The GBP/USD currency pair fell by another 140 points on Monday from the very beginning of trading. And this is although on Friday the losses of the British currency amounted to about 220 points. We expected the pair to start correcting on Monday, but instead, it continued to collapse. With the same missing macroeconomic and fundamental backgrounds, as in the case of the European currency. Thus, we believe that the pound resumed falling against the dollar due to the same "set of problems" as the euro currency. The geopolitical, fundamental, and macroeconomic backgrounds are now playing "against" risky currencies and "for" the US dollar, which acts as a "reserve" currency. In a little more detail, the US economy is stronger than the British or European, the intentions of the Fed are much more "hawkish" than the intentions of the Bank of England or the ECB, and the geopolitical conflict creates risks and threats primarily for the economies of the UK and the European Union, not the US. Therefore, from our point of view, nothing unexpected is happening now. The only unexpected thing is the rate of decline of the euro and the pound, which they demonstrated on Friday and Monday. A smooth fall of both currencies would be much more logical.

Meanwhile, in France, the results of the second round of presidential elections were summed up and, as expected by most experts, Emmanuel Macron won. He won 58% of the vote, Le Pen - 42%. However, despite Le Pen's defeat, she called these elections a "victory", as she won significantly more votes than five years earlier. Also, political experts called Macron's victory not entirely convincing, since many voted for him on the principle of the "American elections of 2020" - if only not for the "ultra-right" Marine Le Pen. About 28% of the French ignored the election, which is the largest no-show since 1969. Macron has already stated that he understands the essence of the election results and promised to become president for the whole nation and take into account the interests of all segments of society. However, as we can see, the euro and the pound were not helped in any way by Macron's victory in the elections.

The American economy also raises questions, but the British one raises them much more.

As we have repeatedly said, an important factor in determining the exchange rate of the pound and the euro against the dollar is the monetary policy of central banks. The central banks of the European Union, the United Kingdom, and the United States are now considering the possibility of tightening monetary policy, as inflation has already gotten out of control. However, the main issue here is the state of the economy of each country or bloc. Or, simply put, it all depends on the GDP indicator. The higher and more stable the GDP, the more opportunities the Central Bank has to raise the rate. In the European Union, GDP in the fourth quarter was +0.4%, and in the first quarter, it may be +0.2-0.3% q/q. In the United States, economic growth in the fourth quarter was approaching 7%, and in the first may be more than 1%. In the UK, there was an increase of 0.9% in the last quarter, and in the first quarter, it is projected to grow by 1.3%. Thus, it is the Fed and the BA that have real grounds for raising the rate. However, the Bank of England has already raised its rate three times and announced another increase this year. Accordingly, it could exhaust the margin of safety of its economic growth. In this regard, the Fed occupies a much more advantageous position, but even for the American economy, there is a possibility of a recession if the Fed does its best to return inflation to 2%. One way or another, the management of each bank will have to choose what to sacrifice: economic growth or inflation. However, the States can sacrifice less than the ECB and the Bank of England. Therefore, the positions of the US currency still look much more confident than the positions of the pound and the euro. Plus, do not forget about the military conflict in Ukraine, which is still completely unclear what consequences it will have for the European Union and the UK. There is already a shortage of sunflower oil in Britain, as its main exporter in Ukraine.

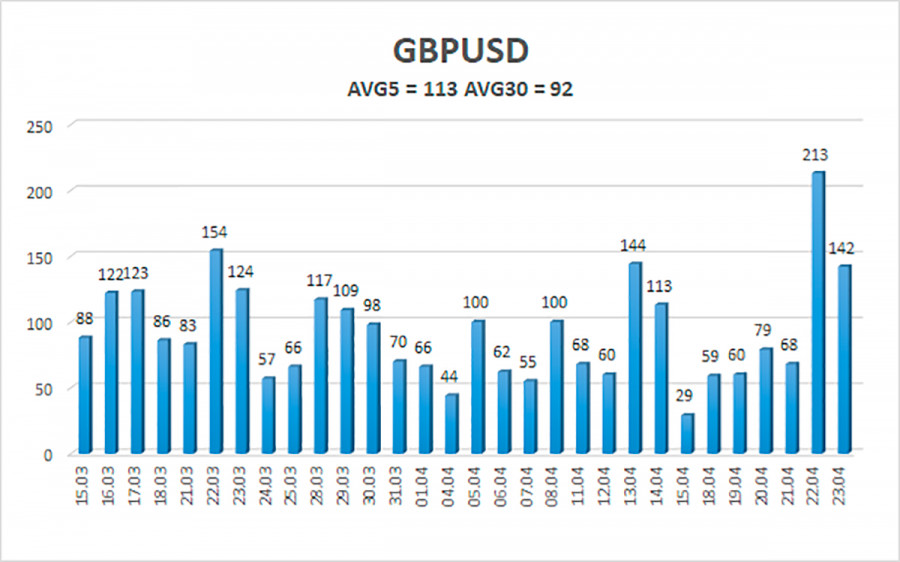

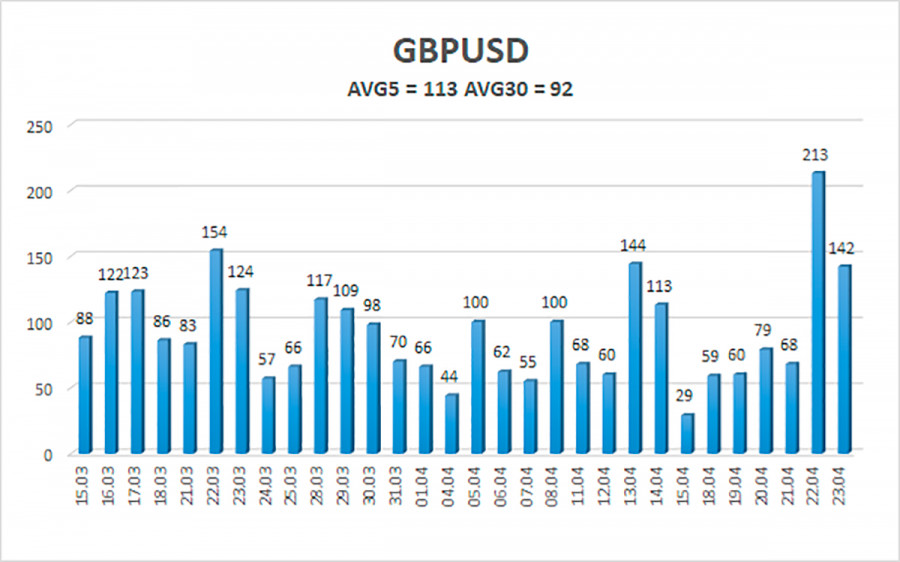

The average volatility of the GBP/USD pair over the last 5 trading days is 113 points. For the pound/dollar pair, this value is "high". On Tuesday, April 26, thus, we expect movement inside the channel, limited by the levels of 1.2624 and 1.2851. The upward reversal of the Heiken Ashi indicator signals the beginning of an upward correction.

Nearest support levels:

S1 – 1.2695

S2 – 1.2634

S3 – 1.2573

Nearest resistance levels:

R1 – 1.2756

R2 – 1.2817

R3 – 1.2878

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe has finally overcome the Murray level of "2/8" - 1.3000 and continues a strong downward movement. Thus, at this time, you should stay in sell orders with targets of 1.2695 and 1.2634 until the Heiken Ashi indicator turns up. It will be possible to consider long positions if the price is fixed above the moving average line with targets of 1.3000 and 1.3062.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.