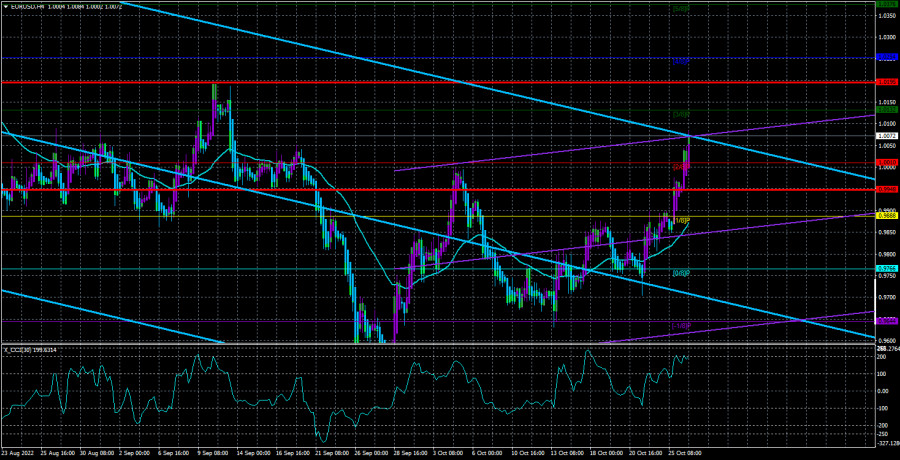

The EUR/USD currency pair has risen sharply and has gained more than 200 points this week alone. The pair moved away from the 20-year low by only 450 points; exactly as much as it moved away after each new fall within the long-term downward trend. We again saw a standard correction, after which the fall of quotations may well resume. One of the important points that regularly drew the attention of traders is the inability to update their recent highs. Yesterday it happened - the price rose more than on October 4 (the last high of the price). However, we also wonder why the European currency was growing at all this week, if there were practically no macroeconomic statistics, the fundamental background remains unchanged, and the geopolitical situation is not improving.

We believe that the current strengthening of the euro currency is in some way an accident. There are sometimes moments when the pair moves in a certain direction, but no one can explain why. Recall that the market is not obliged to stand in one place if there are no new data, reports, or important events. Therefore, we are now seeing a purely technical growth of the pair, which is even a little logical if we take into account the fact that the euro has been falling for almost 2 years. However, in the near future, on the 24-hour TF, the price may collide with the Senkou Span B line, which may provide strong resistance. If you look at the daily TF, it will even be very difficult for you to distinguish the current movement, which looks very impressive on a 4-hour TF. Thus, it is too early to open champagne about the end of the downtrend. 450 points up at a slow pace is not a reason to consider the trend completed.

Will the ECB meeting provoke an even greater growth of the euro?

Let's be frank. The Bank of England raised the key rate seven times, which did not prevent the pound from continuing to fall against the dollar. The ECB raised the rate twice, but not by 0.25%, but by 0.5% and 0.75%, which in itself is a very "hawkish" measure. Nevertheless, the European currency also continued to fall, and the decisions and rhetoric of the Fed representatives were important to traders, not some European Central Bank. The results of the penultimate meeting of this year will be announced today. The rate is almost guaranteed to increase by another 0.75%. But how can this be compared with the fact that the European currency has been growing for most of the week? That is, the euro grew on Monday, Tuesday, and Wednesday, and then it will grow even more on Thursday when there really will be grounds for this. With what similar reasons earlier for traders were not a good reason to buy euros, and then suddenly, for no reason, the market rushes to buy the currency that it got rid of in the last two years? We believe that such an option is unlikely.

It has long been known that the ECB will not be able to raise the rate as much as the Fed. This means that the rate in the European Union will remain lower than in the United States in the long run. This factor alone is enough to ensure that the euro does not continue to grow since cash and investment flows will still prefer America to Europe. A banal example: a higher Fed rate - a higher deposit rate in American banks – the desire of investors to invest in safe assets (against the background of tightening monetary policy, this is logical) in America, not in Europe. Thus, we do not yet believe that the euro currency can grow to the value of 1.05 or 1.10. It would be too perfect for her. In two years, it has lost about 2500 points, and here it will grow by 1000-1500 in a few months. When there are no clear reasons for this? When the geopolitical conflict is burning brighter and brighter every day? When relations with the Russian Federation are completely ruined, and how the economy will survive this winter, no one can say yet. It's fantastic.

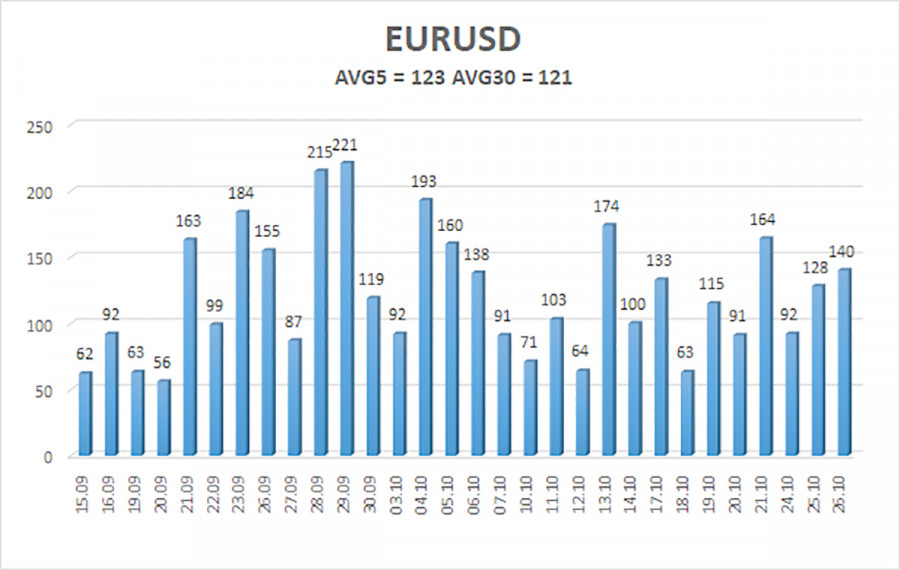

The average volatility of the euro/dollar currency pair over the last 5 trading days as of October 27 is 123 points and is characterized as "high." Thus, we expect the pair to move between 0.9948 and 1.0195 levels on Thursday. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.0010

S2 – 0.9888

S3 – 0.9766

Nearest resistance levels:

R1 – 1.0132

R2 – 1.0254

R3 – 1.0376

Trading Recommendations:

The EUR/USD pair continues to be located above the moving average. Thus, now you should stay in long positions with targets of 1.0132 and 1.0194 until the Heiken Ashi indicator turns down. Sales will become relevant no earlier than fixing the price below the moving average with a target of 0.9766.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong now.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

We believe that the current strengthening of the euro currency is in some way an accident. There are sometimes moments when the pair moves in a certain direction, but no one can explain why. Recall that the market is not obliged to stand in one place if there are no new data, reports, or important events. Therefore, we are now seeing a purely technical growth of the pair, which is even a little logical if we take into account the fact that the euro has been falling for almost 2 years. However, in the near future, on the 24-hour TF, the price may collide with the Senkou Span B line, which may provide strong resistance. If you look at the daily TF, it will even be very difficult for you to distinguish the current movement, which looks very impressive on a 4-hour TF. Thus, it is too early to open champagne about the end of the downtrend. 450 points up at a slow pace is not a reason to consider the trend completed.

Will the ECB meeting provoke an even greater growth of the euro?

Let's be frank. The Bank of England raised the key rate seven times, which did not prevent the pound from continuing to fall against the dollar. The ECB raised the rate twice, but not by 0.25%, but by 0.5% and 0.75%, which in itself is a very "hawkish" measure. Nevertheless, the European currency also continued to fall, and the decisions and rhetoric of the Fed representatives were important to traders, not some European Central Bank. The results of the penultimate meeting of this year will be announced today. The rate is almost guaranteed to increase by another 0.75%. But how can this be compared with the fact that the European currency has been growing for most of the week? That is, the euro grew on Monday, Tuesday, and Wednesday, and then it will grow even more on Thursday when there really will be grounds for this. With what similar reasons earlier for traders were not a good reason to buy euros, and then suddenly, for no reason, the market rushes to buy the currency that it got rid of in the last two years? We believe that such an option is unlikely.

It has long been known that the ECB will not be able to raise the rate as much as the Fed. This means that the rate in the European Union will remain lower than in the United States in the long run. This factor alone is enough to ensure that the euro does not continue to grow since cash and investment flows will still prefer America to Europe. A banal example: a higher Fed rate - a higher deposit rate in American banks – the desire of investors to invest in safe assets (against the background of tightening monetary policy, this is logical) in America, not in Europe. Thus, we do not yet believe that the euro currency can grow to the value of 1.05 or 1.10. It would be too perfect for her. In two years, it has lost about 2500 points, and here it will grow by 1000-1500 in a few months. When there are no clear reasons for this? When the geopolitical conflict is burning brighter and brighter every day? When relations with the Russian Federation are completely ruined, and how the economy will survive this winter, no one can say yet. It's fantastic.

The average volatility of the euro/dollar currency pair over the last 5 trading days as of October 27 is 123 points and is characterized as "high." Thus, we expect the pair to move between 0.9948 and 1.0195 levels on Thursday. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.0010

S2 – 0.9888

S3 – 0.9766

Nearest resistance levels:

R1 – 1.0132

R2 – 1.0254

R3 – 1.0376

Trading Recommendations:

The EUR/USD pair continues to be located above the moving average. Thus, now you should stay in long positions with targets of 1.0132 and 1.0194 until the Heiken Ashi indicator turns down. Sales will become relevant no earlier than fixing the price below the moving average with a target of 0.9766.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong now.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.