The GBP/USD currency pair declined on Monday. After determining the moving average line and failing to gain a foothold above it, it resumed its decline. Recall that the previous upward correction began last Thursday when Boris Johnson's resignation was announced in the United Kingdom. The prime minister will not resign immediately, but when elections are held for a new Conservative Party leader, that person will automatically become the new prime minister. It is anticipated that the transition of power will not occur before autumn. Even though the pound showed a slight increase at this event, it remains extremely low and failed to surpass the moving average. Thus, the position of the British pound remains extremely weak, and most factors continue to favor its continued decline. The pair is near its 2-year lows, which can be updated almost daily.

We cannot even say at this time that the "Scottish question," the "Northern Ireland protocol," Boris Johnson's resignation, and the vicissitudes of Brexit affect the pound. Consider the euro/dollar pair, unaffected by the factors mentioned earlier. It is falling at the same rate as the pound. Thus, there are strong reasons to believe that the dollar will continue to rise due to the Fed's monetary policy and the geopolitical conflict in Eastern Europe, which primarily affects the economies of European nations and not those of the United States. Although the US economy experienced a decline of 1.6% in the first quarter and, according to the majority of experts, is already on the verge of recession, the US dollar is still rising due to rising Fed rates. Moreover, the effects of military actions on the continent are unlikely to affect the American economy. No matter how bad things are in the United States, the dollar is still in much higher demand than the euro or the pound.

There will be nothing of interest in the United Kingdom this week.

What's the status of macroeconomics this week? As previously stated, the US inflation report will be released on Wednesday, considered the most significant event of the entire week, allowing the dollar to strengthen against its European counterparts even further. The Fed's Beige Book, which is of no interest to anyone, will be published on Wednesday, and a second report on unemployment claims will be released on Thursday. The University of Michigan retail sales, industrial production, and consumer sentiment index on Friday. These facts are all intriguing, but they hardly qualify as vital. Other than the inflation report, there will be no significant reports in the United States this week.

Similarly, the situation in the United Kingdom is quite depressing. The monthly GDP indicator for May and industrial production will be released on Wednesday. This concludes the list of macroeconomic statistics for the UK, and even the GDP report, which is prominently displayed, is irrelevant because it is a monthly report and not a quarterly one. It turns out that traders will have nothing to react to this week other than the US inflation rate. There is currently not even a single speech scheduled by the head of the central bank. We might have anticipated a dull, low-volatility week, but Monday demonstrated that both major currency pairs have no intention of wasting time and are committed to achieving the lowest prices possible. Who knows how low the euro and the pound will fall following this week's election? Both European currencies aim for new lows, and the decline resembles an uncontrolled collapse more and more. There is nothing more to say about this.

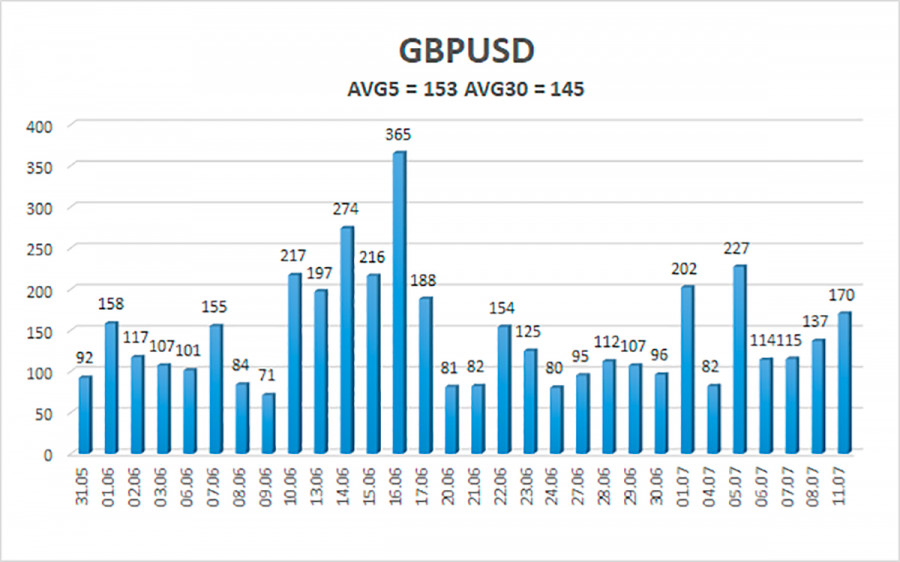

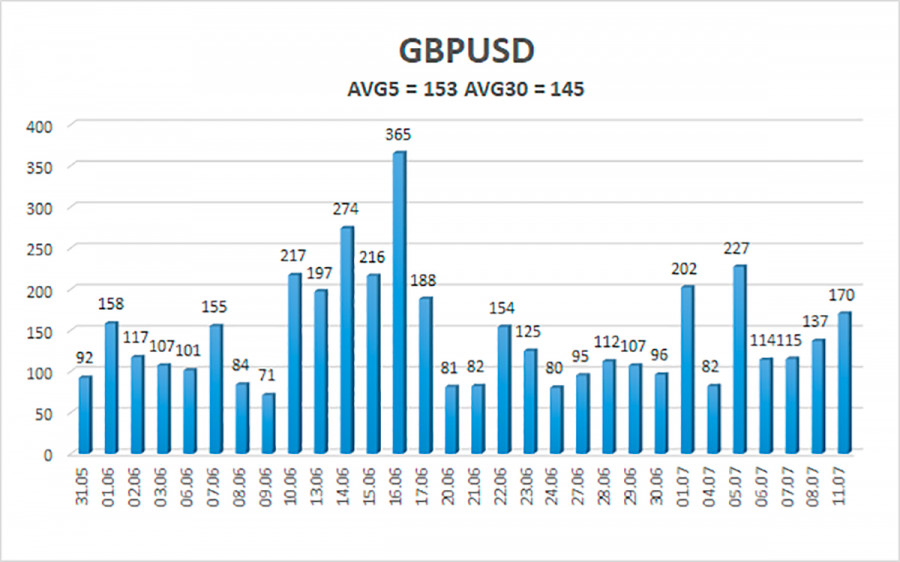

153 points is the average volatility of the GBP/USD pair over the last five trading days. This value for the pound/dollar pair is high. On Tuesday, July 12, therefore, we anticipate movement within the channel, bounded by 1.1746 and 1.2051. The Heiken Ashi indicator's upward reversal will signal a possible new round of corrective movement.

Nearest support levels:

S1 – 1.1902;

S2 – 1.1841.

Nearest resistance levels:

R1 – 1.1963;

R2 – 1.2024;

R3 – 1.2085.

The GBP/USD pair resumed its downward movement in the 4-hour timeframe, prompting the issuance of bearish trading recommendations. Therefore, until the Heiken Ashi indicator turns up, you should maintain sell orders with targets of 1.1841 and 1.1746. When the price is above the moving average, open buy orders with targets of 1.2085 and 1.2146.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, it means that the trend is now strong;

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which to trade now;

Murray levels – target levels for movements and corrections;

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators;

CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.