The GBP/USD currency pair also did not show anything outstanding on Wednesday, although the most important event of the week was scheduled for that day. At least for the British pound. No, we are not talking about Jerome Powell's speech in the US Congress right now. Recall that over the weekend we reported that the head of the Fed would not say anything new and extravagant just a week after the Fed meeting. Therefore, we did not expect any market reaction to this event in principle. But the report on British inflation, based on which the Bank of England will decide on a rate hike in early August, is important. However, we will talk about this report a little below, and now we note that the pound/dollar pair has also entered a phase of calm and consolidation, as has the euro/dollar pair. In recent weeks, and maybe months, both pairs have been moving almost identically, which greatly facilitates the understanding of the processes that are currently taking place in the foreign exchange market.

We believe that 80-90% of the future of the two main pairs now depends on the dollar, the US, and the Fed. The fact that both pairs are trading almost identically, from our point of view, says just that. If so, then the US currency will continue to rise in price, as the fundamental, geopolitical backgrounds remain frankly in its favor. By the way, this conclusion also explains why the market practically did not react to the increase in the key rate of the Bank of England. Five times. Recall that literally until last week, the Fed and BA rates were equal, but only the dollar was growing anyway (in the medium term, of course). Even at the moment, when the fifth BA rate hike in a row seems to have been worked out, the pound remains very close to its 2-year lows. Thus, its prospects remain extremely unfavorable.

Inflation in the UK has risen again.

Yesterday's report on British inflation showed another acceleration, now to 9.1% y/y. Some consider this value to be contradictory since it completely coincided with the forecast value. That is, there seems to be another increase in the consumer price index, and it seems to be within the forecast. Traders were also a little confused by the core CPI indicator (excluding energy and food prices). It was 5.9% y/y with a forecast of 6.0-6.1% and the previous value of 6.2%. That is, we even have a slight slowdown in core inflation. Every month, inflation also rose within the forecast – by 0.7%. Thus, at first, it was even unclear how to react to such figures. And a little later it became clear. Recall that the market reaction just happens when the actual value does not coincide with the forecast. In our case, the coincidence is almost one hundred percent, and the report itself means practically nothing either for the Bank of England or for the pound sterling.

Let's explain. In the States a month ago, inflation also fell by several tenths of a percent, and the next month it rose again to record highs. Thus, one slowdown in the indicator means absolutely nothing. This means that the Bank of England is unlikely to decide not to tighten monetary policy even for a while. Inflation in the UK is now even higher than in the US. From our point of view, given the low pace of monetary policy tightening in the UK, the rate should continue to increase continuously to achieve this goal. Surely, this is understood in the bank itself. Further, even if we assume that inflation will not grow anymore and we are at the very beginning of its decline cycle, it should still decrease under the influence of an external factor. That is, the same increase in the BA rate. Thus, although the forecasts were not exceeded, inflation accelerated anyway, and the BA is simply obliged to continue tightening. And for the pound, all this does not mean anything at all, since the market, as we figured out at the beginning of the article, looks more at data from the United States, geopolitics, and the dollar.

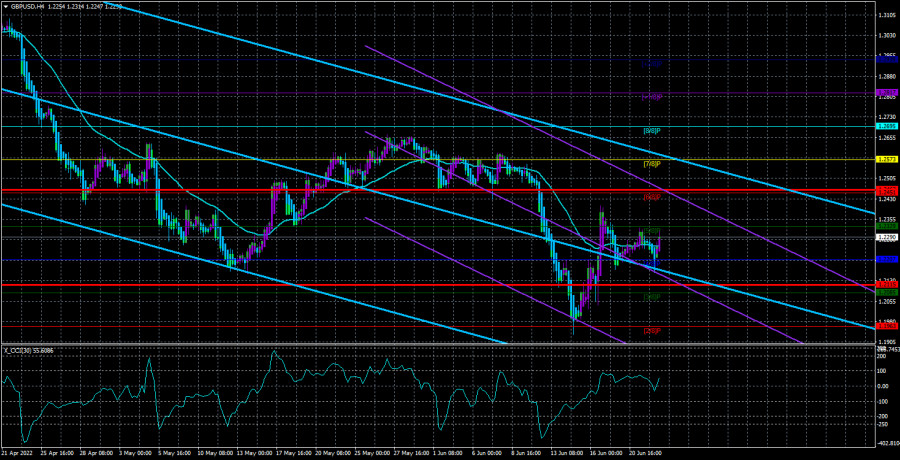

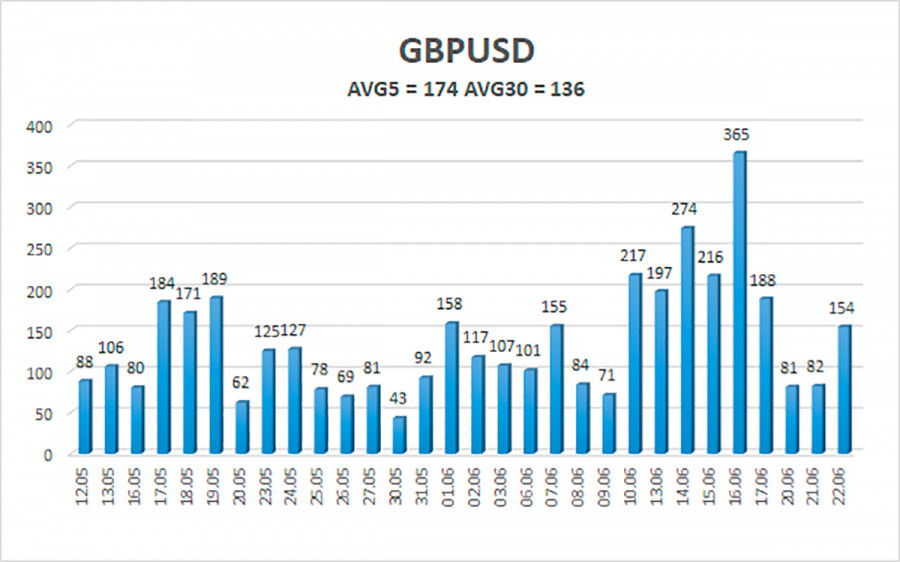

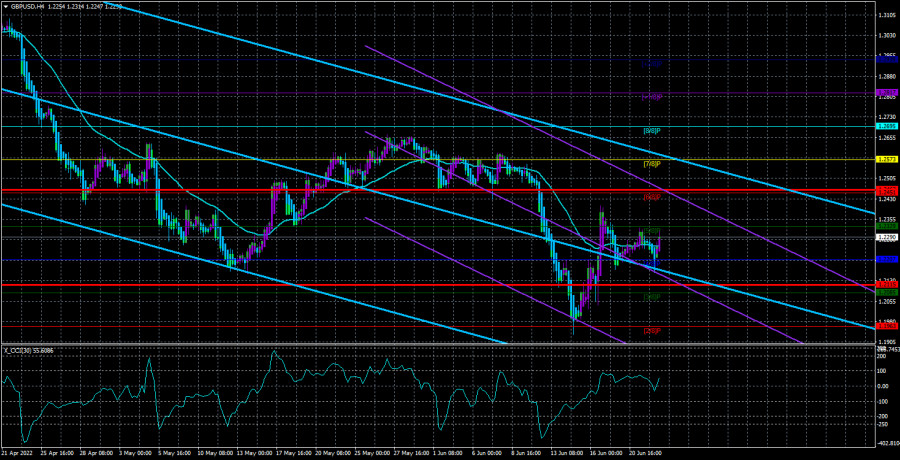

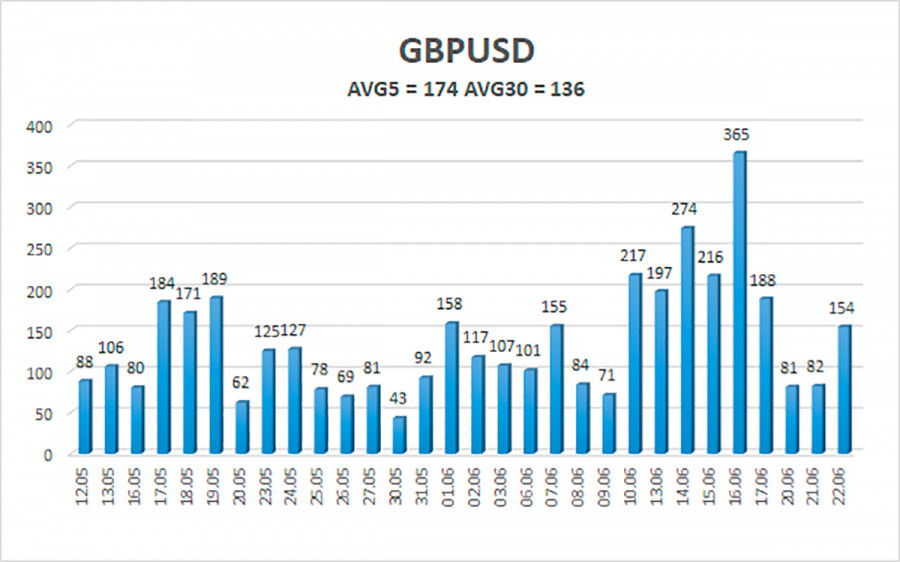

The average volatility of the GBP/USD pair over the last 5 trading days is 174 points. For the pound/dollar pair, this value is "very high". On Thursday, June 23, thus, we expect movement inside the channel, limited by the levels of 1.2115 and 1.2463. The reversal of the Heiken Ashi indicator downwards signals a possible new attempt to resume the downward trend.

Nearest support levels:

S1 – 1.2207

S2 – 1.2085

S3 – 1.1963

Nearest resistance levels:

R1 – 1.2329

R2 – 1.2451

R3 – 1.2573

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe has started the daily mode of overcoming the moving average. Thus, at this time, there is a high probability of "swings", so you can trade on the reversals of the Heiken Ashi indicator. Or not to trade at all until the trend movement resumes.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.