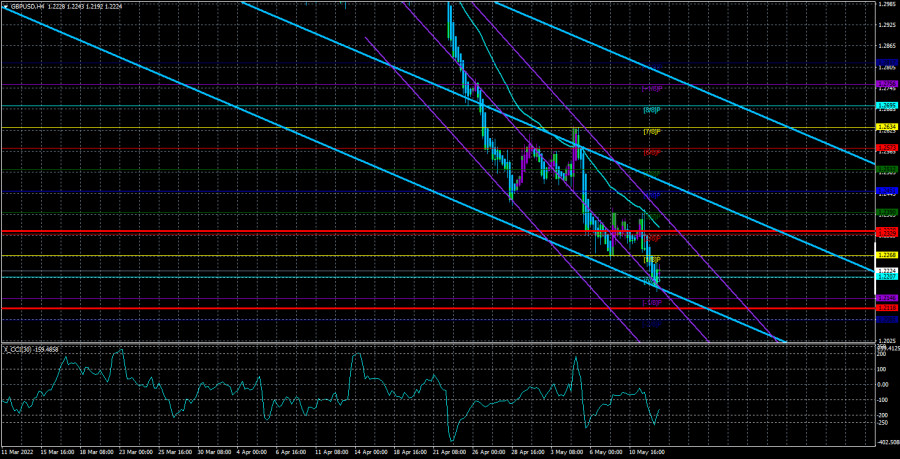

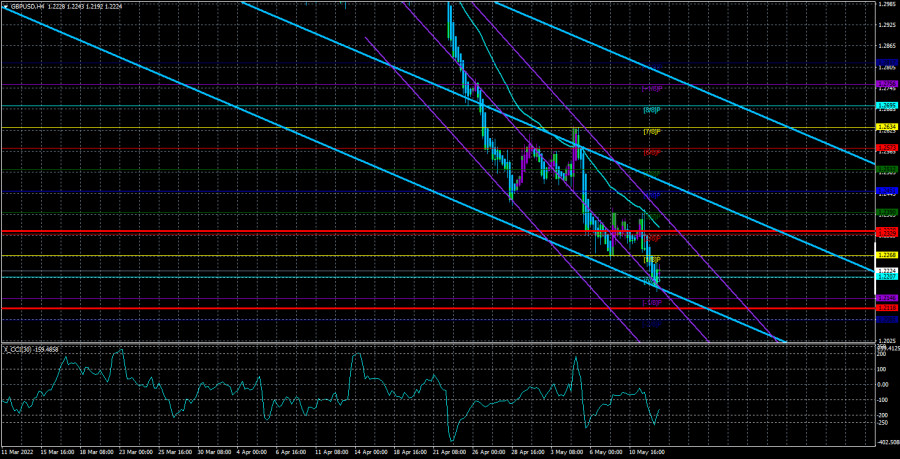

The GBP/USD currency pair fell on Thursday in the same way as the EUR/USD pair. There were formal grounds for this since the report on British GDP turned out to be worse than experts' forecasts. However, below we will look at why this is not the case. First of all, it should be noted that the British currency could not adjust after falling by 800 points, not that it rolled back up, it did not even get to the moving average. This suggests that there are no bulls on the market right now, and bears are not closing their short positions. All technical indicators continue to point down. Even the CCI indicator has entered the oversold area, which does not happen so often with it. However, it has already entered this area for the third time, and growth still does not begin. The good news is that the lower the pound falls, the higher it will then rise. A pair cannot move constantly in the same direction. Moreover, there are no grounds for this now. A couple of months ago, when the next round of depreciation of the British currency was just beginning, there were these reasons. Geopolitics, the Fed's intentions to raise the rate throughout 2022, possible military actions in Europe, the energy and food crises in Europe, and the status of the "reserve" currency of the dollar. However, all these factors have already been played out several times, and the pound has been falling and falling. Moreover, even when it is the dollar that should fall.

Recall that not so long ago, a report on GDP was published in the States, which showed a decrease in the indicator in the first quarter by 1.4%. Some members of the Fed monetary committee openly declare that the unemployment rate will rise, negative GDP may be in the second quarter, and it may take several years to repay inflation. As you can see, not everything is good in the USA either. However, even on such news and statements, the dollar is still growing. Thus, we believe that the current fall of the pair is already absolutely illogical and groundless. Therefore, we continue to expect its speedy completion. Unfortunately, for the fall to end, traders must start at least fixing profit on sales. Until this happens, the pound cannot expect to grow. Therefore, the strategy is as follows: while all indicators (especially moving) signal a downward trend, we sell as soon as the price overcomes the moving, and be prepared for a powerful recovery of the pound.

And again about the rate

In recent weeks, rumors have been actively circulating in the press and the media that the Bank of England may refuse to raise the rate at the next meetings. For some reason, this information shocks traders, although we recall that in December, when the rate was raised for the first time, the Bank of England did not even announce its increase, and the markets were completely unprepared for this. Then BA raised the bid three more times and what is the effect? The pound is still falling, but the dollar is growing. That is, it turns out that even monetary policy no longer matters. What is the British regulator, and what is the American one? There is talk inside the Bank of England that a pause is necessary. They say that policy tightening has a downside to the coin, and first, you need to assess the consequences for the economy from an increase to 1%, and then decide on a new tightening. Yes, this is not the most "hawkish" rhetoric, but recall that BA has already raised the rate four times anyway, and its GDP indicator in the first quarter is not negative, as in the United States. That is, all indicators indicate that the UK economy in terms of percentage growth is in no way inferior to the American one, and monetary policy is in no way weaker than the American one. So why is the pound falling then? Geopolitics? It can't have a destructive effect on the pound forever. We believe that the market is simply selling off the British pound by inertia. There is a trend - why not follow the trend, even if there are no fundamental and macroeconomic reasons for this?

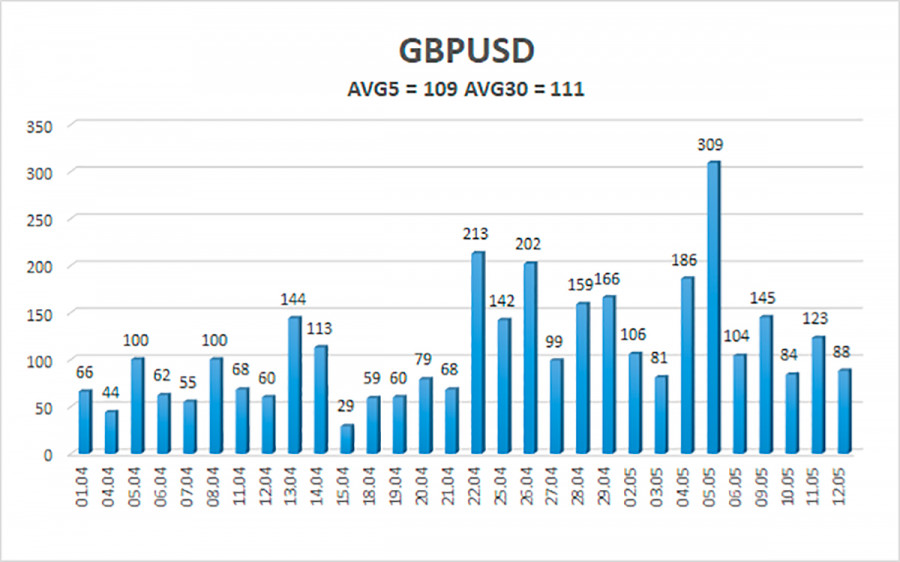

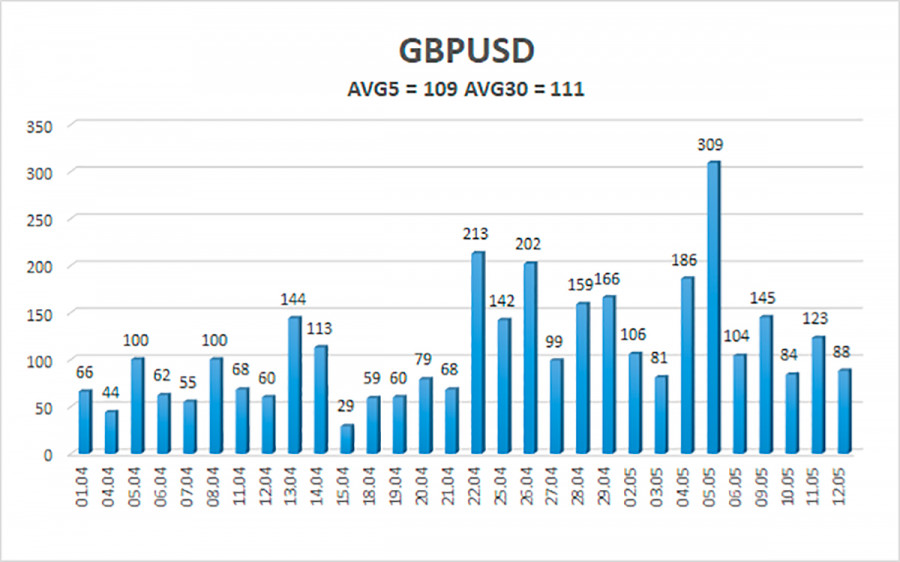

The average volatility of the GBP/USD pair over the last 5 trading days is 109 points. For the pound/dollar pair, this value is "high". On Friday, May 13, thus, we expect movement inside the channel, limited by the levels of 1.2118 and 1.2338. The upward reversal of the Heiken Ashi indicator will signal a new attempt to start an upward correction.

Nearest support levels:

S1 – 1.2207

S2 – 1.2146

S3 – 1.2085

Nearest resistance levels:

R1 – 1.2268

R2 – 1.2329

R3 – 1.2390

Trading recommendations:

The GBP/USD pair maintains a downward trend in the 4-hour timeframe. Thus, at this time, you should stay in sell orders with targets of 1.2146 and 1.2118 until the Heiken Ashi indicator turns up. It will be possible to consider long positions if the price is fixed above the moving average line with a target of 1.2451.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.