The GBP/USD currency pair continued its upward movement on Friday, surpassing the recent local maximum. What were the reasons for the market to continue buying the British pound? None, from our point of view. At this point, there needs to be more sense in reiterating the obvious regarding the fundamental background. It is best to focus on the technical picture and trade the trend. What does it tell us?

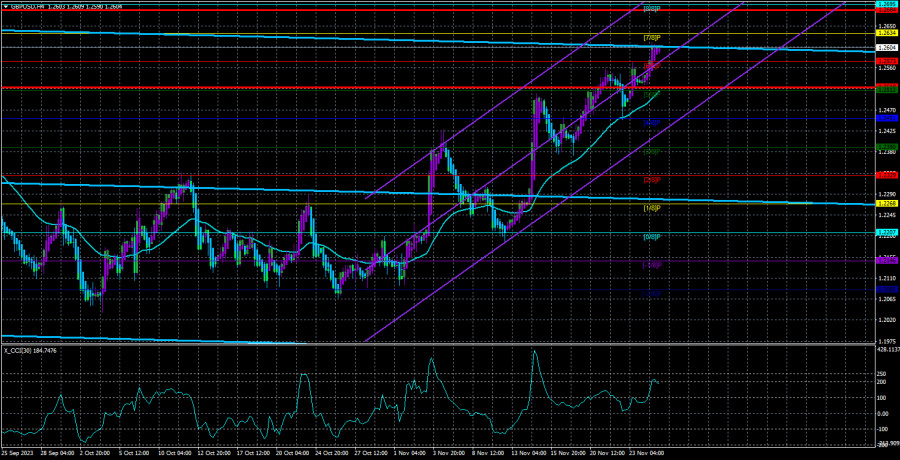

The CCI indicator entered the overbought zone three times and is now within arm's reach of this zone for the fourth consecutive time. The upward movement is slowing down, as clearly seen in the illustration above: each subsequent upward wave is weaker than the previous one, and pullbacks are shrinking. It is evident that the bulls are attacking with their last strength, and there are simply no grounds for such actions. We still believe that the current upward movement is corrective, even though it has clearly prolonged over time. However, corrections come in various forms. We are used to the fact that there is a specific background behind each movement, based on which the market trades. However, this is only sometimes the case.

We have said many times that the foreign exchange market is a combination of a vast number of major traders, not just speculators. Major players may buy or sell a particular currency for their own business purposes, for the conclusion of large contracts. If a bank needs a large amount of euros, it will enter the market and buy them regardless of whether the fundamental background for the euro is currently favorable or not. Therefore, movements occur in the market that are very difficult to explain.

Nevertheless, in most cases, the market eventually reaches equilibrium, and this is another reason why we expect the pound to fall. While major players are buying, speculators are selling.

A dull Monday and exciting movements

The new trading week started, and guess what? Right, with another strengthening of the British currency. Yes, the upward movement is not strong, but it is still an upward movement that is once again not based on anything. Obviously, there were no significant events over the weekend and last night that could plant the idea of the need for further purchases in the minds of market participants. Therefore, we can only observe this illogical movement and speculate on when it might end.

On the 24-hour timeframe, it is clearly seen that the recent rise of the British pound still perfectly fits the definition of "correction." This means that it can end at any moment and the downward trend may resume. Yes, the correction turned out to be stronger than we expected, although initially, the pound could not correct upwards at all. But it turned out the way it did.

The second option is that we are witnessing a resumption of the global upward trend, but in this case, the pair should rise to at least the 31st level. We currently see no grounds for the pair's growth, and even less so for its growth to the 31st level. Therefore, theoretically, the pair can rise another 500-600 points, but there are no fundamental reasons for this.

On Monday, there are no important events planned in the UK or the US. Moreover, the UK's calendar for the entire week is empty. The pound can only count on macroeconomic support from across the ocean, but important events there are scheduled only for Friday. So, from Monday to Thursday, we will see the continuation of the unfounded upward movement, or traders will finally remember that the current movement is a correction.

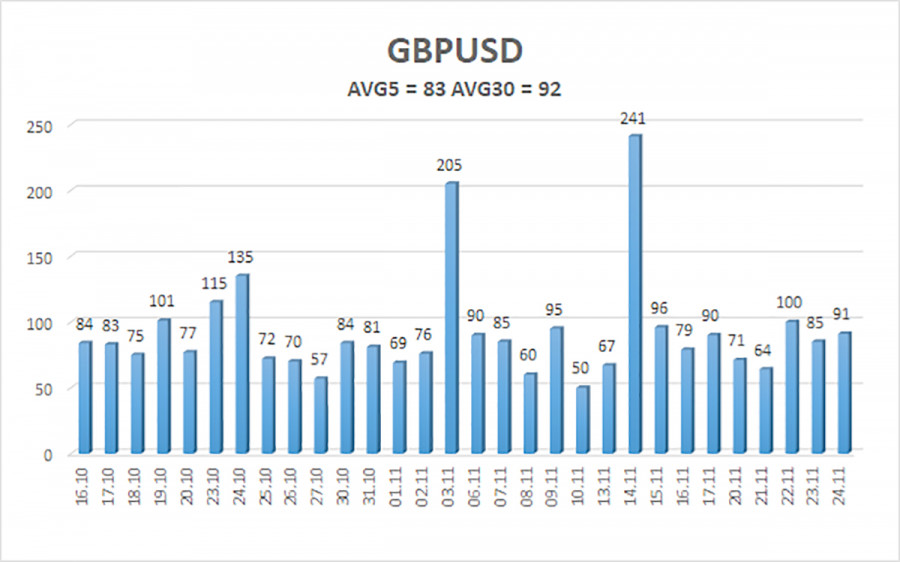

The average volatility of the GBP/USD pair for the last 5 trading days as of November 26 is 83 points. For the pound/dollar pair, this value is considered "average." Therefore, on Monday, November 27, we expect movements within the range limited by the levels of 1.2518 and 1.2684. A reversal of the Heiken Ashi indicator back down will indicate a new phase of the downward correction, which may mark the beginning of a downward trend.

Nearest support levels:

S1 - 1.2573

S2 - 1.2512

S3 - 1.2451

Nearest resistance levels:

R1 - 1.2634

R2 - 1.2695

R3 - 1.2756

Trading recommendations:

The GBP/USD pair continues a new upward movement phase above the moving average. Short positions can be opened with targets at 1.2451 and 1.2390 if the price consolidates below the moving average. Long positions can technically be considered since the price is above the moving average, with targets at 1.2634 and 1.2695. However, the triple overbought condition of the CCI indicator still suggests the danger of opening such deals.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.