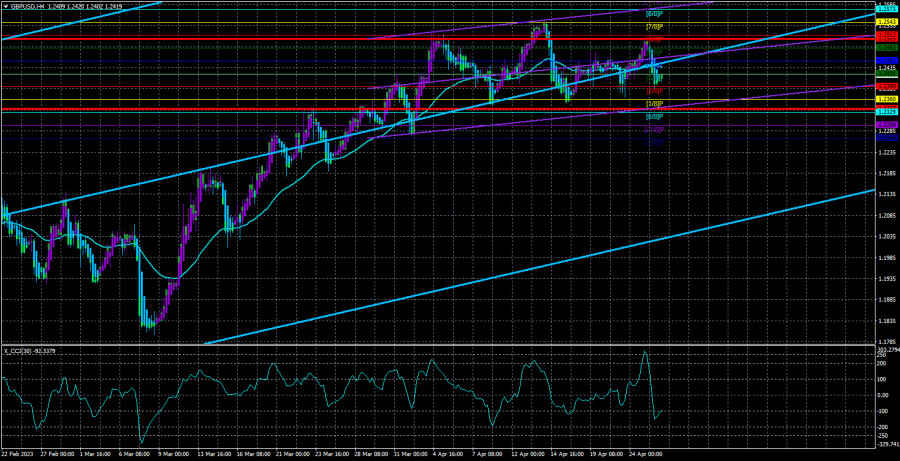

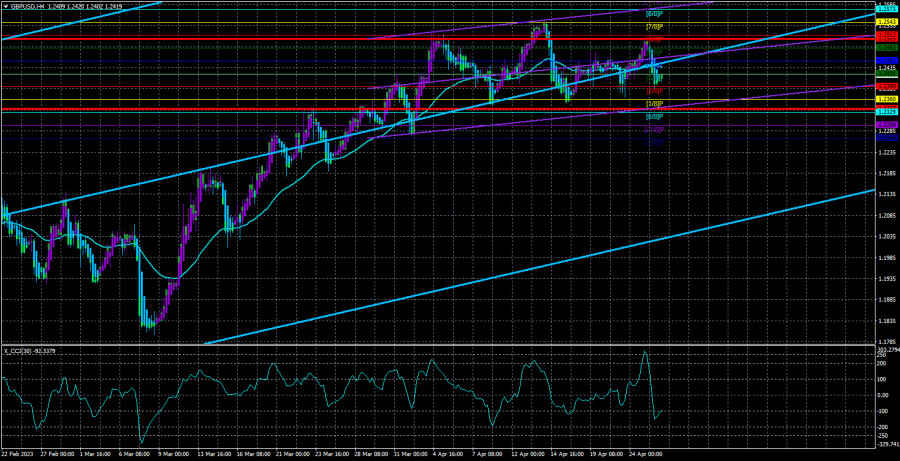

The GBP/USD currency pair was also in a downward movement yesterday, and there was no reason for this either. We have long been waiting for a strong drop in the British currency, but the market refuses to sell the pair. And there is simply no strength left for further purchases. On the 4-hour TF, it is visible that the pair has been moving sideways in recent weeks while being close to its local maximums. For three weeks now, the pair has been unable to correct downwards after strong growth and moved sideways between 1.2360 and 1.2543. Thus, we have another sideways channel. That is, a flat or "swing," whichever you prefer. There is no logic in the pair's movements, as there never was. Last week, there was a significant amount of macroeconomic information for the British currency, but the pair was in a frank flat for almost all five trading days. And with low volatility. On Monday and Tuesday, there was no news or data for the pound or the dollar, but we saw strong movements up and down. Therefore, the movements remain random, which should be considered when opening positions.

Yesterday, the CCI indicator entered the overbought area, so now, sell signals have been formed for both currency pairs. As we have already said, such signals are rare and usually strong. Of course, the indicator can enter the area above the +250 level 2 or 3 more times before the pound's fall finally begins. However, now almost all factors favor a strong downward correction or the beginning of a new downward trend. We still need to understand how the pair continues to hold so high.

Ben Broadbent believes the BoE was late in raising rates.

The Bank of England began raising rates a year and a half ago, the first of the "trio" that interests us. Nevertheless, it is the Bank of England that is so far losing the fight against inflation. In the European Union, inflation is steadily declining, and in the United States - too. It has fallen by 1% in the UK and remains above the psychological level of 10%. Of course, over time, the consumer price index will decrease. Both the British regulator and the American one have stated that the effect of monetary policy tightening will be maintained for up to 18 months. Therefore, the BoE can expect a decline in inflation. But it is unlikely that "Andrew Bailey's target" of 2.9% will be achieved by the end of this year. The UK risks high inflation for many years, and the BoE cannot raise rates forever. It is already approaching the moment when it will have to stop.

Bank of England Deputy Governor Ben Broadbent said yesterday that the BoE's monetary policy was not optimal. He reported that the key rate should have started to rise earlier, but no one could have guessed that inflation could be so strong and resilient. At the same time, he noted that the regulator had done almost everything it could. If it had started raising rates six months earlier, the peak inflation rate would have been a maximum of half a percent lower. Thus, the problem of high inflation now depends more on the not-so-well-being of the British economy. It is also on the verge of recession, so the BoE must do more to raise rates. And raising rates is a key factor in the growth of the British currency. Accordingly, the fundamentals no longer support further growth of the pound sterling.

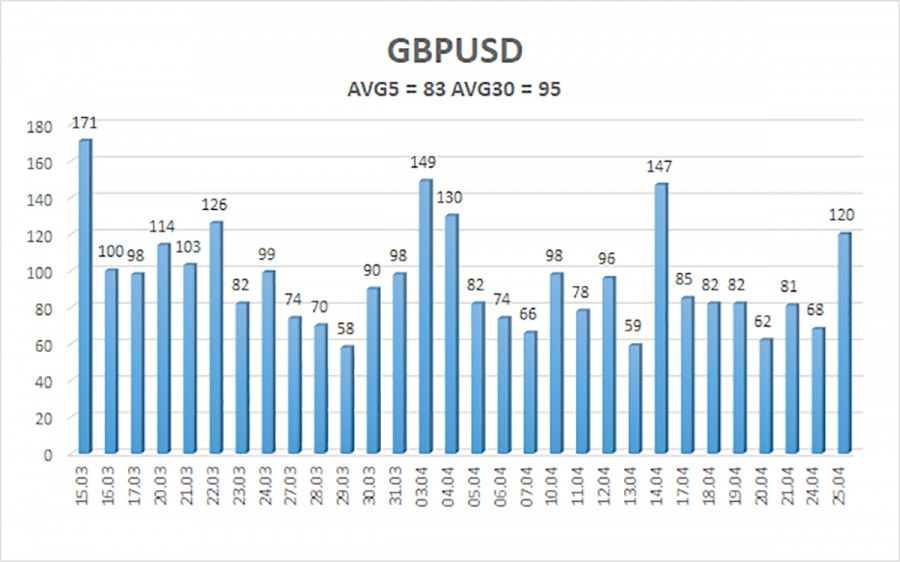

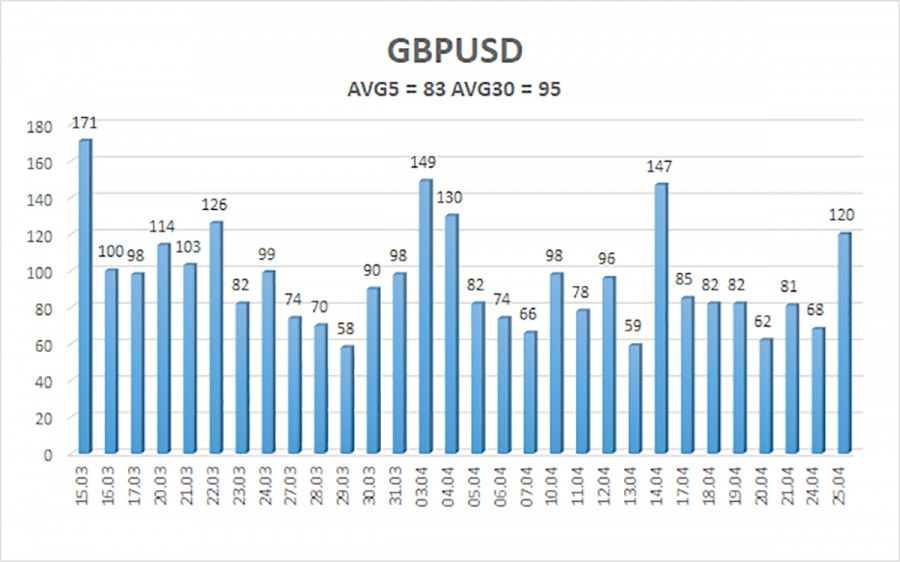

The average GBP/USD pair volatility for the last five trading days is 83 points. For the pound/dollar pair, this value is considered "average." On Wednesday, April 26, we thus expect movement within the channel limited by levels 1.2337 and 1.2503. A reversal of the Heiken Ashi indicator upwards will signal a new wave of upward movement within the sideways channel.

Nearest support levels:

S1 – 1.2421

S2 – 1.2390

S3 – 1.2360

Nearest resistance levels:

R1 – 1.2451

R2 – 1.2482

R3 – 1.2512

Trading recommendations:

The GBP/USD pair is trading near the moving average line in a flat on the 4-hour timeframe. At this time, you can trade only by the reversals of the Heiken Ashi indicator or on smaller timeframes, as there is no clear trend - the price is too close to the moving average and ignores it.

Explanation of illustrations:

Linear regression channels - help determine the current trend. If both are pointing in one direction, it means the trend is now strong.

Moving average line (settings 20,0, smoothed) - determines the short-term trend and the direction to trade now.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means a trend reversal in the opposite direction is approaching.