GBP/USD 5M

The GBP/USD currency pair refrained from a new collapse last Friday, but at the same time it still updated its local and 2-year lows. There was no reaction to the NonFarm Payrolls report, as such, but does the US currency really need the support of "macroeconomics" now? The US currency is already growing well, and it reacts to macroeconomic data quite rarely. We have already said in other articles that the pound is not responding even to the tightening of monetary policy by the Bank of England, although this is a very, very significant factor in order to show growth. But the fact remains that the British pound continues to fall, although there is practically no geopolitical news right now. Consequently, in the near future, the pound may fall to the level of 1.2251. There is no point in talking about Friday's reports on unemployment and wages, they were all the more ignored.

No trading signals were generated on Friday. And this, from our point of view, is even good, since the nature of the movement was far from ideal. The pair moved sideways all day, but did it in the "euro style", that is, riding on a "swing". In such a situation, many false signals could be generated, but, fortunately, not a single level or line was worked out during the day. Therefore, it only remains to expect that the movement in the new week will be trending. But it is very difficult to say what the pound can expect...

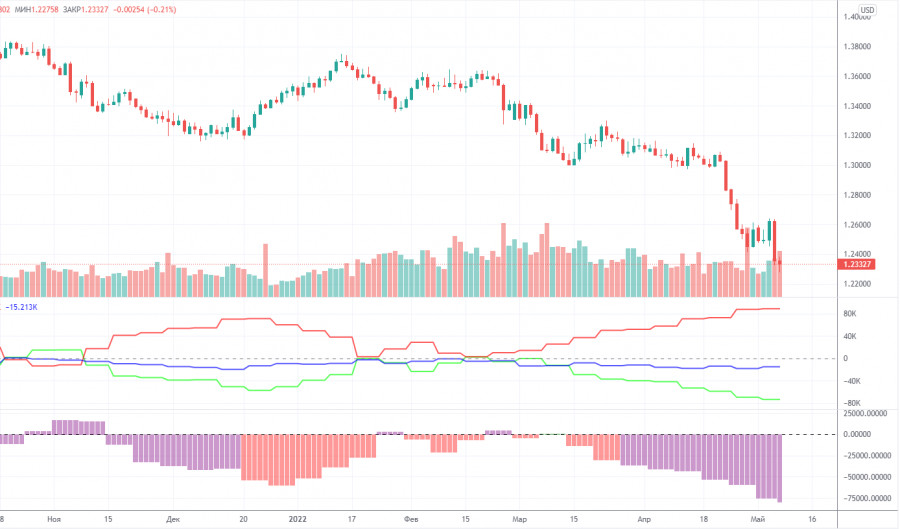

COT report:

The latest Commitment of Traders (COT) report on the British pound has witnessed a new increase in bearish sentiment among professional traders. During the week, the non-commercial group closed 6,900 long positions and 2,700 short positions. Thus, the net position of non-commercial traders decreased by another 4,000. The net position has been falling for 2.5 months already, which is perfectly visualized by the green line of the first indicator in the chart above. The non-commercial group has already opened a total of 107,000 short positions and only 33,500 long positions. Thus, the difference between these numbers is threefold. This means that the mood among professional traders is now "pronounced bearish" and this is another factor that speaks in favor of the continuation of the fall of the British currency. Note that in the pound's case, the data from the COT reports very accurately reflects what is happening in the market. Traders are "strongly bearish" and the pound is also falling strongly against the US dollar. Assume the end of the downward trend, we do not see any reason. COT reports, foundation, geopolitics, macroeconomics, technique, all speak in favor of the fall of the pound and the rise of the dollar. Of course, the fall of the pound/dollar pair cannot continue forever, there must be at least upward corrections, but so far, there is not a single signal about the beginning of one.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. May 9. Geopolitics promises to be very difficult in the coming weeks.

Overview of the GBP/USD pair. May 9. The British pound is falling again, there are few hopes for salvation.

Forecast and trading signals for GBP/USD on May 9. Detailed analysis of the movement of the pair and trading transactions.

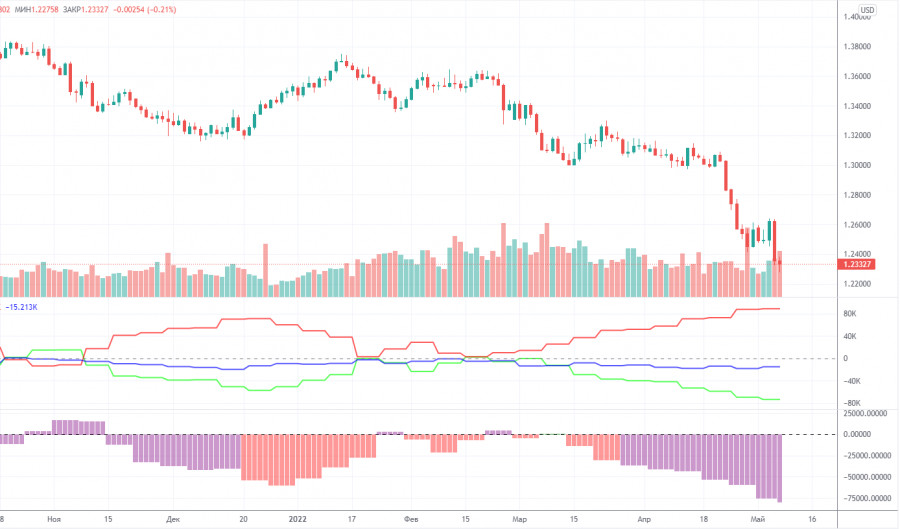

GBP/USD 1H

It is clearly on the hourly timeframe seen that the pound has not managed to correct normally after a strong fall. At the moment, it is obvious that the downward trend continues, and the macroeconomics with the foundation fade into the background. It is even difficult to say whether geopolitics plays any role. The pound seems to be depreciating already simply by inertia. We highlight the following important levels on May 9: 1.2251, 1.2410, 1.2601, 1.2674. Senkou Span B (1.2749) and Kijun-sen (1.2456) lines can also be sources of signals. Signals can be "rebounds" and "breakthrough" of these levels and lines. The Stop Loss level is recommended to be set to breakeven when the price passes in the right direction by 20 points. Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The chart also contains support and resistance levels that can be used to take profits on trades. There are no major events scheduled for Monday in the UK and the US. Therefore, theoretically, we can expect a "boring Monday'' without a new fall from the pound today. But the reality may be quite different...

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.