The EUR/USD currency pair continued to fall on Monday although the fundamental and macroeconomic backgrounds were practically absent that day. The European currency, along with the British pound, began to fall almost from the moment the market opened on Monday night. That is, it is certain that the new fall of the euro was not related to any events or news. Even of a geopolitical nature, since there were no significant events in Ukraine this weekend. Perhaps the most interesting event was the arrival in Kyiv of US Secretary of State Antony Blinken and Defense Minister Lloyd Austin. They held a closed meeting with President of Ukraine Volodymyr Zelensky. This means that new negotiations have taken place regarding the supply of weapons from the United States. Recall that in the near future, the US Congress may vote "for" the lend-lease program in relation to Ukraine, which will allow the transfer of any weapons and in any quantities, bypassing various bureaucratic procedures. Weapons and heavy equipment are already pouring into Ukraine in a huge stream. Most likely, this flow will be increased.

However, this news was also unlikely to have a strong impact on the movement of the euro/dollar pair. Of course, it means that in the near future we can not count on the end of the geopolitical conflict (which is bad for the euro). However, this is already almost openly stated both in Kyiv and in Moscow. Negotiations are officially put on pause, and in the near future, Ukraine may withdraw from them completely and forever if Russia tries to hold a referendum in the Kherson region. This is the official position of Kyiv. However, all this has been known for a long time, so it is not possible to call this news the cause of a new fall in the European currency. Therefore, the reason lies in the whole complex. We have said more than once that the fundamental, geopolitical, and macroeconomic backgrounds remain not on the side of the euro and not on the side of the British pound. Therefore, the pair took a break for several weeks, during which they could not even adjust normally. After that, the patience of the bears broke and new powerful sales followed. Our forecast remains the same: in the near future, the pair will strive for its 5-year lows near the level of 1.0636, and during the year - to the price parity of 1.0000.

Christine Lagarde and Luis de Guindos could not agree on the rates.

Last week, something happened in the European Union that the market hardly expected. From our point of view, this moment could be the reason for the activation of bears and new sales of the euro. Luis de Guindos and the head of the Central Bank of Latvia Martins Kazaks said that the regulator may raise rates in July. And this is although, over the past six months, ECB Head Christine Lagarde has repeatedly stated about the weakness of the European economy, as well as that it is not worth waiting for a rate hike in 2022. However, as the practice has shown, not everyone holds the same opinion within the ECB. Therefore, the market first reacted with purchases of the euro currency, which ended very quickly as soon as traders realized that the confusion in opinions within the regulator is even worse than if this opinion was unified and "dovish". Now it is generally unclear what to expect from the regulator in the coming months. But even if de Guindos is right and the rates will be raised, what kind of rate increase are we talking about if it is negative now? Even if the ECB raises it to 0%, it will still not be in any comparison with the size of the Fed's rate. That is any tightening of the ECB's monetary policy will, at best, stop the fall of the European currency against the dollar, but will not change the global difference in the "hawkishness" of monetary approaches. Thus, even a rate hike in July is unlikely to mean that now the euro currency will finally begin to grow.

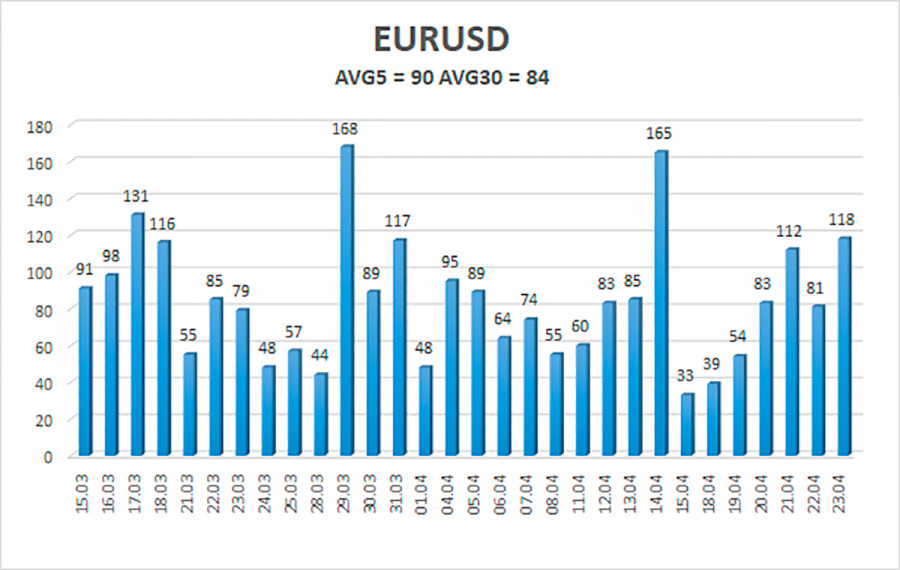

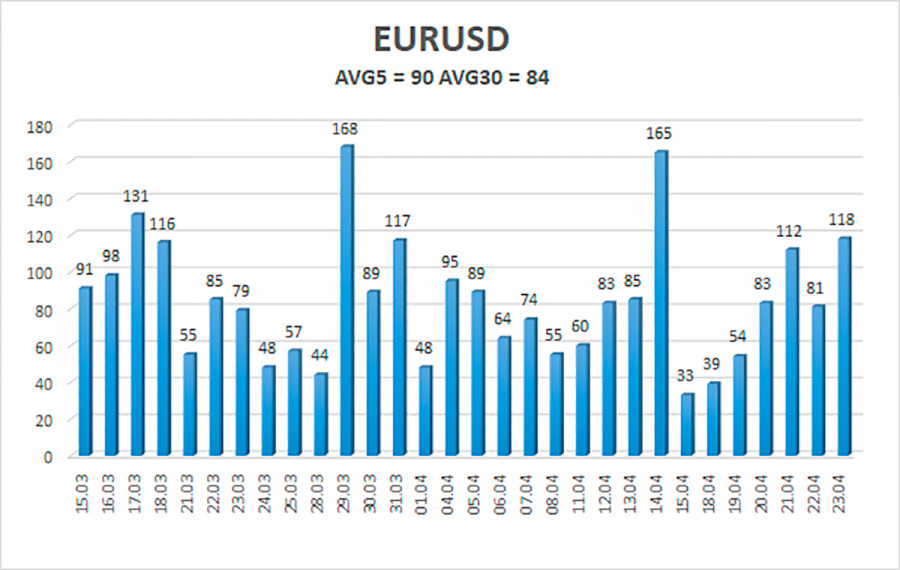

The average volatility of the euro/dollar currency pair over the last 5 trading days as of April 26 is 90 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0623 and 1.0806. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 1.0681

S2 – 1.0620

Nearest resistance levels:

R1 – 1.0742

R2 – 1.0803

R3 – 1.0864

Trading recommendations:

The EUR/USD pair continues to move down. Thus, now it is necessary to stay in short positions with targets of 1.0681 and 1.0620 until the Heiken Ashi indicator turns upwards. Long positions should be opened with targets of 1.0864 and 1.0925 if the price is fixed above the moving average line.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.