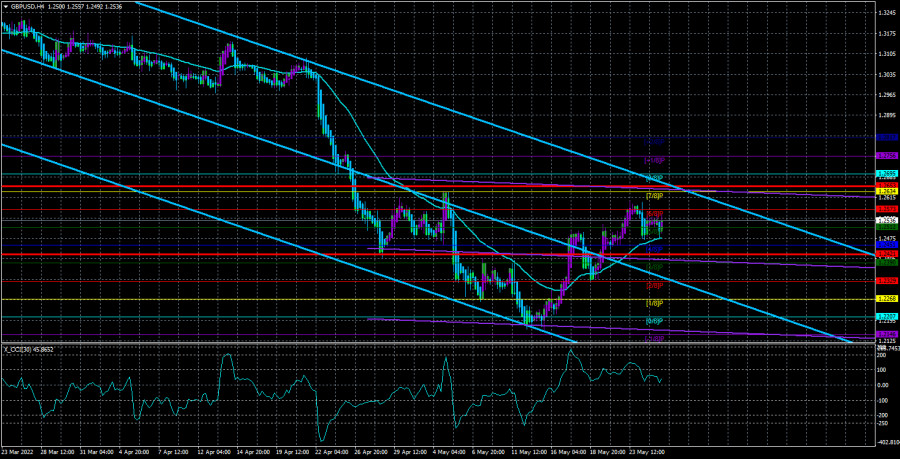

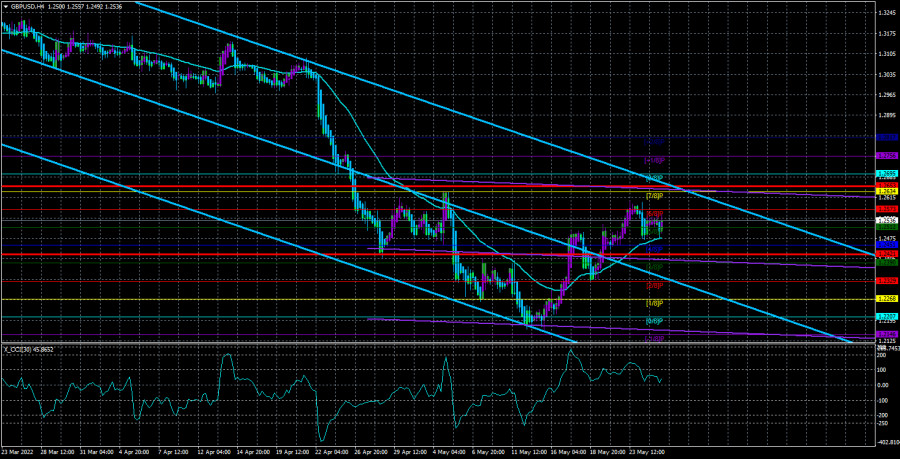

The GBP/USD currency pair adjusted to the moving average line on Wednesday. This movement does not deserve to be considered at all, as it is very weak. The pound sterling continues to trade not too far from its 2-year lows, and it failed to update its last local maximum of May 4 near the Murray level "7/8"-1.2634. Therefore, if the probability of further growth for the euro currency is 60 percent, then for the pound it is falling and is already 40 percent. We cannot say that the situation with the EU economy is now much better than the situation with the UK economy. Rather, on the contrary. The UK recorded higher GDP growth in the second quarter, and higher GDP in the first quarter, and the Bank of England has already raised its key rate four times. Unfortunately, the British are very fond of creating problems for themselves and believe that the European Union should dance to their tune. Naturally, we are referring to the "Northern Ireland Protocol", discussions of which have resumed in recent weeks. So now Britain is on the verge of a trade war with the EU and guess who will suffer big losses if it starts? Also in the UK, the index of business activity in the service sector has fallen significantly, so the British pound has been feeling out of place in the last couple of days.

Separately, we can note the British inflation, which has already risen to 9% and overtook the American one. On the one hand, this gives a new reason for the Bank of England to continue raising the rate in 2022. On the other hand, is the British regulator ready to raise it and sacrifice economic growth? In the last few weeks, the topic of BA's refusal to raise the rate at the next meetings has been actively discussed in the foreign exchange market. However, even this does not matter, because inflation did not react at all to the rate increase to 1%. Thus, the pound sterling may well fall in the coming days under the moving average, which will mean the resumption of the downward movement.

The Fed does not change its rhetoric, but slightly eases the pressure on monetary policy.

In the last few days, there has also been a very popular topic with the possible pause of the Fed in raising the rate, which it may take as early as this fall. The reason for such conversations was the speeches of several members of the monetary committee, who admitted that in September the regulator would not raise the rate, but would actively monitor inflation and wait for a positive reaction to the tightening that would already happen by that time. From our point of view, this means absolutely nothing for the dollar and the markets. Recall that the Fed plans to raise the rate to 3.5%, which has been repeatedly stated by almost all members of the committee. Yesterday, James Bullard, the most "hawkish" member of the committee, said that the rate should be brought up to 3.5% as soon as possible so that next year when inflation starts to slow down, the regulator will have the opportunity to reduce it already.

Most likely, this means a reduction in the rate to a neutral level of 2.5%. That is, the following picture turns out: the Fed is going to raise the rate to 3.5%, and then gradually lower it to 2.5% in 2023 and 2024. Also, the head of the St. Louis Federal Reserve noted that raising the rate at one of the meetings by 0.75% at once may be quite an appropriate decision. Thus, the general rhetoric of the Fed members has not changed much in recent weeks. Of course, Bullard is a "hawk of hawks", and the rest of the committee members do not take such a tough position. But this does not mean that the regulator will now abandon its plans and goals. And if so, then until the end of this year, the fundamental background will remain in favor of the US dollar. Unless it has already been worked out by traders in advance, which also cannot be completely excluded. Therefore, we believe that it is still necessary to expect a rise in the dollar in the medium term, and the strengthening of the pound may be like a "technical correction".

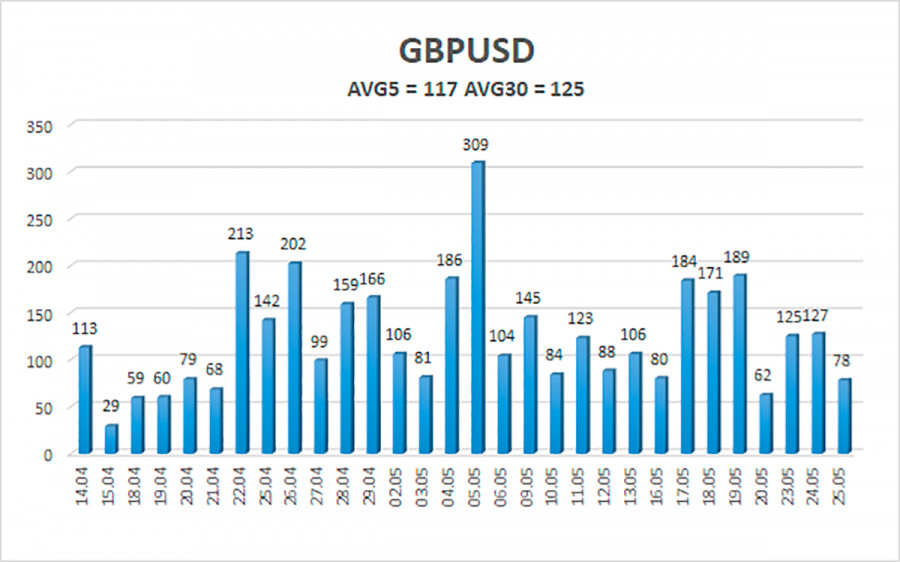

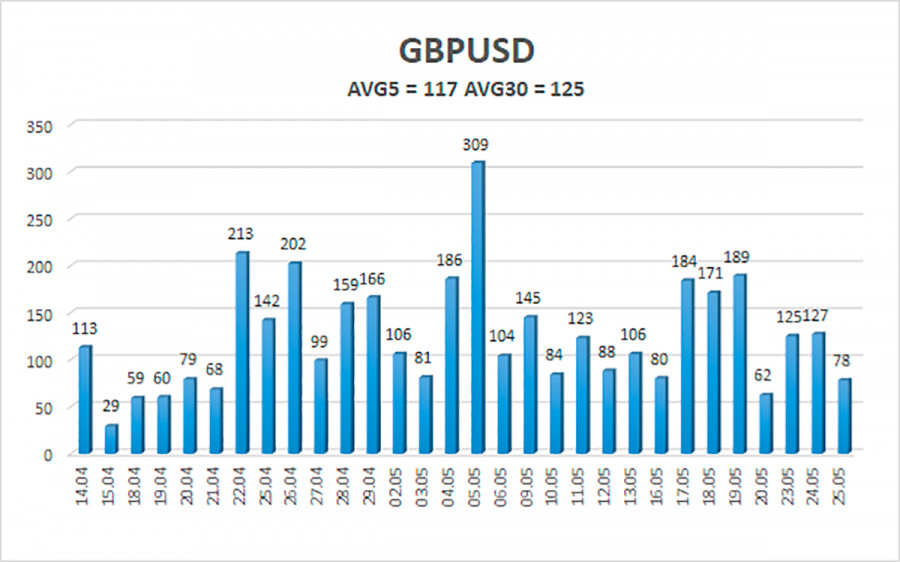

The average volatility of the GBP/USD pair over the last 5 trading days is 117 points. For the pound/dollar pair, this value is "high". On Thursday, May 26, thus, we expect movement inside the channel, limited by the levels of 1.2421 and 1.2653. The upward reversal of the Heiken Ashi indicator will signal the resumption of the upward movement.

Nearest support levels:

S1 – 1.2512

S2 – 1.2451

S3 – 1.2390

Nearest resistance levels:

R1 – 1.2573

R2 – 1.2634

R3 – 1.2695

Trading recommendations:

The GBP/USD pair continues to form a new upward trend in the 4-hour timeframe. Thus, at this time, new buy orders with targets of 1.2634 and 1.2653 should be considered in the event of a reversal of the Heiken Ashi indicator or a rebound from the moving average. It will be possible to consider short positions if the price is fixed below the moving average line with targets of 1.2421 and 1.2390.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.