The EUR/USD currency pair has been standing still in the last few days. Therefore, it is not necessary to say that traders react to any events in the world. By the way, there are practically no such events in the world right now. However, we still allowed for an option in which traders would begin to work out the results of the Fed meeting in advance. The fact is that information is already available to the market that the rate will be increased by 0.75%. The market is also familiar with the latest US inflation report. This report was followed by a 200-point drop in the euro-dollar pair last week. However, it now seems that traders last Tuesday were not working out inflation, but a future Fed rate hike, because, as we have already said, the report itself was not shocking. One way or another, the pair remains near its 20-year lows, maintaining a slim chance of new growth. We want to say that the probability of a resumption of the downward trend now remains very high because the euro currency has once again shown its inability to adjust normally. There are only 100 points left to go to the minimum levels over the past 20 years, which is, in fact, the task of one day.

Recall that, from a technical point of view, global trends do not end in flats at the lowest values for a few decades. Usually, we see a sharp departure of quotes from extreme levels, which begins a new trend. That is why we do not believe that the downtrend is over now. The pair remains too low, and buyers do not show any desire to trade the pair. Consequently, the euro currency can resume falling at any time. Since the current levels are minimal, the bears are afraid to continue selling the pair. But, if there are no buyers, then sooner or later, sellers will get down to business again.

What is the new week preparing for the euro currency?

The current article can be considered a kind of "announcement." There was not a single important event or publication in the United States or the European Union on Monday, so there is nothing wrong with the fact that it comes out on Tuesday. Let's briefly go through the events that await us this week. Of course, the key event is the Fed meeting because we have long realized that news from overseas is paramount for market participants. However, there will be other events that cannot be ignored. For example, ECB President Christine Lagarde will speak today. After the European regulator also decided to counteract inflation, everyone became interested in how long and how much the ECB intended to raise the key rate. Lagarde seems to have answered this question, saying that by the end of the year, her department will raise the rate aggressively, but there are still fewer specifics than in the case of Powell and the Fed. Therefore, new information about this will not be excessive.

In principle, these are all of the important events for this week in the European Union. An ECB meeting on non-monetary issues is scheduled for this week, and several speeches by ECB representatives are planned, but all of this is empty. On Friday, reports on business activity in the service and manufacturing sectors will be published, which, according to experts, will continue to decline. In principle, this is not surprising given the impending recession in the European Union. The recession has already begun in the USA and will begin in Europe, so business activity may fall and fall there and there. The next reports will show at what rate it is decreasing. And it's quite another thing that a recession will begin in the States and the EU, but for some reason, only the European currency is falling. Therefore, we believe that this week's fundamental and macroeconomic background will not change the general state of affairs in the foreign exchange market. The euro will also remain low because it is unlikely that "dovish" decisions can be expected from the Fed now. And the market continues to sell the euro currency with great pleasure, especially when there are specific reasons for this.

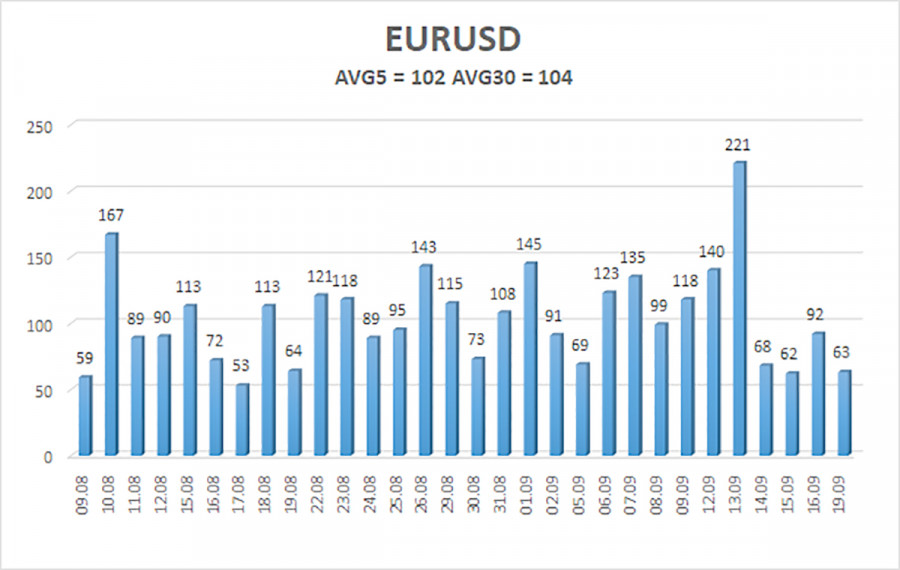

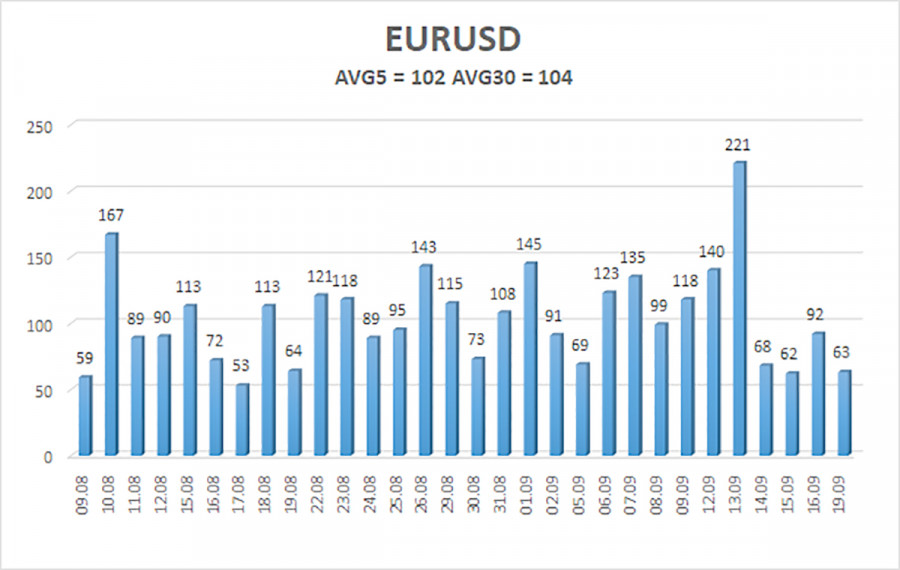

The average volatility of the euro/dollar currency pair over the last five trading days as of September 20 is 102 points and is characterized as "high." Thus, we expect the pair to move today between 0.9895 and 1.0106. A reversal of the Heiken Ashi indicator back up will signal a round of upward movement within the next flat.

Nearest support levels:

S1 – 0.9949

S2 – 0.9888

S3 – 0.9827

Nearest resistance levels:

R1 – 1.0010

R2 – 1.0071

R3 – 1.0132

Trading Recommendations:

The EUR/USD pair is trying to continue the global downtrend, but it turns out that it is only inside the 0.9888-1.0072 side channel so far. Thus, you either need to wait for the flat to be completed or trade for a rebound/overcome its boundaries with appropriate goals.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.