The GBP/USD currency pair also continued its upward correction on Friday and, in general, showed almost identical movements to the EUR/USD pair. There is nothing surprising about this, as all the macroeconomic statistics on Friday came from across the ocean, which means they had the same impact on both currency pairs. From this, it follows that the euro and the pound rose to the same extent, though not entirely fairly, on the last working day of the previous week because the reports from America turned out to be very strong in aggregate. To be more precise, only one report—Non-Farm Payrolls—turned out to be strong. The number of new non-farm jobs created was 336,000, compared to a forecast of 170,000. Moreover, the previous month's figure was revised from 187,000 to 227,000. In other words, in essence, only non-farm payrolls gave two strong reasons to buy the US dollar again.

As we have already mentioned, the market reacted precisely to purchases of the dollar, but the rise of the American currency quickly ended. This moment concerned us because what is the point of such a reaction if it is completely nullified within half an hour? In yesterday's articles for beginners, we assumed that Monday would start with a downward correction, which we immediately saw overnight. Monday opened with a gap for both pairs, and at the moment, both are leaning towards a decline.

Let's also remember the unemployment rate, which, by the end of September, remained unchanged. Given the "ultra-hawkish" monetary policy of the Fed, further unemployment growth could have been expected. However, what do we have in the end? The labor market, although shrinking over the past year and a half, still remains at a very good level, allowing the Fed to continue raising the interest rate for as long as necessary. Unemployment, although it increased from 3.4% to 3.8%, still remains close to its 50-year lows. Everything is fine in America, and the dollar can continue to rise until the end of the year.

Inflation is the most significant event of the week, even though it's a bit of a stretch. What interesting events await us this week? In the UK, the event calendar looks like this: On Thursday, there will be a monthly GDP report and an industrial production report. And that's pretty much it. Some might say that GDP reports are always interesting and important, but they're just a monthly gross domestic product figure. The market primarily pays attention to quarterly and annual GDP values, so it can be considered that this week we are expecting two secondary reports in the UK.

In the US, the situation is a bit more interesting. From macroeconomic publications, we can note the producer price index, the consumer price index, FOMC minutes, initial jobless claims, and the University of Michigan Consumer Sentiment Index. However, let's be frank and honest: none of the above events currently have a significant impact on the market. Perhaps inflation in the US could influence trader sentiment because if the CPI rises for the third consecutive time, then a November rate hike by the Fed can be considered a done deal. In theory, the dollar could get a new reason to strengthen, but it already has enough of them. All other publications are frankly secondary and may trigger a market reaction of 20–30 points at best.

Also, this week will see a series of speeches by members of the Federal Reserve's monetary committee. In particular, Barr, Jefferson, Logan, Bostic, Kashkari, Daly, Waller, Bowman, and Harker will deliver speeches. That is, at least half of the monetary committee. Some will speak twice. However, what sense do these events make for traders? The market clearly understands what to expect from the Fed right now, so what information can FOMC members provide that is not already known to the market? We believe that even in the US, there is nothing extraordinary to expect this week.

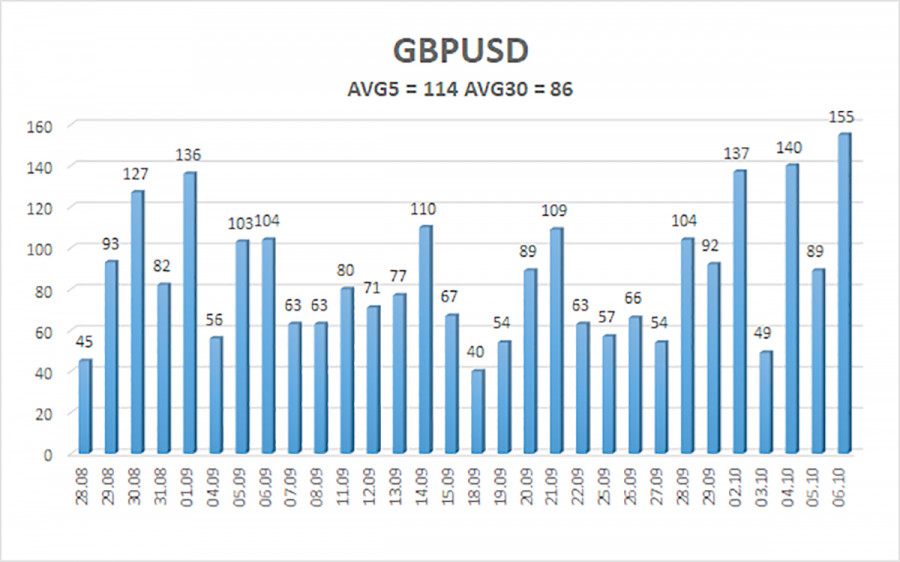

The average volatility of the GBP/USD pair over the last 5 trading days as of October 9th is 102 pips. For the pound/dollar pair, this value is considered "average." As a result, on Friday, October 6, we anticipate movement that stays within the range defined by the levels of 1.2078 and 1.2282. A reversal of the Heiken Ashi indicator downwards will signal a resumption of the downward movement.

Nearest support levels:

S1 – 1.2146

S2 – 1.2085

S3 – 1.2024

Nearest resistance levels:

R1 – 1.2207

R2 – 1.2268

R3 – 1.2329

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair has started a new phase of corrective movement. Therefore, at the moment, new short positions can be considered with targets at 1.2085 and 1.2024 in case the price settles back below the moving average. Long positions can be considered now, with targets at 1.2207 and 1.2282 until the Heiken Ashi indicator reverses downward.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is currently strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will trade over the next day based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates a trend reversal in the opposite direction.