On Thursday, the GBP/USD currency pair continued the correction that began a day earlier. In the pound situation, there is at least some logic in the movements, as the dollar fell due to a sharp drop in inflation in the United States, and then the pound fell even more sharply due to a decline in inflation in Great Britain. Of course, inflation in the UK fell much more, so it would be logical to see a more significant decline in the British pound, but at least it's something. Over the past two days after the inflation report, the European currency has not been able to start a correction at all.

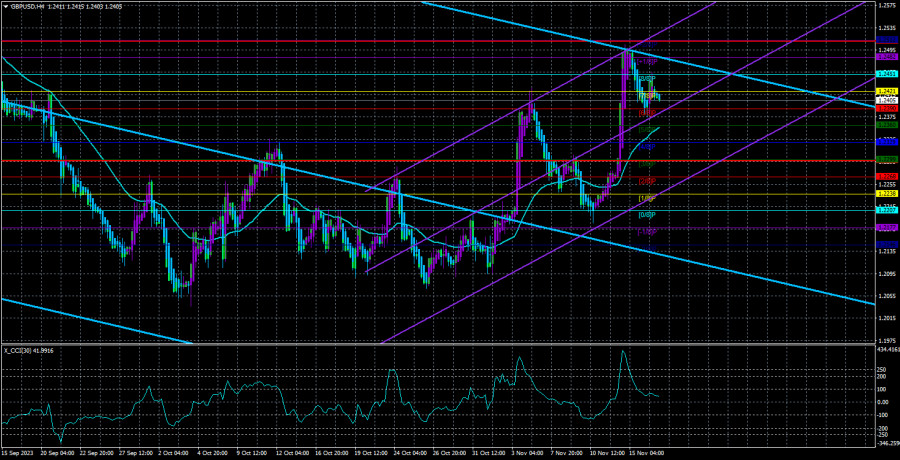

Thus, from a technical point of view, we currently have a short-term upward trend of about 80% triggered by a series of weak reports from across the ocean. It is better to say not "weak reports" but "reports against the US dollar." The downward trend would have resumed long ago without macroeconomic statistics from across the ocean. But in any case, the CCI indicator has already entered the overbought zone three times. We discuss this daily because we consider these entries important and strong signals that warn us of a decline. A good downward correction should occur even if the downward trend does not resume. As for longer-term prospects, we still need to see what could help the British pound restore its year-and-a-half-long upward trend.

On the 24-hour timeframe, the pair is still inside the Ichimoku cloud and has not overcome its upper boundary, the Senkou Span B line. Thus, again, a new decline in the pair is more likely at this stage.

Inflation in Great Britain has dropped below 5%, but this does not mean it will continue to fall. Recall that inflation in Britain initially soared much higher than in the EU or the USA, and then it could only slow down for a short time. The last month, with a 2.1% drop, looks like an exception to the rule. Many experts also adhere to this point of view. They warn that inflation in the UK may rise again, and its decline will be erratic and unstable. However, if the consumer price index still falls, the Bank of England should wait to adopt a new tightening monetary policy soon.

However, according to Commerzbank experts, the problem with the pound may not be the Bank of England's refusal to raise rates but a shift in sentiment towards "dovishness." It is no secret that next year, all three central banks may start lowering rates, and now it will matter which bank will start this process first and how quickly the easing will be. It is very difficult to make predictions because Britain's inflation may start accelerating again. The latest report on wages showed that the growth rates remain high. And, let's remind you, the Bank of England blames high wages for inflation. If British workers are getting more and more money, they spend more and more money. Therefore, manufacturers, who are also forced to increase wages, raise prices for their products, provoking inflation to rise. Therefore, the sudden 2.1% drop in the consumer price index may be a coincidence, and in the near future, the Bank of England will certainly not switch to a rate-cut policy.

The market is now in a stalemate. The probability of rate hikes by all three central banks is minimal, but the likelihood of a quick shift to easing is also minimal. A kind of "fundamental balance" has formed. This means the pair may stay within a limited price range and constantly correct. Of course, one should remember macroeconomic statistics because only it currently influences market participants.

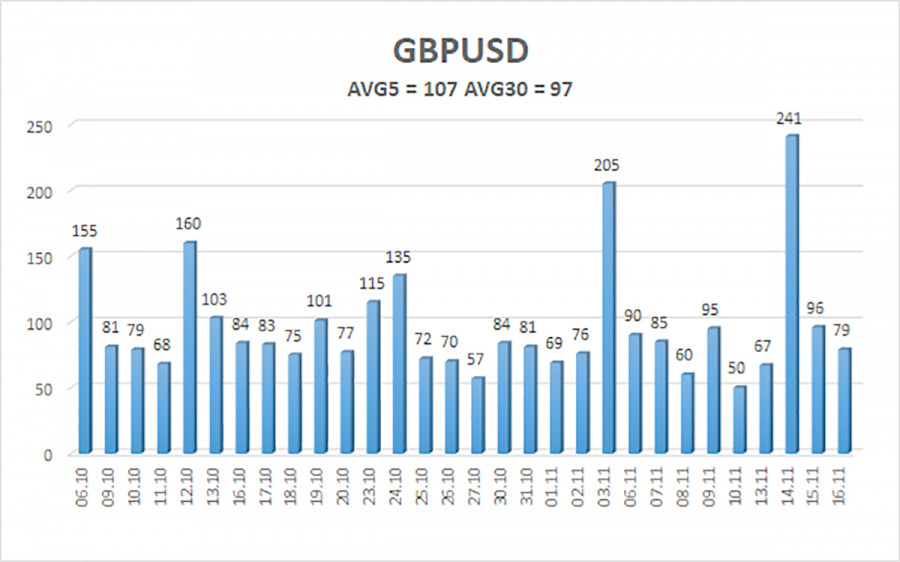

The average GBP/USD pair volatility for the last five trading days is 107 points. For the pound/dollar pair, this value is considered "average." On Friday, November 17, we thus expect movement within the range limited by the levels of 1.2298 and 1.2511. The reversal of the Heiken Ashi indicator upwards will indicate a new twist in the upward correction.

Nearest support levels:

S1 – 1.2390

S2 – 1.2360

S3 – 1.2329

Nearest resistance levels:

R1 – 1.2421

R2 – 1.2451

R3 – 1.2482

Trading recommendations:

The GBP/USD currency pair has started a new twist in the downward movement but is still above the moving average. Short positions can be opened with targets at 1.2329 and 1.2299 if the price is below the moving average. Long positions can be formally considered since the price is above the moving average, with targets at 1.2482 and 1.2511. However, the triple overbought of the CCI indicator indicates the danger of opening such deals.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

The moving average line (settings 20,0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates that a trend reversal in the opposite direction is approaching.