The EUR/USD currency pair continued its downward movement on Tuesday, which absolutely no one is surprised by. In recent weeks, we have repeatedly listed the reasons why, from our point of view, the European currency will continue to fall. And here's what we didn't do since we didn't list the reasons why the euro could grow in the near future. Everything is simple here. There are no such reasons. Of course, market participants can always decide that it's enough, it doesn't make sense to continue selling the euro currency. However, they continue to sell it and buy dollars, which look like a much more stable currency, given that the States are not involved in the Ukraine-Russia conflict, the States are very far from the Ukraine-Russia conflict, the States do not depend on the Russian or Ukrainian economy in any way. Thus, the US dollar now looks like the most attractive currency in all respects.

The future of the Eurozone, as stated in The Terminator, is not predetermined. If a couple of months ago the main problem lay in the plan of ultra-soft monetary policy, which the ECB refused to change in 2022, now Europe is on the verge of a whole host of new problems. Starting from the food crisis that European countries will face if the crisis in Ukraine continues, ending with the energy crisis if an oil embargo is imposed on Russia. That is, Europe is suffering from the current situation in Ukraine from all sides. It was to Europe that several million Ukrainians left. It is Europe that is most dependent on Russian oil and gas. It is Europe that is very dependent on food from Ukraine. Thus, as we said earlier, many countries will suffer from the conflict, which, it would seem, affects only Ukraine and Russia.

With such a fundamental background, how can we expect that the euro currency will grow? It may show local growth, but this is all that buyers can count on now. The pair continues to be located below the moving average line, and the Heiken Ashi indicator has colored all the bars blue in the last round of the downward movement. Moreover, this turn was preceded by the CCI indicator entering the overbought area, and this is always a strong signal to sell. In addition, we drew attention to the fact that the entire upward movement in the period from March 7 to March 31 looks like a classic correction. And after any correction, the main trend resumes.

The EU countries decided not to wait for the board to adopt a package of sanctions.

Meanwhile, some EU countries, which are also members of NATO, have begun to work without synchronizing their actions with the European Parliament and the European Council. The Baltic states and Poland announced this week that they completely prohibit the transit of any cargo heading to or from Russia and Belarus. In addition, Estonia, Lithuania, Latvia, and Poland have already decided to abandon Russian gas and oil. Many EU countries have begun expelling Russian diplomats, accusing them of espionage. In general, from whatever side you look, you can only see the deterioration of the situation. Europe continues to cut off all business ties with Russia and does it faster and harder with every news from Ukraine. As early as this week, the introduction of duties on imports of Russian hydrocarbons may be announced, which should provoke an acceleration of the transition to alternative energy sources. For Russia, this will be another blow to the economy. However, it will also be a blow for the EU. Already, many experts are predicting a new increase in oil and gas prices. Moscow is unlikely to be able to sell at new prices since in most cases contracts were signed at the old prices, and hardly anyone is signing new ones now. The media even got information that the Kremlin offered India a $ 45 discount on every barrel of oil purchased. If this is true, it means that it is already difficult for Russia to sell its oil. After all, you can't do this with oil: if there is no demand, then just wait until it appears. Oil is constantly being pumped out and the well either needs to work or it needs to be mothballed. If it works, then the oil must go somewhere in a continuous flow. If no one buys it, then where should I put it?

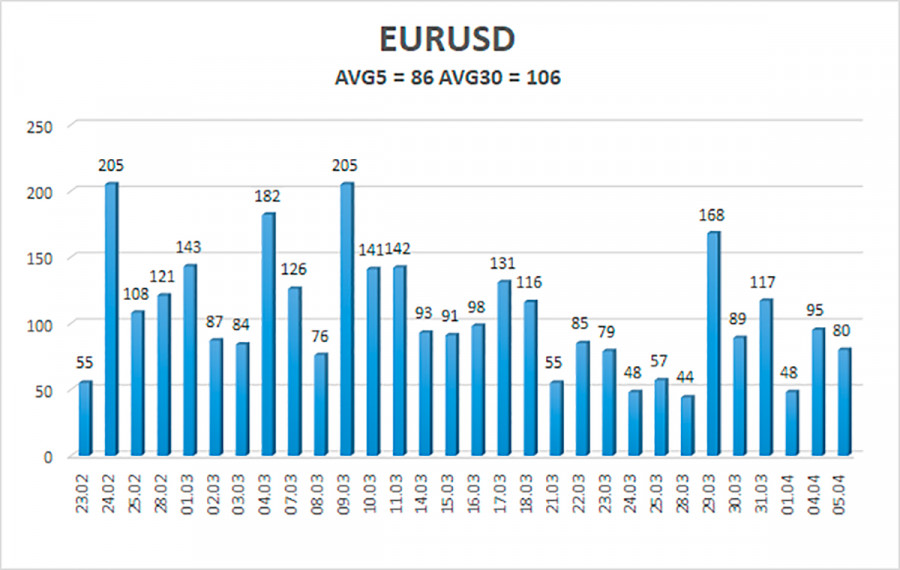

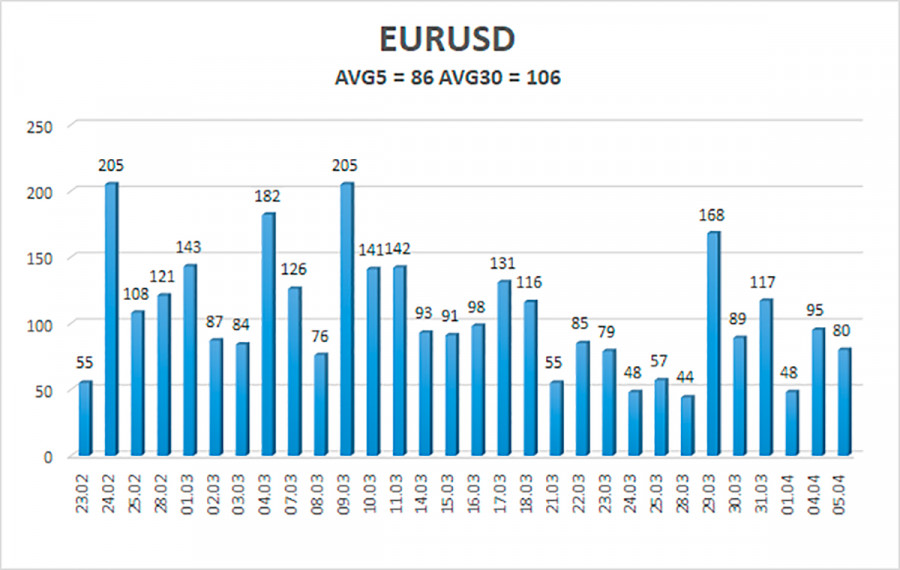

The volatility of the euro/dollar currency pair as of April 6 is 86 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.0836 and 1.1008. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0986

R2 – 1.1108

R3 – 1.1230

Trading recommendations:

The EUR/USD pair continues to be located below the moving average line. Thus, now you should stay in short positions with targets of 1.0864 and 1.0836 until the Heiken Ashi indicator turns up. Long positions should be opened with targets of 1.1108 and 1.1230 if the pair is fixed back above the moving average.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.