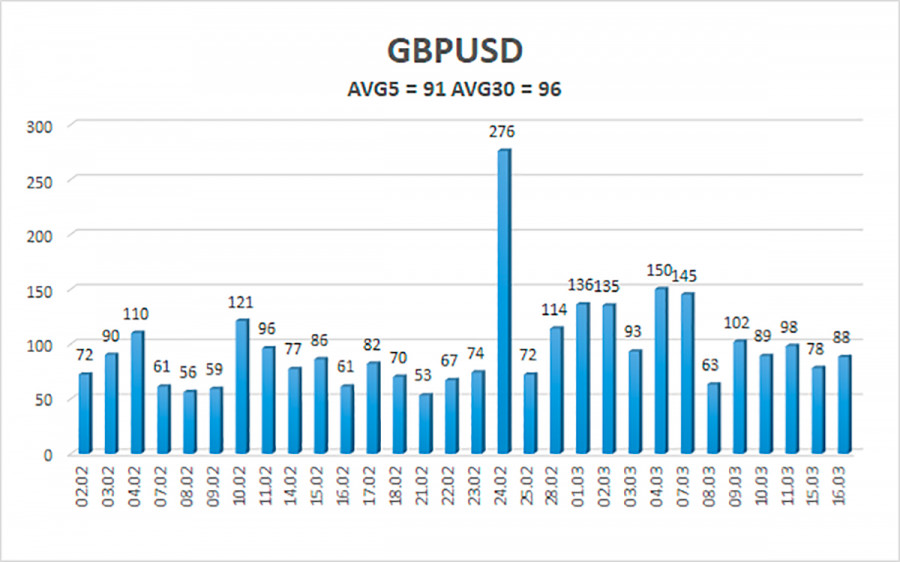

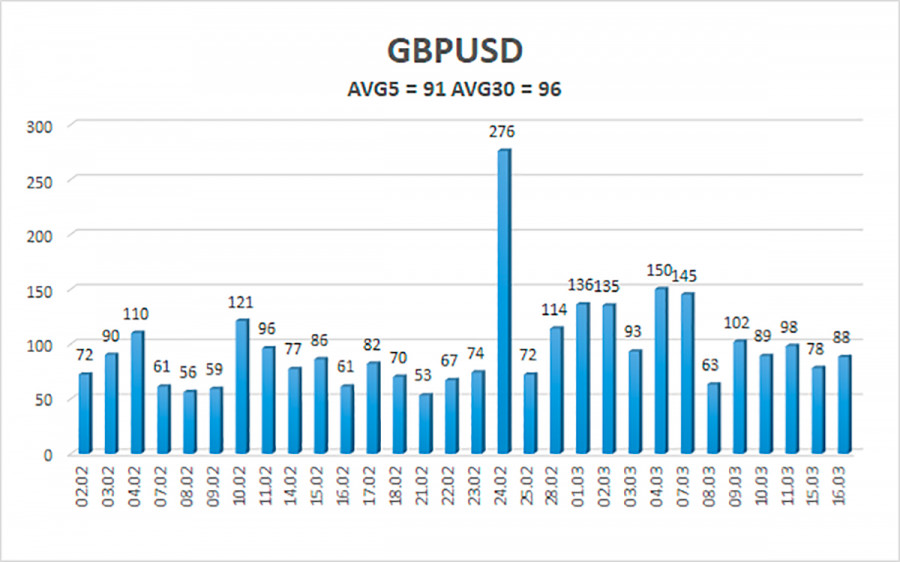

The average volatility of the GBP/USD pair is currently 91 points per day. For the pound/dollar pair, this value is "average". On Wednesday, March 16, thus, we expect movement inside the channel, limited by the levels of 1.2949 and 1.3131. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.3000

S2 – 1.2939

S3 – 1.2878

Nearest resistance levels:

R1 – 1.3062

R2 – 1.3123

R3 – 1.3184

Trading recommendations:

The GBP/USD pair has adjusted quite a bit on the 4-hour timeframe but is now preparing for a new fall. Thus, at this time, new sell orders with targets of 1.3000 and 1.2939 should be considered in the event of a downward reversal of the Heiken Ashi indicator. It will be possible to consider long positions no earlier than fixing the price above the moving average with targets of 1.3184 and 1.3245.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.