The EUR/USD currency pair was trading quite calmly again on Tuesday. A day earlier, it had overcome the moving average line, so the trend changed to a downward one. In principle, despite the 550-point increase in recent weeks, the euro currency still does not give the impression of being ready to start forming a long-term upward trend. Last week, the euro grew on expectations of an ECB rate hike. This is one of the most bullish factors for the euro. If it were not for this, perhaps no update of the local maximum would have occurred. Recall that the excess of the previous local peaks is a sign of the formation of an upward trend. As we can see, such a peak was overcome last week, thanks to a combination of circumstances. The price is below the moving average, so the fall may continue. Moreover, the results of the Fed meeting will be announced this evening.

However, we will talk about the Fed meeting a little lower, but for now, I would like to note that the European economy does not show any positive signs. Recently, it has become very popular to talk about the weakness of the European economy. It has not yet shown a single negative quarter in terms of GDP, while the American economy closed the first and second quarters "in the red." Nevertheless, the US economy still makes a monolithic impression, and the Fed rate is higher than the ECB rate, redirecting cash flows to the US. In addition, the dollar continues to be in high demand due to its status as a "reserve currency." However, the European economy is still slowing down, as shown by the latest GDP report for the third quarter. And inflation continues to rise despite several major rate hikes from the ECB.

It is not the Fed's decision on rates that is important; the regulator's rhetoric is important.

In principle, it's no secret that today the Fed rate will rise by another 0.75% for the fourth time in a row. Of course, a "surprise" in the form of an increase of only 0.5% is also possible, but the probability of this is low. Inflation in the US is still too high and slowing down too slowly for the US regulator to ease its monetary pressure. However, the market may already win a rate increase of 0.75%, as the US currency has been growing quite actively in the last few days. At this time, it is much more interesting to see whether the Fed will begin to reduce the pace of monetary policy tightening at the next meeting. If so, and it will be said openly, then the US dollar may lose its advantage over the euro. Of course, rates in the US will remain higher than rates in the EU for a long time, but based on this factor alone, the dollar is unlikely to be able to continue to grow. Most likely, this factor may deter the growth of the euro.

Is the fifth consecutive increase of 0.75% realistic? From our point of view, yes. The next two inflation reports will be important if the rate rises by 0.75% today. If they show a significant slowdown, the Fed may raise the rate by only 0.5% in December. If not, there may be a fifth consecutive tightening by a point. For the dollar, of course, the second option is better. But without the next two inflation reports, it makes no sense to think about it. We still believe that there is not enough fundamental background for the strong and long-term growth of the pair. What are the reasons for the euro currency to grow long-term? The EU currency barely managed to stop its decline, but in the event of a deterioration in the geopolitical situation, the "foundation" may fade into the background. Thus, the position of the euro remains very precarious. So far, everything is calmer with geopolitics, and the euro is being held back from a new depreciation. As soon as the situation starts to deteriorate again, it may lead to a new collapse. And an increase in the ECB rate at a higher Fed rate will not have enough effect to form an upward trend.

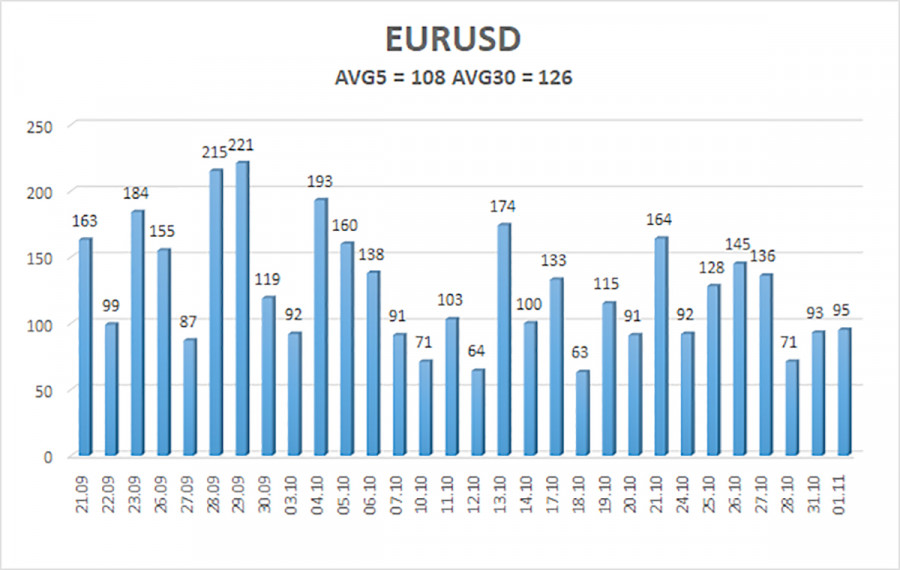

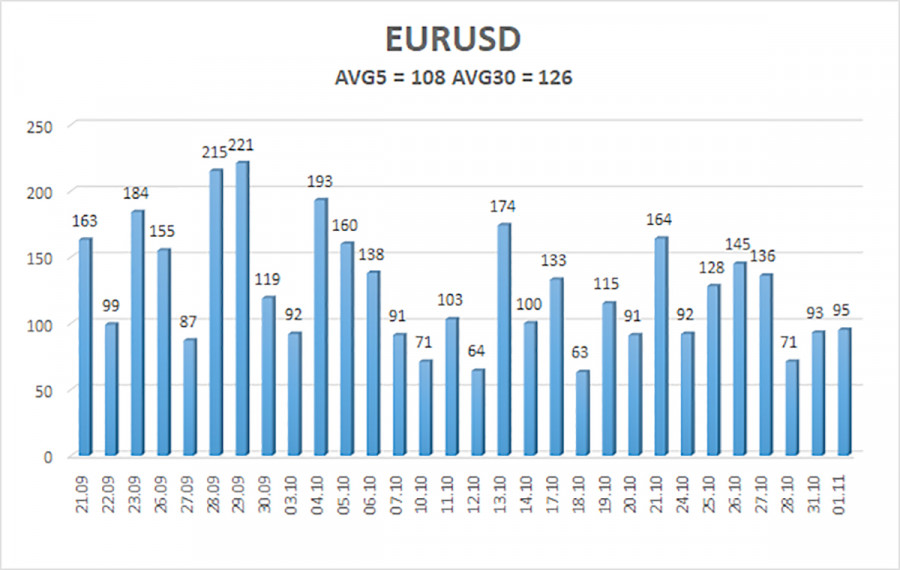

The average volatility of the euro/dollar currency pair over the last five trading days as of November 2 is 108 points and is characterized as "high." Thus, on Wednesday, we expect the pair to move between 0.9762 and 0.9978 levels. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 0.9766

S2 – 0.9644

S3 – 0.9521

Nearest resistance levels:

R1 – 0.9888

R2 – 1.0010

R3 – 1.0132

Trading Recommendations:

The EUR/USD pair has consolidated below the moving average. Thus, it would be best if you stayed in short positions with a target of 0.9766 until the Heiken Ashi indicator turned up. Purchases will become relevant again no earlier than fixing the price above the moving average with goals of 0.9978 and 1.0010.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong ifThe trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.